EV Roundup: LI Slashes Q1 Deliveries View, STLA Partners With CARB & More

Amid slowing electric vehicle (EV) sales, the U.S. government announced the relaxation of emission rules and adjustments to fuel economy requirements for EVs. The Department of Energy (“DOE”) and the Environmental Protection Agency (“EPA”)revised regulations, giving automakers flexibility to produce gas-powered vehicles while meeting CAFE standards through 2030. The DOE eased proposed drastic reductions in EV mileage ratings, opting for a gradual reduction from a 72% cut by 2027 to 65% by 2030. The EPA's revised emission requirements also follow a gradual approach, recognizing challenges in EV sales and aiming to balance environmental goals with market realities. By moderating standards from 2027 to 2029 and ramping up to preferred levels by 2030-2032, the EPA aims for this balance.

On the news front,U.S. legacy automaker Ford F put the plan for a three-row electric SUV on hold to focus on the development of affordable EVs. Italian-American automaker Stellantis STLA joined forces with California Air Resource Board (“CARB”) to reduce emissions. Meanwhile, China-based EV maker Li Auto Inc. LI downwardly revised its outlook for first-quarter 2024 deliveries. Electric truck and powertrain company Xos, Inc. XOS and China-based EV maker XPeng Inc. XPEV released their fourth-quarter and full-year 2023 results.

While F sports a Zacks Rank #1 (Strong Buy), LI and XOS are #2 Ranked (Buy) presently. Meanwhile, STLA and XPEV currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Last Week’s Important Stories

Stellantis and CARB entered into an agreement to reduce greenhouse gas emissions. The deal is aligned with the company’s Dare Forward 2030 strategic plan. As part of the deal, Stellantis agreed to consolidate its ongoing electrification initiative through educational endeavors aimed at informing U.S. consumers and dealers about the advantages of EVs. This commitment involves partnering with Veloz, a leading promoter of EV awareness programs, offering discounted EVs to organizations in underprivileged communities and providing an additional $10 million to develop EV charging infrastructure. The contract will avoid 10-12 million metric tons of greenhouse gas emissions over its lifetime. It will also benefit STLA’s U.S. consumers through its advanced technologies, which include five plug-in hybrids and two pure EVs.

Stellantis offers five plug-in hybrids in the United States, including popular models like Jeep Wrangler 4xe and Chrysler Pacifica Hybrid, along with two pure electric vehicles – the FIAT 500e and Ram ProMaster EV. In a significant move toward electrification, the company plans to introduce eight BEV models in the United States this year, contributing to its goal of launching 48 BEV nameplates worldwide by the end of 2024.

Ford is shifting its focus from three-row electric SUVs toward the development of affordable EVs. As affordable China-based EVs start to engulf markets, Ford is deferring its attention from larger EVs to work on a series of cheaper and compact EVs. The company’s first cheaper and compact electric SUV, due in late 2026, will have a starting price of around $25,000 and target the upcoming entry-level Tesla car. Lithium-iron-phosphate batteries, which are 30% cheaper than standard lithium-ion batteries, are expected to be used in the compact SUV to lower cost.

The compact e-SUV will be manufactured on a new electric platform. Besides the SUV, the platform will also produce a small pickup truck that could be electric equivalent to Maverick. Furthermore, the architecture may pave the way for a specialized ride-hailing vehicle. This year, the automaker is set to release a compact electric crossover in Europe with Explorer’s nameplate. It will be built on the same Volkswagen MEB platform as VW ID.4 and Audi Q4 e-tron but will remain an Old World exclusive.

Li Auto cut its outlook for first-quarter 2024 delivery due to lower-than-expected order intake. The China-based automaker now estimates first-quarter vehicle delivery in the range of 76,000-78,000 units, down from the previous guidance of 100,000-103,000 units. Per Xiang Li, chairman and CEO of Li Auto, the operational strategy of Li MEGA was misaligned. The company structured the operation of the model under the assumption that it had already transitioned into the 1-to-10 scaling phase while it was in the early stages of the 0-to-1 business validation period.

Like the Li ONE and EREV technologies, Li Mega and BEV technologies need to go through the same 0-to-1 business validation period. Subsequently, the company will focus on its core user group and target cities with higher purchasing power, reverting the Li MEGA strategy to the 0-to-1 phase initially. Later, the automaker will extend its reach to a wider user base and additional cities. Instead of focusing on sales volume and competition, the company will emphasize on value creation for its users and driving operating efficiency. For these reasons, LI is expected to have lowered its delivery expectations.

Xos incurred a fourth-quarter 2023 loss of $2.33 per share, narrower than the Zacks Consensus Estimate of a loss of $2.40 and the year-ago loss of $4.20 per share. Revenues of $18.4 million slightly missed the consensus mark of $19 million but rose from $8.6 million generated in the fourth quarter of 2022. The company achieved positive gross margins in the quarter under review, attributed to the launch of an enhanced stepvan platform. In 2023, It solidified its position as the leading EV stepvan provider, delivering 283 units to major North American fleets like FedEx Ground, UPS, Loomis, Canada Post, UniFirst and Penske.

As of Dec 31, 2023, the company had cash and cash equivalents worth $11.6 million. For 2024, Xos envisions revenues between $66.7 million and $100.4 million. Deliveries are expected in the band of 400-600 units. Adjusted operating loss is forecast in the range of $43.7-$48.7 million.

XPeng incurred a loss per share of 21 cents in the fourth quarter of 2023, narrower than a loss of 40 cents per share in the year-ago period. Total revenues were $1.84 billion, rocketing 154% on a year-over-year basis. While revenues from vehicle sales were up 162.3% year over year to $1.72 billion, service and other sales rose 71.6% to $0.12 billion. Deliveries came in at 60,158 units during the quarter, up 171% from the corresponding period of 2022. Gross margin came in at 6.2%, falling from 8.7% registered in the year-ago period.

Vehicle margin was 4.1% in the quarter under review, down from 5.7% in the corresponding period of 2022. R&D and SG&A expenses were $184.2 million (up 6.2% year over year) and $272.7 million (up 10.3% year over year), respectively. As of Dec 31, the company had cash and cash equivalents of $2.97 billion. Long-term borrowings were $795.9 million as of Dec 31. For the first-quarter of 2024, XPEV expects deliveries within 21,000-22,500 units, implying a year-over-year of 15.2-23.4%. Revenues are envisioned in the band of RMB 5.8-6.2 billion, indicating a surge of 43.8-53.7%.

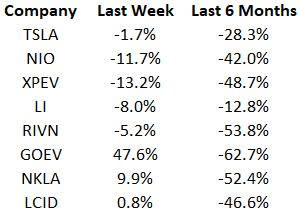

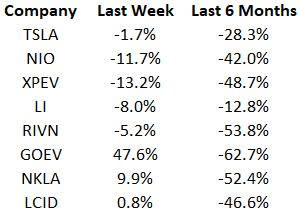

Price Performance

The following table shows the price movement of some of the major EV players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the EV Space?

Stay tuned for the announcements of upcoming EV models and any important updates from the red-hot industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

Xos, Inc. (XOS) : Free Stock Analysis Report