Evans Bancorp (EVBN) to Sell Insurance Operations of Subsidiary

Evans Bancorp, Inc. EVBN has entered an agreement to sell the insurance operations of The Evans Agency, LLC to Arthur J. Gallagher & Co. AJG for $40 million. The completion of the deal, expected in the fourth quarter of 2023, is subject to customary closing conditions.

Evans Agency was founded in 1913. It is a retail insurance agency offering life insurance, employee benefits, and property and casualty insurance throughout New York and the Northeast.

The sale is expected to result in an after-tax net gain of $15.1 million. Moreover, the deal eliminates $12 million of goodwill and other intangibles.

The transaction is expected to result in an improvement in the tangible common equity to tangible assets ratio by 112 basis points (bps) to 7.47%.

The tier 1 leverage ratio is anticipated to improve by 119 bps to 10.58% and the total risk-based capital ratio will likely improve by 151 bps to 14.80%.

Notably, the proceeds from the transaction provide potential net income and earnings enhancements as the generated capital is deployed through strategic and franchise growth initiatives over time.

David J. Nasca, the president and CEO of EVBN, said, “For 23 years, the insurance business has been an integral part of Evans Bank. During that time, the Bank acquired over 15 agencies and successfully built a customer-centric, high-performing operation with strong values and a reputation for outstanding talent and service excellence. After extensive diligence, we believe AJG is the right partner, providing optimal benefit for all stakeholders, including assuring our associates and clients are well taken care of. This transaction realizes a significant valuation premium and is immediately accretive to Evans’ capital, tangible book value, and liquidity.”

Aaron Whitehouse, the president of Evans Agency, stated, “Evans Agency associates will be joining a global insurance brokerage, risk management, and consulting services firm with an unrivaled tool kit to respond to client needs. Clients will have access to enhanced resources and a greater breadth of insurance expertise, while continuing to work with the existing talented team of Evans Agency associates and leadership. Our partnership with Evans has been marked by two core principles: a commitment to excellent client service and creating a culture where associates thrive and can realize their full potential. Together, we chose to partner with Gallagher as they share these same principles.”

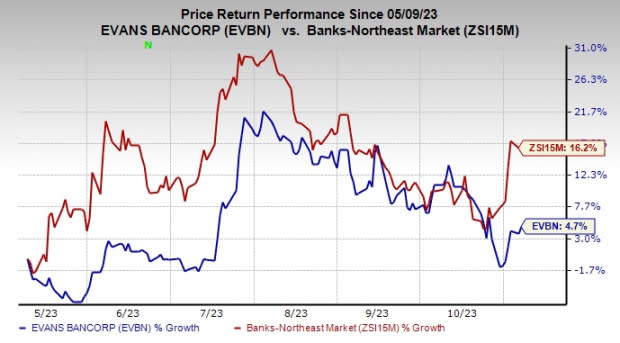

Over the past six months, shares of EVBN have gained 4.7% compared with the industry’s growth of 16.2%.

Image Source: Zacks Investment Research

Currently, EVBN carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Divestiture by Another Finance Firm

Last month, The Goldman Sachs Group, Inc. GS entered a definitive agreement to divest its consumer lending platform, GreenSky, and associated loans to a consortium led by investment firm Sixth Street Partners. Subject to closing conditions, the completion of the deal is expected in the first quarter of 2024.

The platform will be managed by Goldman until the conclusion of the transaction. The ongoing business performance will be recorded, including the effects of the consortium's agreement to purchase newly originated loans.

GreenSky's divestment is part of Goldman’s major business restructuring initiative to focus on its core strengths of investment banking and trading, while reducing its retail footprint.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Evans Bancorp, Inc. (EVBN) : Free Stock Analysis Report