Eurozone property debts worse than pre-financial crisis, warn ECB

Commercial property companies in the eurozone have worse debts than they had before the global financial crisis in 2008, the European Central Bank (ECB) has said, as it warned the sector could struggle for years under the weight of high interest rates.

A commercial real estate boom is now unravelling in countries like Germany and Sweden, the ECB outlined in a report that examines the impact of the currency bloc’s record high interest rates, which stand at 4pc.

It said eurozone banks have around 10pc of loans exposed to the commercial property sector, which is grappling with declining profitability as it faces “a higher likelihood of facing debt servicing challenges” compared to the residential market, which is supported by a strong employment.

The ECB said that commercial property prices have been hit by economic weakness and high interest rates over the last year, challenging the sector’s profitability and business model.

The report added that commercial property could “play a significant amplifying role in the event of broader market stress” as larger firms grapple with debt levels “close to or above pre-global financial crisis levels”.

It comes as deep cracks emerged in the property market of the eurozone’s largest economy, Germany, where the construction of one of the country’s tallest buildings has suddenly halted midway after the developer stopped paying its builder.

Signa Group, the Austrian property giant and owner of New York’s Chrysler Building, had been making steady progress this year on the planned 64-story Elbtower skyscraper in Hamburg but the company, founded by René Benko, fell behind on payments.

Read the latest updates below.

06:48 PM GMT

Wrapping up

That’s it for today here on the live blog. Tomorrow, Chris Price and I will be joining a dedicated Autumn Statement live blog which is already up and running. We’d encourage you to join us there.

In the meantime, here are some latest business stories from The Telegraph:

Civil service red tape is a £50bn tax on Britain’s growth, says Tory peer

China’s CO2 emissions may be falling already, in a watershed moment for the world

06:44 PM GMT

Wind turbine maker Siemens Energy plans €400m of cost cuts after €15bn bailout

Siemens Energy’s wind turbine division announced on Tuesday that it is to cut €400m (£350m) in costs after receiving a €15bn rescue package from the German government and a group of banks.

The troubled turbine division became wholly owned by Siemens Energy last year, but has been beset by quality control problems that potentially affect 2,900 onshore turbines out of 65,000 installed by the company.

The unit’s chief executive, Jochen Eickholt, said that so far the company had experienced “a limited number of failures” but that the company was working off “probabilistic assumptions” and “it is not so that I can say I know everything now”.

Investors were not reassured by the scale of cost-cutting, amid concerns that the company would need to raise more capital. Shares in Siemens Energy plunged 7.9pc.

06:41 PM GMT

There is no OpenAI without Microsoft 'leaning in', says Microsoft boss

Talks have reportedly begin between ousted chief executive Sam Altman and members of the OpenAI board about his possible return.

According to Bloomberg, the move follows pressure from OpenAI shareholders including Thrive Capital, Khosla Ventures and Tiger Global Management.

Meanwhile, in a podcast today presented by techbology journalist Kara Swisher, Microsoft chief executive Satya Nadella expressed his frustration at the matter, which saw Mr Altman being sacked without consultation with the software giant:

It’s not even the money and the capital. I mean, here’s a simple way to think about this. Sam chose Microsoft once. Sam chose Microsoft twice. Someone’s got to think about why? There is no OpenAI without, sort of, Microsoft leaning in, in a deep way, to partner with this company on their mission.

05:46 PM GMT

FTSE closes in the red

The FTSE 100 declined 0.19pc today to 7,481.99, while the FTSE 250 dropped by 1.35pc to 18,347.63.

The biggest riser on FTSE 100 was Coca-Cola Hellenic Bottling Company, up 4.16pc, followed by JD Sports, up 3.95pc. British Airways owner IAG saw the biggest decline, by 4.98pc.

There were some quite sizable declines on the FTSE 250, including Workspace Group - best known for renting out London office space - which was down by 7.2pc. Telecom Plus (owner of Utility Warehouse) was down 7.05pc after it announced that its chief executive, Andrew Lindsay, would step down.

05:04 PM GMT

Hargreaves Lansdown faces demotion from the FTSE 100

Hargreaves Lansdown is poised to be relegated from the FTSE 100 next week, according to the index’s compiler, FTSE Russell.

The pensions and investment company is expected to be replaced by Intermediate Capital Group, a private equity firm.

Hargreaves Lansdown’s growth has been hit by banks raising the interest rates on savings accounts and increased competition, especially from low-cost US entrant Vanguard.

The company, which will join the FTSE 250, has 1.8m customers. But in a trading update for the quarter of the year to the end of September, it acknowledged that its customer retention rate had slipped by half a percentage point to 91.7pc, while it was also securing new customers more slowly than in the previous financial year.

Shares in Hargreaves Lansdown have dropped 17.5pc since January.

04:25 PM GMT

CRH buys concrete plants in Texas after ditching FTSE 100

Building materials giant CRH has struck a $2.1bn deal to buy a network of 20 concrete plants in Texas after ditching its London listing and decamping to New York, writes Howard Mustoe:

The deal pushes the company further into the US, where it hopes to capitalise on building growth spurred by President Joe Biden’s subsidy bonanza.

Last year saw the start of construction projects worth more than $1 trillion in the US. Big infrastructure projects include an expansion of JFK airport in New York and California’s delayed and over budget high speed rail project.

In Texas, big projects include the world’s largest carbon capture project, as well as an expansion to Austin’s tram network and a number of vast solar farms.Subsidies unveiled by Mr Biden have led to a surge in green infrastructure spending in the US, including investment in wind farms, electric car plants and chargers. The President’s $369bn Inflation Reduction Act became effective last August.

