Even With A 59% Surge, Cautious Investors Are Not Rewarding System1 Group PLC's (LON:SYS1) Performance Completely

System1 Group PLC (LON:SYS1) shareholders would be excited to see that the share price has had a great month, posting a 59% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 97% in the last year.

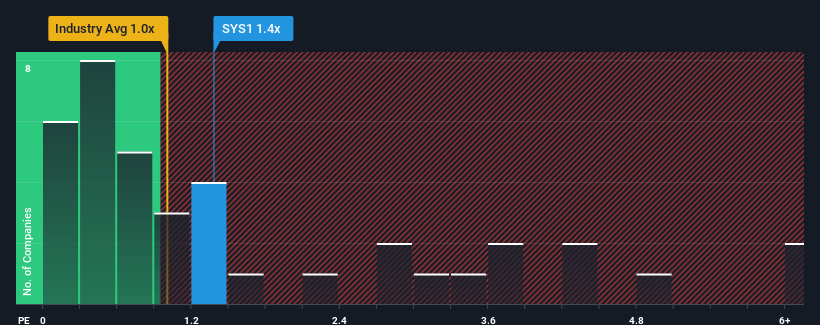

Although its price has surged higher, there still wouldn't be many who think System1 Group's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in the United Kingdom's Media industry is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for System1 Group

How Has System1 Group Performed Recently?

Recent times haven't been great for System1 Group as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on System1 Group will help you uncover what's on the horizon.

Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, System1 Group would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. As a result, it also grew revenue by 20% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 7.8% as estimated by the one analyst watching the company. With the industry only predicted to deliver 3.7%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that System1 Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

System1 Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that System1 Group currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for System1 Group (1 makes us a bit uncomfortable) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.