Evaluating Darden Restaurants' Rise, Growth and Potential

Over the past two months, Darden Restaurants Inc. (NYSE:DRI) has seen a notable increase in its share price, climbing nearly 22% from $134 to $163 per share. This rise coincides with the company's recent announcement of satisfactory earnings results for the second quarter of fiscal 2024, where revenue and earnings per share showed healthy growth. With these developments in mind, let's investigate whether Darden Restaurants presents a sound investment opportunity at its current price.

Inside Darden Restaurants' brand portfolio

Darden Restaurants manages a diverse portfolio of nearly 2,000 full-service dining restaurants with 10 unique concepts and brandings. These include Olive Garden, celebrated for its Italian cuisine made with fresh ingredients; LongHorn Steakhouse, which offers a range of fresh steaks, chicken, salmon, shrimp and burgers; and Cheddar's Scratch Kitchen, known for its contemporary take on classic American favorites, all crafted from scratch.

With its distinct brands, Darden Restaurants caters to a broad spectrum of customer preferences, offering a variety of dining experiences. The average per-person check ranges from $18 at Cheddar's Scratch Kitchen to $114.5 at Eddie V's, a fine dining restaurant. Additionally, the sales contribution from alcoholic beverages varies notably among these brands, from 5.3% of total sales at Olive Garden to a substantial 32.6% at Yard House. This significant alcoholic beverage contribution at Yard House is primarily due to its impressive array of over 100 draft beers, a vibrant bar atmosphere and a diverse American-style menu featuring more than 100 chef-driven items.

Among those restaurant brands, the most substantial contributors to Darden's revenue and operating profit are Olive Garden and LongHorn Steakhouse. Olive Garden leads the way with $4.88 billion in revenue and $1 billion in profit, while LongHorn Steakhouse ranks second with $2.6 billion in revenue and $431 million in profit.

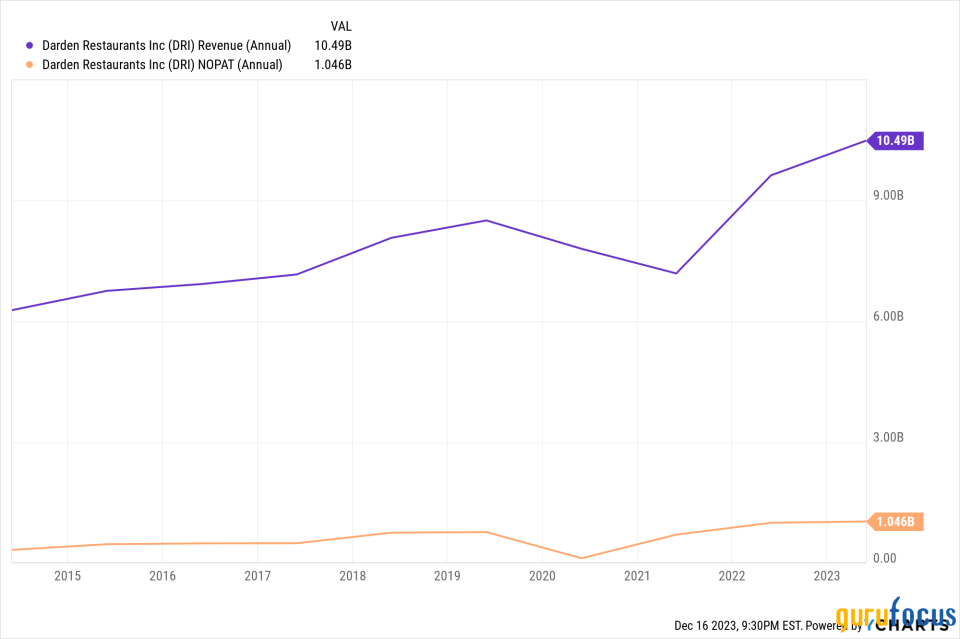

A decade of consistent growth and cash flow generation

Over the past decade, Darden Restaurants has shown consistent growth, increasing its revenue in eight of the last 10 years. The only declines occurred in 2020 and 2021, reflecting the adverse impacts of the Covid-19 pandemic. Subsequently, the company's revenue rebounded, rising from $7.2 billion in 2020 to nearly $10.5 billion in 2023. Its operating income increased significantly during this period, jumping from $438.1 million to $1.19 billion in just three years. Notably, this operating income has surpassed the pre-Covid level of $851.5 million recorded in 2019.