CRH, which was a FTSE 100 member, said in March that it was moving its listing to New York to chase infrastructure investment in America.

The company said at the time: “Our exposure to [the US] is likely to increase further driven by substantial increases in infrastructure funding, a renewed drive for the onshoring of manufacturing activity and significant levels of under-build in the residential construction market.”

04:20 PM GMT

Why America is a magnet for the best talent

Elon Musk could never have made it in Britain, or anywhere else in Europe, writes Jeremy Warner:

Musk is obviously unique in many respects, a genuine oddball who courts and delights in controversy – a drama queen as well as a serial creator of hugely successful businesses.

But he is also one of what is now a veritable army of extraordinarily impactful entrepreneurs that the US economy has given birth to these past 150 years. That the US can continue to foster such transformative wealth creators is testament to its enduring qualities as an economic superpower.

Sadly, the same cannot be said of the UK and Europe more widely. Why is this? Too much tax? Too much regulation? Not really. The World Bank’s last published “Ease of Doing Business” survey placed the US at just sixth in the rankings, with a score not much higher than that of the UK.

04:04 PM GMT

Zara owner hits all-time highest share price

The owner of high street fashion retailer Zara has reached its highest-ever share price since its floatation in 2001. Inditex, which is listed in Spain, put on 1.43pc today, reaching nearly €37. This year so far the stock has put on around 50pc.

Zara is well-known as a fast-fashion retailer, with much of its manufacturing closer to its European markets than other retailers. By using factories in Spain, Portugal, Turkey and Morocco, shipping time is cut and it is able to respond to customer demand more quickly.

Grace Smalley, a Morgan Stanley analyst, said: “Inditex continues to outperform and gain market share, led by the company’s continued widening moat [ability to defend its position in the marketplace] and differentiation across product and store experience relative to peers.”

03:46 PM GMT

British Airways investors show unhappiness with vague promise of dividends

The stock market showed its unhappiness with BA-owner International Airlines Group (IAG) today, sending the shares down to the current level of around 3.9pc (and as much as 4.4pc).

The company had issued a market announcement this morning ahead of an investor meeting promising a “commitment to dividends once our balance sheet and investment plans are secure”. But, according to a Bloomberg report, investors were unhappy that it “lacked concrete timing”.

Nicholas Cadbury, IAG’s Chief Financial Officer, said: “We are looking to consolidate the industry but once we’ve looked at the opportunities that are out there for inorganic growth, any excess cash that we have, we will also look to return that back to our shareholders.”

IAG has not paid a dividend since 2019, with the dividend cancelled the following year because of the pandemic.

03:33 PM GMT

Handing over

That’s all from me for another day. Alex Singleton will make sure you stay updated into the evening.

I will leave you with a look at the US bond markets, which are not buying any suggestions that interest rates are staying higher for longer:

Ten-year yield back below 4.4%

Closed yesterday “through the 4.437 bear market trendline .. the next line or resistance is 4.34 and after that our objective is 4.05.” - NatAlliance pic.twitter.com/lig26eyC4k— Carl Quintanilla (@carlquintanilla) November 21, 2023

03:13 PM GMT

US home sales slump to 13-year low

Sales of previously occupied US homes slumped in October to their slowest pace in more than 13 years as surging mortgage rates and rising prices hammered the property market.

Existing home sales fell 4.1pc last month from September to a seasonally adjusted annual rate of 3.79m, the National Association of Realtors said.

That is weaker than the 3.9m sales pace economists were expecting, according to FactSet.

The last time sales fell as sharply was in August 2010, when the housing market was in recovery from a severe crash.

Sales sank 14.6pc compared with the same month last year. They have fallen five months in a row, held back by climbing mortgage rates and a thin supply of properties on the market.

Fewer US existing homes are selling today than at any point since 2010. The 3.79 million annual rate is even below the lowest level of sales during the 2020 covid shutdowns (4.01 million). pic.twitter.com/4OKlTAwroa

— Charlie Bilello (@charliebilello) November 21, 2023

02:54 PM GMT

NHS awards software contract to Peter Thiel's Palantir

A tech giant founded by a US billionaire has won a £480m contract handling NHS patient data, it has been confirmed.

The Telegraph first reported the controversial deal for the “federated data platform” to join up medical information across the health service is expected to be announced shortly, after a series of delays.

Palantir, the tech giant founded by Peter Thiel, a US Republican party donor, has long been the frontrunner for the contract.

The company, best known for its work with intelligence and military agencies in the US, put in a joint bid with professional services company Accenture for the platform, in the biggest IT contract in NHS history.

Our health editor Laura Donnelly has the details.

02:42 PM GMT

UK launches talks on free-trade deal with South Korea

Britain will open talks on a new free trade agreement with South Korea as the King welcomed South Korea’s president at the start of a state visit.

His Majesty greeted President Yoon Suk Yeol with a royal guard of honour following his arrival in London on a three-day trip marking 140 years of diplomatic ties between Britain and South Korea, before travelling by carriage to Buckingham Palace.

Yoon, a conservative who has cited a “polycrisis” of global challenges as a reason for seeking closer ties with like-minded partners, was due to Parliament today before a state banquet in his honour.

He will hold talks with the Prime Minister on Wednesday, and sign an accord on closer diplomatic ties.

In a statement announcing that talks on a new Free Trade Agreement (FTA) would start on Wednesday, Rishi Sunak said: “I know a Free Trade Agreement fit for the future will only drive further investment, delivering on my promise to grow the economy and support highly skilled jobs.”

02:35 PM GMT

US markets slump at the open

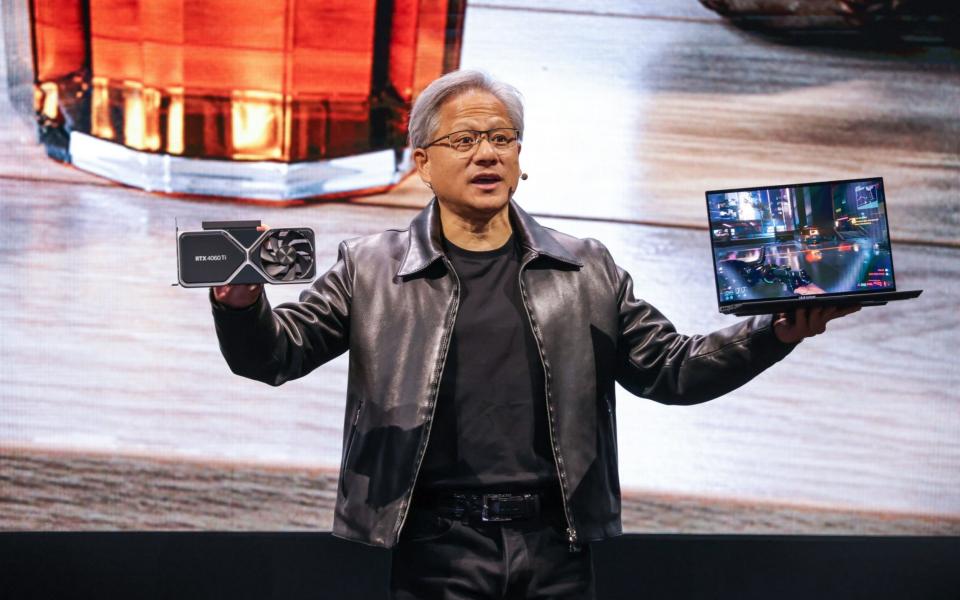

Wall Street’s main indexes opened lower as investors awaited artificial intelligence chip leader Nvidia’s quarterly report and the release of minutes from the Federal Reserve’s recent meeting.

The Dow Jones Industrial Average fell 46.20 points, or 0.1pc, at the open to 35,104.84.

The S&P 500 opened lower by 8.61 points, or 0.2pc, at 4,538.77, while the Nasdaq Composite dropped 67.30 points, or 0.5pc, to 14,217.23 at the opening bell.

02:26 PM GMT

Wall Street poised to fall ahead of Nvidia results

US stock indexes are on track to open lower as investors wait for quarterly results from artificial intelligence chip leader Nvidia due out after markets close tonight.

A technology-fuelled rally led the S&P 500 and the Nasdaq to register their highest closing level in more than three months on Monday, as investors continued to bet that the Fed was at the end of its rate hiking cycle.

Nvidia is expected to deliver yet another blockbuster revenue forecast but the real focus will be on the impact of widening US curbs on sales of its high-end chips to China.

Stuart Cole, head macro economist at Equiti Capital, said: “The market is expecting a large pick-up in revenue growth in Q3, with expectations of an even bigger number for Q4.”

However, given potential headwinds such as a slowdown in China, the company’s 2024 guidance could be key for the stock’s performance going forward, he added.

Shares of Nvidia were flat in premarket trading while other megacap stocks were mixed.

Dow Jones Industrial Average futures were down 0.2pc, the S&P 500 was down 0.3pc and and Nasdaq 100 contracts had fallen 0.5pc.

02:09 PM GMT

Olaf Scholz’s government ‘finished’, say rivals as it announces spending freeze

The German government announced a near-total freeze on new spending on Tuesday, as its rivals claimed Olaf Scholz, Germany’s chancellor, had wrecked the economy and that his coalition was “finished”.

Our correspondent James Rothwell in Berlin has the latest:

German officials said the freeze was a necessary response to a court ruling last week which blocked the government’s spending proposals for 60 billion euros (£50 billion) in unused pandemic funds, a move that plunged the budget into chaos.

The constitutional court’s decision to block the spending of the funds, which the government had earmarked for green initiatives, has had far-reaching consequences for financial planning across the federal budget.

It also prevents the German government from using the pandemic-era funds to help German businesses be more competitive amid a weak economy, according to Reuters news agency.

Read what the German government said about the budget freeze.

01:52 PM GMT

Gas prices slide as Goldman Sachs reduces forecasts

Gas prices have fallen after Goldman Sachs reduced its forecasts for costs amid fuller-than-expected storage sites.

Europe’s benchmark contract has dipped 2pc today to less than €45 per megawatt hour, while the UK equivalent has dropped by the same amount to below 114p per therm.

It comes as Goldman Sachs reduced its pricing forecast for the winter from €47 to €43 and during the summer next year to €41 from €45.

Goldman analyst Samantha Dart said lower gas usage and higher power generation from renewable energy sources had kept prices in check this year.

She admitted the risks to gas prices in winter were “skewed to the upside” from potentially cold weather, shocks to supply or consumers using more energy.

01:34 PM GMT

Autumn Statement holds the answers for Telegraph Puzzles players

Readers of the Telegraph business blog are divided into two groups: those who are fans of the Telegraph Puzzles section and those who are about to become fans of the Telegraph Puzzles section.

We cannot verify whether Jeremy Hunt is a regular player of our Mini Crossword, Cross Atlantic or games like PlusWord, but he will certainly be hoping that tomorrow’s Autumn Statement will be able to deliver the answers needed to unlock growth in the economy.

In honour of this, the Telegraph’s Puzzles section will be running a number of themed games to coincide with the Chancellor’s fiscal event.

Make sure you do not miss out on the fun here. The Autumn Statement-themed games will be playable tomorrow.

01:11 PM GMT

OpenAI in talks with founder Sam Altman in effort to calm staff backlash

An OpenAI executive has said it is in “intense discussions” to unify its workforce after almost all of the ChatGPT-maker’s employees threatened to quit.

Our senior technology reporter Matthew Field has the latest:

The Silicon Valley start-up is scrambling to ease tensions after the sacking of founder Sam Altman four days ago angered staff and investors, who are now plotting his return.

A memo was sent to employees on Monday by Anna Makanju, OpenAI’s head of global affairs, who said the company was exploring “mutually acceptable” options with Mr Altman, as first reported by Bloomberg.

It remains unclear as to whether this means OpenAI will try to bring Mr Altman back to the business after he struck a deal to join Microsoft.

OpenAI has already appointed Twitch co-founder Emmett Shear as its new boss, although news of his appointment led to 95pc of staff threatening to quit in a letter to the board on Monday.

Read how leading investors are piling pressure on OpenAI’s board.

12:46 PM GMT

UK's debt interest bill hits record level for October

Jeremy Hunt was hit with a £7.5bn debt interest bill for October alone, as higher borrowing costs meant the Chancellor spent more than expected servicing the £2.6trillion national debt.

Our deputy economics editor Tim Wallace has the details:

The monthly cost was 50pc higher than the £4.9bn the Office for Budget Responsibility had anticipated when it set out its forecasts at the time of the Budget in the spring, driven by higher interest rates and sustained inflation. Around one-quarter of the national debt is linked to the cost of living.

It represents a jump from £6.4bn in the same month of 2022, according to the Office for National Statistics, and is the biggest debt interest payment for any October on record.

At the same time the Exchequer had to send £9.1bn to the Bank of England to cover losses incurred on the portfolio of bonds it purchased under quantitative easing schemes between 2009 and 2021. The portfolio peaked at a size of £895bn.

It has since fallen to £748bn as the Bank has stopped replacing bonds as they mature, and is steadily selling gilts into the market.

Martin Beck, chief economic advisor to the EY Item Club, said the Chancellor’s main hope is that the pressure on debt payments may start to ease now inflation is dropping and interest rates may start to come down next year, potentially allowing more tax cuts.

“Interest rates are higher than the OBR expected but they have peaked lower than people were fearing a few months ago, the markets are pricing in three rate cuts per year, and that will help bring down debt interest payments as will falling inflation,” he said.

12:25 PM GMT

Pound higher as Bailey says markets 'underestimating inflation'

The pound has gained as the Governor of the Bank of England said traders are “underestimating” the risks to inflation.

Sterling has risen 0.3pc against the dollar to $1.25 as Andrew Bailey said interest rates would stay high for an “extended period”.

The pound was up 0.2pc against the euro, which is worth 87p.

12:07 PM GMT

Services inflation 'needs to subside' to hit 2pc target, says Ramsden

Bank of England deputy governor Sir Dave Ramsden said inflation in the services sector is expected to remain above 6pc until spring and he cautioned that this will need to fall significantly in order for overall inflation to meet the 2pc target rate.

He told the Treasury Committee:

It’s a very varied sector but it has a large labour input and we know wages are around 7pc for the whole economy.

As slack comes out in the labour market, we will see wages and services come down.

We do think services inflation will subside through next year.

And it needs to subside through next year because services inflation above 6pc is not consistent in getting headline inflation back to the 2pc target.

12:01 PM GMT

Bailey 'takes comfort' that OBR to give forecast for Autumn Statement

Andrew Bailey said it is “important that the OBR is fully engaged in this process” as he was asked if he had concerns whether the Autumn Statement could be inflationary.

The Governor said the OBR’s involvement ahead of the Chancellor’s fiscal event was in contrast to the mini-Budget delivered during Liz Truss’ brief time as Prime Minister.

The statement infamously triggered a crisis in the pensions and bonds market which led to the downfall of her premiership.

Mr Bailey told MPs: “I take comfort from the fact that we are now running a process which the OBR is fully involved in.”

11:57 AM GMT

Bank of England responsible for bringing down inflation, says Bailey

Andrew Bailey has stressed to MPs that the Government’s pledge to halve UK inflation by the end of the year was not to do with the Bank of England’s own target.

It comes after the Prime Minister last week said the Government had “delivered” on its pledge to bring down inflation, which fell to 4.6pc last month.

MP Dame Angela Eagle asked during a Treasury Committee session with Bank policymakers: “There have been claims in some places that the Prime Minister personally is responsible for halving inflation, do you agree with that?”

Mr Bailey said: “The Government and the Prime Minister adopted a target, it’s not our target, I must be very clear on that.

“Any comment I make on that is always purely a matter of fact, I can tell you where the figures are. But I can tell you, it’s not to do with our target.”

Asked who is responsible for inflation coming down, he said: “It’s very clear, the Bank of England is responsible for that.”

11:54 AM GMT

No collapse in credit demand in face of higher interest rates, says Bailey

The Governor of the Bank of England told MPs that policymakers are “not seeing a collapse” in the demand or supply of credit despite the uncertain economic backdrop.

Andrew Bailey told the Treasury Committee:

For both corporate and household sectors, at the moment, we are seeing some signs of small pick-ups in arrears and some weakening in demand for credit, but from a low level.

We are not seeing a collapse in either demand for credit or the ability of the financial system to supply credit.

We keep quantitative tightening under constant review but so far I have not observed an effect that is happening which is giving me cause for alarm in terms of an impact on broader credit conditions or the broader health of the corporate sector or household sector.

11:51 AM GMT

Lower unemployment limiting mortgage arrears, say Bank officials

Higher wage growth and greater difficulty in repossessing homes has limited the number of mortgage holders falling into arrears, according to Andrew Bailey.

The Governor of the Bank of England also said the stricter affordability tests were keeping the number of people falling into difficulty lower, although he acknowledged there had been “some tick up”.

Deputy Governor Sir Dave Ramsden added that lenders were getting in touch with borrowers before their mortgage deals came to an end because it is not in their interest to have to repossess a property.

He said the key difference with the mortgage crisis in the 1990s is the lower levels of unemployment now, which the Bank forecasts will only reach 5pc compared to more than 10pc some 30 years ago.

11:37 AM GMT

Shipyard workers back strike action

Cammell Laird shipyard workers are poised to strike in a dispute over pay and conditions, unions have announced.

The Unite and GMB unions said more than 400 workers have voted in favour of a strike at the site in Birkenhead, near Liverpool, which makes Royal Navy Dreadnought submarines and Type 26 frigates.

Workers, including welders, electricians, fitters, cleaners and office staff, voted with a 96pc majority in favour of a strike, following a turnout of almost 75pc.

Unite general secretary Sharon Graham said:

Cammell Laird has signed contracts worth hundreds of millions with the UK Government to build and maintain its ships, yet it thinks it can get away with cutting our members’ pay in real terms.

Unite won’t stand for such behaviour or any attempts by management to bully, harass or discriminate our members.

GMB organiser Albie McGuigan said: “These are skilled workers doing vital work for the Royal Navy and the commercial sector.”

11:24 AM GMT

Bank of England officials rebuff claims they were 'behind the curve' on rate rises

Bank of England officials have a testy exchange with Conservative MP John Baron after he suggested that policymakers had been “behind the curve” on raising interest rates.

Governor Andrew Bailey and his colleagues were quick to point out that the Bank of England began raising rates before both the US Federal Reserve and the European Central Bank, insisting “those are the facts”.

Deputy Governor Sir Dave Ramsden acknowledged that headline inflation was 5.4pc when the Bank began raising rates from historic lows of 0.1pc in December 2021 but said it is “simply not the case that we were behind the curve”.

He pointed to services inflation, which accounts for 45pc of the total inflation number, standing at 3.2pc at the time, although he acknowledged fuels inflation was 23.6pc.

Fellow policymaker Jonathan Haskell said the Bank is “looking at the underlying numbers as a much better guide” to the outlook for inflation, rather than the headline number.

11:17 AM GMT

Markets unmoved by Bailey's pleas

Money markets were little changed despite Andrew Bailey suggesting traders are “underestimating” how long interest rates will stay high.

Traders will think the next interest rate cut will come by June and most likely in May,

Meanwhile, the yield on the 10-year UK Government gilt has eased slightly to 4.11pc.

Bond yields fall when markets expects that interest rates are likely to decrease in the future.

11:04 AM GMT

Markets 'underestimating' how hard it will be to reduce inflation, says Bailey

Markets “underestimating” how difficult it will be to get inflation down, Andrew Bailey has said.

Senior economics reporter Eir Nolsøe is watching the Treasury Select Committee hearing:

The Bank of England Governor has told MPs that market expectations of how fast inflation will fall are too optimistic.

He said: “We are concerned about the potential persistence of inflation as we go through the remainder of the journey down to 2pc and I think the market is underestimating that.”

It comes as the Governor last night warned that it was “far too early” to talk about rate cuts despite inflation falling by more than expected in October to 4.6pc.

11:01 AM GMT

Interest rates should rise to stop inflation become 'stuck', says policymaker

Interest rates should be raised again to avoid inflation becoming “stuck” above the 2pc target, a hawkish policymaker at the Bank of England has said.

Catherine Mann, who has consistently voted for heavy interest rate increases since inflation began rising in 2021, told MPs on the Treasury Select Committee that “more tightness is important to cement our commitment to the 2pc target”.

In her annual report released ahead of the hearing, she said:

To me, the prospects for more persistent inflation imply a need for tighter monetary policy.

While I acknowledge that the monetary policy stance has started becoming restrictive, it is so only recently and not by so much.

Dr Mann added that when it comes to taming market expectations on interest rates “actions speak louder than words”.

Her colleague Sir Dave Ramsden, deputy governor at the Bank of England, said he “would not rule out” further rate rises and “a restrictive policy stance is likely to be warranted for an extended period of time.”

In early November, Sir Dave voted with the majority on the Monetary Policy Committee to keep rates on hold, while Dr Mann pushed for a quarter-point increase.

10:50 AM GMT

UK will not have another fall in inflation like the last one, says Bailey

The Governor of the Bank of England has said the sharp drop in UK inflation in October was “good news”, but not unexpected to policymakers.

Andrew Bailey told MPs during a Treasury Committee session:

It was obviously good news - it was largely news that we expected.

As we set out in the Monetary Policy Report, we expect a little bit more of what I would call this unwinding of last year’s external shocks to come through.

We’re not going to get another one like last week though; that’s the last of those base effects to come through.

Food price rises are set to ease further, he said.

