European Recession in Focus Ahead of the ECB

With the eurozone and Germany now in a technical recession, the euro has nevertheless made gains so far this week and major indices have held close to highs. Traders of European instruments are now looking ahead to the ECB’s meeting and expected rate hike on Thursday next week. This article takes a quick look at the news this week, expectations for rates in the eurozone and the charts of euro-yen and the DAX.

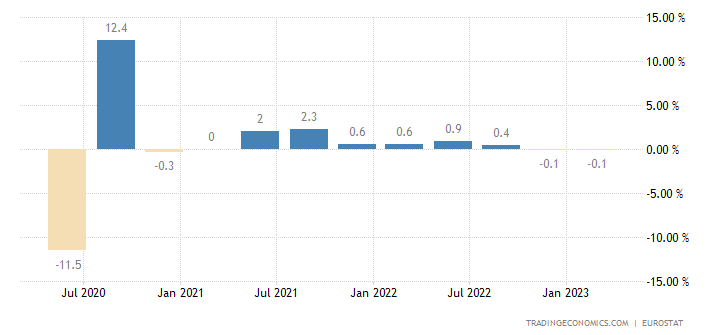

Against expectations and previous estimates of around 0.1% growth, yesterday’s quarterly GDP from the eurozone came in at negative 0.1%. This is now a technical recession for the eurozone, defined as two successive quarters of contraction by GDP.

Conversely, growth in the euro area had been lukewarm for quite some time. Many participants in major financial markets have been expecting a general recession around the world since early last year, so in some respects yesterday’s release is unremarkable. Equally, the contraction so far is negligible across the block, although Germany’s recession is slightly less mild with 0.5% contraction in the fourth quarter of 2022 and 0.3% in Q1 2023.

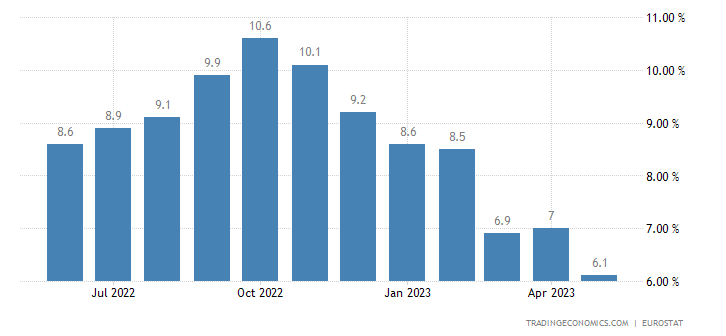

The other side of the coin is that inflation in the eurozone has come down significantly from the peak in double digits last October:

This is somewhat encouraging for sentiment because it suggests that like the USA and seemingly unlike the UK the ECB is making considerable progress on stability of prices. 6.1% is the flash release for May, though – the final figure next Friday might be different – and this is still slightly more than triple the usual target.

That’s why the large majority expects the ECB to continue hiking its main rates next week. The main refinancing rate is expected to reach 4% after a single hike on Thursday. At the time of writing, participants are mostly pricing in another single hike in July with a possible pause after that in September’s meeting.

Assuming a single hike as expected on Thursday, participants will focus in the subsequent press conference on any hints that might be given by Christine Lagarde and the rest of the Executive Board about a pause or possible further hawkishness later this year. A single hike by the Fed on Wednesday is currently unfavourable with less than 30% chance according to CME FedWatch Tool. However, if the Fed does tighten further there’s very likely to be pressure on euro-dollar.

Euro-yen, Daily

EURJPY has been more active than euro-dollar so far this week overall although it’s very close to the critical psychological resistance of ¥150. With the price moving in a rising wedge since early last month and higher lows since 12 May, a breakout upward would be possible but contingent on upcoming news, primarily the ECB’s press conference.

6 June’s doji might support the upward bias in the short term while there’s no signal of saturation from the slow stochastic or Bollinger Bands. The price has also tracked the dynamic support of the value area between the 20 and 50 SMAs since the middle of May. However, the last time euro-yen successfully broke above ¥150 was nearly 17 years ago, so traders should obviously evaluate critically the likelihood of a generational movement for a major forex pair in summer during a recession.

DAX, Daily

As the second half of 2023 approaches, the DAX has recovered and then some from March’s banking crisis, driven primarily by manufacturing and specifically cars. Participants seem to have priced in the lower likelihood of a pivot next quarter. However, the price of the DAX seems to be settling into a sideways trend after the fakeout from 17 May.

Moving averages are bunched close together, the slow stochastic is neutral and ATR has declined quite strongly since the end of the first quarter. The next earnings season in Germany is quite far ahead around the end of July, so 26 June’s Ifo business climate seems to be a point of focus for further direction after next week’s events which might drive some movement on the chart. For now, traders will probably watch interactions around the edges of the range between 15,700 and 16,300.

For the latest analysis of live charts and a detailed preview of the two big central banks’ meetings next week, please register for and attend Exness’ upcoming webinar on Monday 12 June at 10.00 GMT.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire