Euronet Worldwide Inc (EEFT) Reports Strong Q4 and Full Year 2023 Results

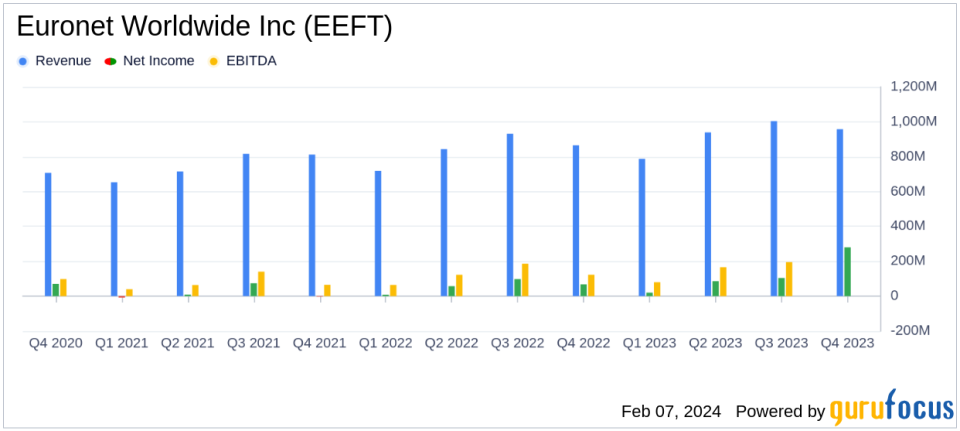

Revenue Growth: Q4 revenues increased by 11% year-over-year to $957.7 million, and full year revenues rose by 10% to $3,688.0 million.

Adjusted Operating Income: Q4 adjusted operating income grew by 26% to $99.9 million, with full year adjusted operating income up by 12% to $432.1 million.

Adjusted EBITDA: Q4 adjusted EBITDA increased by 16% to $147.6 million, and full year adjusted EBITDA grew by 9% to $618.7 million.

Net Income: Net income attributable to Euronet for the full year was $279.7 million, a significant increase from the previous year.

Adjusted EPS: Q4 adjusted EPS soared by 35% year-over-year to $1.88, with full year adjusted EPS up by 15% to $7.46.

Global Footprint: Euronet's global payments network includes 52,652 installed ATMs and approximately 580,000 locations serving 198 countries and territories.

On February 6, 2024, Euronet Worldwide Inc (NASDAQ:EEFT) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, a leading provider of electronic financial transaction solutions, reported an 11% increase in Q4 revenues to $957.7 million and a 10% increase in full year revenues to $3,688.0 million, compared to the previous year.

Company Overview

Euronet Worldwide Inc operates an independent network of ATMs in Europe, offers a network for prepaid products, and processes point-of-sale transactions. It also provides global money transfers, payment services and software, banking services, credit and debit card outsourcing services, and card issuing and merchant acquiring services. The company's largest segment by operating income is electronic financial transaction processing, which generates revenue from monthly ATM management fees and currency conversion transactions, with the United States being the largest country by revenue.

Financial Performance and Challenges

The company's performance in the fourth quarter and full year of 2023 was marked by significant growth across all segments. Adjusted operating income for Q4 increased by 26% to $99.9 million, and full year adjusted operating income grew by 12% to $432.1 million. Adjusted EBITDA also saw a healthy increase, with Q4 adjusted EBITDA up by 16% to $147.6 million and full year adjusted EBITDA growing by 9% to $618.7 million. Net income attributable to Euronet for the full year was $279.7 million, translating to $5.50 diluted earnings per share, compared with $231.0 million, or $4.41 diluted earnings per share in the previous year. Adjusted earnings per share for the full year increased by 15% to $7.46.

These financial achievements are particularly important for Euronet Worldwide Inc as they reflect the company's ability to navigate the complexities of the global financial landscape, including the ongoing recovery from the COVID-19 pandemic and the impact of inflation and currency fluctuations. The company's strong performance in its electronic financial transaction processing segment, along with growth in its money transfer and epay segments, underscore its diversified revenue streams and resilience in the face of economic challenges.

Segment Performance and Outlook

The EFT Processing Segment reported a 13% increase in Q4 revenues to $237.9 million, with adjusted operating income up by 47% to $28.0 million. The Money Transfer Segment saw an 8% growth in U.S.-outbound transactions and a 10% increase in international-originated money transfers. The epay Segment's growth was driven by digital media and mobile sales, despite a decline in promotional sales compared to the previous year.

Looking ahead, Euronet anticipates its 2024 adjusted EPS to grow by 10% to 15% year-over-year, consistent with its long-term growth rates. This outlook is based on current trends and does not account for potential changes in foreign exchange rates, interest rates, or other unforeseen factors.

Balance Sheet and Financial Position

As of December 31, 2023, Euronet's unrestricted cash and cash equivalents stood at $1,254.2 million. Total indebtedness was $1,869.6 million, with availability under the company's revolving credit facilities at approximately $661.2 million.

The company's use of non-GAAP financial measures provides additional insight into its performance, allowing investors to see the company through the same lens as the management. These measures include constant currency financial measures, adjusted operating income, adjusted EBITDA, and adjusted earnings per share, which are integral to the company's internal reporting and performance assessment.

Euronet Worldwide will host an analyst conference call on February 7, 2023, to discuss these results and may include discussion of company developments, operations, and forward-looking information.

For a detailed reconciliation of non-GAAP financial measures to their most directly comparable U.S. GAAP financial measure, investors are encouraged to review the attached financial schedules in the company's 8-K filing.

Value investors and potential GuruFocus.com members interested in Euronet Worldwide Inc's detailed financial data, performance metrics, and future prospects can find more information on the company's website and SEC filings.

Explore the complete 8-K earnings release (here) from Euronet Worldwide Inc for further details.

This article first appeared on GuruFocus.