The consumer prices index (CPI) measure of inflation slowed to 4.6pc last month from 6.7pc in September, according to official figures.

10:38 AM GMT

Middle East conflict and jobs market mean inflation is still a risk, says Bailey

Inflation could rise as a result of risks caused by Britain’s tight jobs market and the conflict in the Middle East, according to the Governor of the Bank of England.

Appearing before the Treasury Select Committee, Andrew Bailey said it is “sensible” to keep interest rates at 5.25pc in the face of “upside” risks to inflation.

He said:

My view is that it is sensible, based on what we’ve seen to date, to keep rates where they are.

However, I have to say, and this is where I would stand out, I think the risk remains still on the upside.

He added: “We don’t think the labor market is performing as efficiently as it was. That’s one of the reasons why we’re seeing wage pressure, higher than we thought we would see it.”

10:16 AM GMT

Deliveroo workers not entitled to union pay negotiations, Supreme Court rules

Deliveroo’s riders cannot be represented by a trade union for the purposes of collective wage negotiations, the UK’s Supreme Court has ruled.

The Independent Workers Union of Great Britain (IWGB) had tried to represent a group of Deliveroo riders in order to negotiate pay and conditions with the company, known as collective bargaining.

The union was first refused permission in 2017 on the basis that riders were not “workers” under UK labour law and it has since mounted a number of appeals.

The IWGB took its case to Britain’s highest court in April, arguing that it was an unlawful interference with riders’ human rights to deny the IWGB’s application to be recognised by Deliveroo for negotiations on pay and conditions.

But the Supreme Court unanimously dismissed the IWGB’s appeal in a ruling today.

Announcing the court’s decision, Judge Vivien Rose said Deliveroo riders do not have an “employment relationship” with Deliveroo and were not entitled to compulsory collective bargaining.

09:58 AM GMT

Royal Mail announces delivery deal with TikTok

Royal Mail has agreed a deal with TikTok to integrate its parcel drop off service with the social network’s shopping platform.

Sellers who use TikTok Shop will be able to integrate the parcel deliverer’s Click & Drop service into their accounts, which Royal Mail says will save time for customers and allow them to see all their orders in one place.

Patrick Nommensen of TikTok Shop said: “The partnership with Royal Mail will make our merchants’ lives easier and bring considerable customer benefit by streamlining and improving the fulfilment process.”

Nick Landon, chief commercial officer at Royal Mail, said:

People love shopping online and through social media, and TikTok Shop is a great example of that.

People also love getting deliveries from their trusted Royal Mail postie.

It gives them the confidence to order again, and everyone benefits from that growth.

We are really excited about working with TikTok shop, helping them to grow and delivering a brilliant service to all of their customers. Sellers can rest easy knowing their deliveries are in good hands.

09:42 AM GMT

Rise in long-term sickness has happened on Tories' watch, say Labour

The rise in economic inactivity due to long-term sickness has happened under the Government’s watch, Labour’s shadow work and pensions secretary Liz Kendall said.

She told Sky News:

It’s very interesting to see Rishi Sunak railing against the fact millions of people are out of work due to long-term sickness, saying it’s a scandal they’ve been written off. Well, who’s done that?.

Being out of work is bad for individuals. It’s bad for businesses, and it’s bad for the economy, but it’s happened under their watch.

And we haven’t seen anywhere near the scale of ambition we need to get Britain working again.

Ms Kendall accused the Government of “desperately trying to wipe their hands for the last 13 years that they are responsible for”.

.@leicesterliz critcises the government for the 'highest number of people out of work because of long term health conditions' and says there needs to be an 'ambitious reform' to get people back into work. https://t.co/PAiZ4D1jU3

📺 Sky 501, Virgin 602, Freeview 233 and YouTube pic.twitter.com/lsl7nPnjtO— Sky News (@SkyNews) November 21, 2023

09:28 AM GMT

Shell Energy fined for not telling customers contracts had ended

Ofcom has fined Shell Energy £1.4m for breaching the regulator’s rules after failing to let close to 73,000 people know that their contracts were coming to an end.

The watchdog said that Shell Energy had committed a “serious breach of our consumer protection rules”.

The business, which provides broadband as well as gas and electricity, said that it was “extremely disappointed” that it let customers down.

Investigators for Ofcom said that they had found a series of failings at the business. The rules require that people are told when their broadband deals are coming to an end, and what better deals they could opt for instead.

Some customers were not told their contract was ending at all, others were given incorrect or incomplete information, Ofcom said. In all 72,837 customers were affected between March 2020 and June 2022.

09:06 AM GMT

AO World returns to profit as it charges for deliveries

AO World swung back into profit and boosted its outlook for the year as bosses focused on improving its bottom line.

The electricals retailer made a half-year profit of £13m after suffering a loss of £12m last year as it removed unprofitable sales and introduced charges on all deliveries.

The company also tightly controlled advertising and marketing spending and reduced warehouse costs by 18pc to £25.5m.

As a result, bosses upgrading the company’s pre-tax profit guidance to between £28m and £33m - up from previous estimates of around £28m.

Shares initially climbed as much as 6.6pc but have since fallen 3pc as the company also reported a 12pc decline in revenue to £482m in the six months to September.

08:48 AM GMT

UK productivity barely above pre-pandemic levels

The Chancellor faces stagnating output from the British workforce as he tries to deliver an Autumn Statement “for growth”.

Output per worker fell buy 0.1pc in the three months to September, according to preliminary estimates by the Office for National Statistics.

It said output her hour work was down 0.3pc compared to a year ago and just 2.5pc higher than before the pandemic.