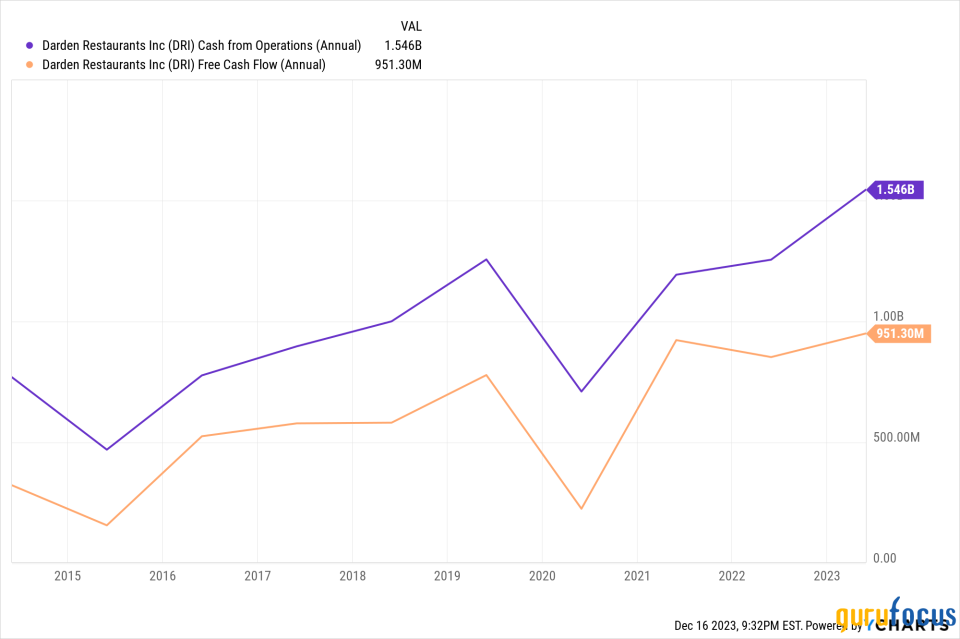

While the pandemic made Darden Restaurants' profit decline, the company still managed to consistently generate positive cash from operations and free cash flow. In 2023, its operating cash flow reached $1.55 billion, while the free cash flow reached $951.3 million.

Surging second-quarter operating results

In the second quarter of 2024, Darden Restaurants reported a significant increase in operating earnings, with total sales surging 9.7% to $2.7 billion. This growth was fueled by a 2.8% rise in same-restaurant sales and the acquisition of 78 Ruth's Chris Steak House locations. Same-restaurant sales, a crucial metric measuring the performance of existing restaurants operating for over a year, signify organic growth, excluding expansions through new openings. The company's 2.8% increase in same-restaurant sales was led by a 4.9% increase at LongHorn Steakhouse and a 4.1% rise at Olive Garden. However, these gains were partially offset by a 1.7% decrease in fine dining and a 1.1% drop in other restaurant businesses. Despite these mixed results, opening new restaurants contributed to overall profit growth across all segments. Consequently, the company's adjusted earnings per share soared by 21% to $1.84.

Darden Restaurants has strongly committed to rewarding its shareholders, consistently distributing cash through dividends and share buybacks. In the past decade, the company has returned over $7 billion to its shareholders, including $3.32 billion in stock repurchases and more than $3.74 billion in dividends. Reflecting this ongoing strategy, in the second quarter, Darden announced a quarterly dividend of $1.31 per share and repurchased $181 million of its outstanding common stock.