The preliminary estimate of UK output per worker for Quarter 3 (July to Sept) 2023 was 0.1% below the same quarter a year ago.

This uses our adjusted labour market estimates and takes on national accounts revisions.

➡️ https://t.co/jfq4DUvddz pic.twitter.com/hZ8npIlIuY— Office for National Statistics (ONS) (@ONS) November 21, 2023

08:32 AM GMT

Pound weighs on FTSE 100 as UK borrowing falls

The FTSE 100 inched down as lower than expected government borrowing delivered a boost to the pound.

The large-cap index dipped 0.2pc while the mid-cap index gained 0.2pc as official data showed Britain borrowed less than predicted by budget forecasters the OBR ahead of the Autumn Statement this week.

The pound has risen 0.3pc against the dollar following the news, adding pressure to the exporter-heavy benchmark index, where most of companies record their profits in dollars.

Oil prices have also fallen in early trading, impacting energy stocks, reversing steep gains made in the past two sessions, as investors turned cautious ahead of an Opec+ meeting this Sunday when the producer group may discuss deepening supply cuts.

Heavyweight energy stocks lost as much as 1pc, tracking oil prices.

Cranswick shares rose as much as 4.3pc to the top of the FTSE 250 after the meat producer forecast annual profit at the upper end of current market estimates.

The company said it expects as “extremely busy” Christmas period as demand for British pork and poultry remained resilient.

08:18 AM GMT

We can talk about tax cuts now UK has turned a corner, says Trott

The Government “can now talk about tax cuts” after turning a corner on the economy, chief secretary to the Treasury Laura Trott has said.

Asked about recent frequent changes to National Insurance, she told Times Radio:

We were in a very, very difficult spot a year ago.

The Prime Minister and Chancellor had to make some extremely difficult decisions, decisions which no government, I think, would want to take, no Conservative government certainly would want to take.

But we have turned a corner. Inflation has halved. That is really significant for people at home. We know how tough things have been.

Real wages are, for three months, now ahead of inflation - again, that’s really important to kind of making a difference to how people feel.

So we can now talk about tax cuts and focus on growth, and that is what we’re going to be doing.

Ms Trott added that the decision to freeze tax thresholds, which has pushed some people into higher tax bands, was “really difficult”.

08:06 AM GMT

UK markets slip at the open

The FTSE 100 has fallen at the open in relatively thin trading ahead of the Thanksgiving holidays in the US.

The UK’s benchmark stock index fell 0.2pc to 7,483.86 while the midcap FTSE 250 gained 0.2pc to 18,605.24.

07:54 AM GMT

High interest rates will offset tax windfall, warns KPMG

Michal Stelmach, senior economist at KPMG UK, said that the latest borrowing figures show that balancing the books with the public finances will be harder than halving inflation.

He said:

The short-term improvement in the fiscal position this year will likely prove unsustainable over the next five years.

While we expect the OBR to revise down its borrowing forecast for 2023-24 by around £22bn, the prospect of persistently higher interest rates is set to more than offset any windfall over the medium term.

Despite the recent strength in tax receipts, we expect the cooling labour market and slowing inflation to put a cap on revenue going forward.

The current plans already factor in restrictive fiscal policy with a sizable drag on growth next year. This comes on top of the monetary tightening which is still in the pipeline and the erosion of excess savings, leaving households vulnerable to further squeeze on disposable incomes.

As part of the Autumn Statement, the Chancellor will likely declare triumph over meeting his fiscal mandate of falling debt in five years’ time.

However, there is a risk that such forecasts will prove unrealistic if they rely on consolidation plans which are subsequently not followed through. Indeed, borrowing has turned out higher than initially forecast in each of the past 20 years, underscoring the gap between fiscal pragmatism and political reality.

07:47 AM GMT

Numbers mean Chancellor 'will not be able to resist pre-election splash'

Although the Treasury borrowed more than expected in October, economists said the over shoot “shouldn’t trouble the Chancellor too much”, according to economists.

Ruth Gregory, deputy chief UK economist at consultancy Capital Economics, said:

We still expect the OBR to reduce its 2023/24 borrowing forecast by about £16bn. And the OBR will probably judge the Chancellor has a decent buffer against his main fiscal rule, perhaps of about £25bn.

With the election drawing nearer, the Chancellor surely won’t be able to resist the temptation to unveil a pre-election splash.

That said, even if Mr Hunt spends the bulk of any money at his disposal, much of the planned £39bn (1.3pc of GDP) tightening unveiled after the Truss/Kwarteng mini-budget will remain in place.

So this won’t be a big fiscal loosening, rather a partial reversal of the planned tightening.

And any pre-election splash in 2024 will almost certainly be followed by hefty tax rises in 2025 after the election.

This fiscal tightening in 2025 is another reason to think that when interest rate cuts occur they will be faster and larger than investors currently anticipate.

07:35 AM GMT

Public sector debt equal to 97.8pc of GDP

Although the public finances are in a better state than had been forecast, there were signs in the official data that all is far from well.

The £14.9bn of public sector net borrowing, excluding banking groups, in October was higher than both the consensus forecast and the OBR’s March forecast of £13.7bn.

It came as public sector net debt reached £2.6trillion, according to the Office for National Statistics, which is equivalent to around 97.8pc of the UK’s annual gross domestic product (GDP).

That figure is 2.3 percentage points higher than in October last year and remains at levels last seen in the early 1960s.

Public sector net debt was £2,643.7 billion at the end of October 2023, provisionally estimated at around 97.8% of the UK’s annual gross domestic product.

➡️ https://t.co/3pz6P3drkT pic.twitter.com/hoUqfxruOo— Office for National Statistics (ONS) (@ONS) November 21, 2023

07:26 AM GMT

Capita to axe up to 900 jobs in cost cutting drive

The outsourcing giant Capita has announced it could axe up to 900 jobs as it tries to slash costs.

The company, which collects the BBC TV licence fee, said the plans will help it save £60m a year from the first quarter of next year.

The group said it “continues to trade in line with its expectations” having won contracts worth a total of £2.9bn so far, ahead of its total of £2.6bn for 2022.

Capita, which also runs outsourced IT services for substantial parts of the NHS, posted a pre-tax loss of £67.9m for the first six months of the year, compared with a profit of £100,000 a year earlier.

Chief executive Jon Lewis said:

We are, today, announcing the accelerated delivery of the efficiency savings announced in our Half Year Results with a £20m increase in overhead cost reduction to £60m on an annualised basis from Q1 2024.

As part of the organisational review which underpins the programme we are announcing today, we continue to identify further areas of cost efficiency and will pursue these during 2024.

07:20 AM GMT

Hunt says Autumn Statement will aim to boost investment

As Government borrowing came in lower than expected over the first seven months of the financial year, Chancellor Jeremy Hunt said:

We met our pledge to halve inflation, but we must keep on supporting the Bank of England to drive inflation down to 2pc.

That means being responsible with the nation’s finances.

At my Autumn Statement tomorrow, I will focus on how we boost business investment and get people back into work to deliver the growth our country needs.

07:18 AM GMT

Chancellor handed £17bn borrowing boost ahead of Autumn Statement

The Government borrowed £16.9bn less than official figures predicted in the first seven months of the year, bolstering hopes that the Chancellor will announce tax cuts in tomorrow’s Autumn Statement.

Public sector net borrowing excluding banks stood at £98.3bn in the first seven months of the financial year, which was £21.9bn more than the same period last year, according to the Office for National Statistics.

However, it was £16.9bn less than the £115.2bn forecast by the Office for Budget Responsibility in March.

The body will deliver revised borrowing figures at the Chancellor’s Autumn Statement on Wednesday.

Chancellor Jeremy Hunt said he will deliver a statement aiming to “boost business investment” after being “responsible with the nation’s finances”.

Ruth Gregory, deputy chief UK economist at consultancy Capital Economics, said the latest data will mean Mr Hunt “won’t be able to resist the temptation to unveil a pre-election splash”.

However, for the month of October, total public sector net borrowing excluding public sector banks was £14.9bn, up from £14.3bn the previous month and ahead of analysts forecasts of £12.8bn.

It was £4.4bn more than the same month last year and the second highest October borrowing since monthly records began in 1993.

Public sector net borrowing, excluding public sector banks, in October 2023 was £14.9 billion.

£4.4 billion more than in October 2022 and the second highest October borrowing since monthly records began in 1993.

➡️ https://t.co/3pz6P3drkT pic.twitter.com/9e5524XQ9g— Office for National Statistics (ONS) (@ONS) November 21, 2023

07:12 AM GMT

Good morning

Thanks for joining me. There are hopes that Chancellor Jeremy Hunt will announce tax cuts in his Autumn Statement after official figures showed borrowing came in below estimates in the first seven months of the financial year.

Public sector net borrowing excluding banks was £98.3bn during the period, which was £16.9bn less than the £115.2bn forecast by the Office for Budget Responsibility in March.

5 things to start your day

1) The UK tax system is a hot mess | Compulsive tinkering and inveterate dithering have created a confusing patchwork of rules

2) Javier Milei isn’t ‘hard Right’. He could be Argentina’s free market saviour | The unconventional president-elect’s proposals are eminently sensible

3) Hunt urged to tackle ‘unacceptably poor service’ at HMRC | Tax office accused of creating huge problems for accountants in letter to Chancellor

4) How Britain’s plague of potholes became a budget black hole | £8bn pledge to fix crumbling roads will just scratch the surface after years of neglect

5) Guinness maker blames alcohol tax for rise in weaker beers | Diageo GB boss says high duties are encouraging ‘wrong behaviours’ among companies

What happened overnight

Asian shares climbed to fresh two-month highs following a rally on Wall Street while the dollar languished near its lowest in two-and-a-half months on expectations the US Federal Reserve has likely finished raising interest rates.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 1pc higher at 510.11 having touched 511.05, the highest since September 18.

The index is up 7pc for the month and on course for its biggest monthly gain since January.

Tokyo stocks ended lower as investors adjusted positions and locked in profits following recent gains and ahead of the US Thanksgiving holiday.

The benchmark Nikkei 225 index fell 0.1pc, or 33.89 points, to 33,354.14, while the broader Topix index slipped 0.2pc, or 4.81 points, to 2,367.79.

China’s blue-chip CSI300 Index was 0.6pc higher, while Hong Kong’s Hang Seng Index gained 0.8pc as reports of Beijing’s latest stimulus rollout for the property sector lifted risk appetite.

On Wall Street, the technology-focused Nasdaq Composite reached its highest level since April 2022 on Monday, rising 1.1pc, fueled by increases in the stock prices of Microsoft and Nvidia.

Meanwhile the S&P 500, a bellwether of corporate America, gained 0.74pc, reaching 4,547.38, while the Dow Jones Industrial Average of 30 leading American companies added 0.58pc, reaching 33,151.04.

The yield on the globally influential 10-year US Treasury yields dropped 0.43pc.