Safe and effectively leveraged

Darden Restaurants has been effectively utilizing leverage in its operations. As of September 2023, its equity stood at $2.15 billion, comprising $192 million in cash and $287 million in inventory. The company's most substantial assets include land, buildings and equipment valued at nearly $4 billion and operating lease right-of-use assets at $3.6 billion. The company's interest-bearing debt amounted to $1.57 billion, characterized by extended maturities and low interest rates. The most imminent obligation is $600 million in unsecured notes due in June 2026, raised for acquiring Ruth's Chris restaurants, while the longest maturity due on 2048, carrying only 4.55% coupon rate.

Darden's operating cash flow, which amounted to approximately $1.55 billion in 2023, is more than adequate to cover both interest and principal payments comfortably. Even during the challenging period of the Covid-19 pandemic, when the operating cash flow decreased to $711 million, it was still sufficient to cover interest and principal obligations.

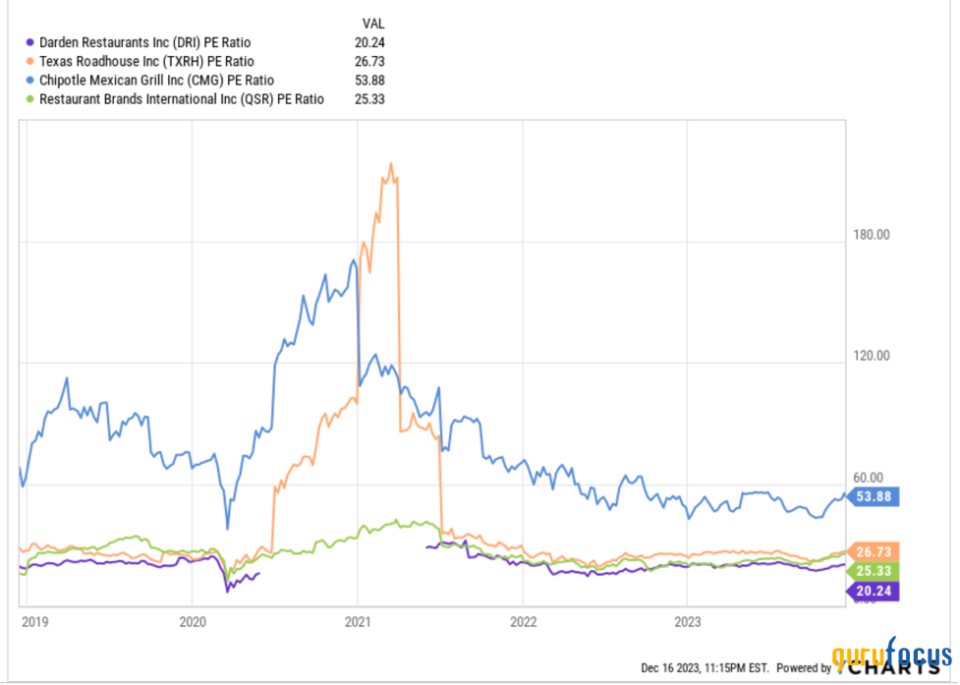

Peer valuation comparison

Among its peers, including Texas Roadhouse (NASDAQ:TXRH), Chipotle Mexican Grill (NYSE:CMG) and Restaurant Brands International (NYSE:QSR), Darden Restaurants holds the lowest valuation. Its current price-earnings ratio is 20.2, matching the company's average five-year earnings multiple, while the other three companies have higher valuations. Chipotle leads as the most expensive, with a nearly 54 times earnings multiple. Restaurant Brands International and Texas Roadhouse have similar valuations, with earnings multiples of 25.3 and 26.7.

For 2024, Darden Restaurants is expected to generate between $8.75 and $8.90 in diluted earnings per share. Using the lower estimate of $8.75 and applying the five-year average price-earnings ratio, the value of Darden Restaurants is projected to be around $177 per share. This valuation is just 9% higher than its current trading price, suggesting Darden Restaurants is fairly valued.

The bottom line

Darden Restaurants demonstrates solid fundamentals and growth potential, underscored by its diverse brand portfolio and robust financial performance. While its current market valuation closely aligns with its projected fair value, suggesting limited short-term gains, Darden's consistent cash flow generation and strategic growth initiatives position it as a potentially stable long-term investment in the restaurant industry.

This article first appeared on GuruFocus.