Even the Americans sitting on piles of cash aren't using it correctly to build wealth

Leon Neal/Getty Images

The average American is holding too much cash in savings, and it's keeping them from building wealth.

You should instead invest your excess savings in the stock market for the best returns, NerdWallet's retirement and investing specialist Arielle O'Shea recommends.

The easiest way to put your savings to work is through a 401(k), which invests your money in stocks through low-cost index funds or exchange-traded funds.

Sitting on a pile of cash may sound nice, but it won't get you very far financially.

The average American is holding more than $32,000 in cash, a new study from NerdWallet found. It calculated that because the money is sitting in a traditional savings account earning less than 1% in interest, the saver is missing out on an estimated $140,000 in investment returns over 30 years — and that's assuming a conservative 6% return rate on stock market investments.

Of the nearly 40% of Americans who say they don't invest at all, more than half say it's because they don't know how to invest or think investing is too risky, NerdWallet found. Another 16% say they don't trust financial institutions, and 8% erroneously think that keeping cash is the best way to save money. (Millennials and the silent generation are the cohorts most likely to feel this way, according to the survey.)

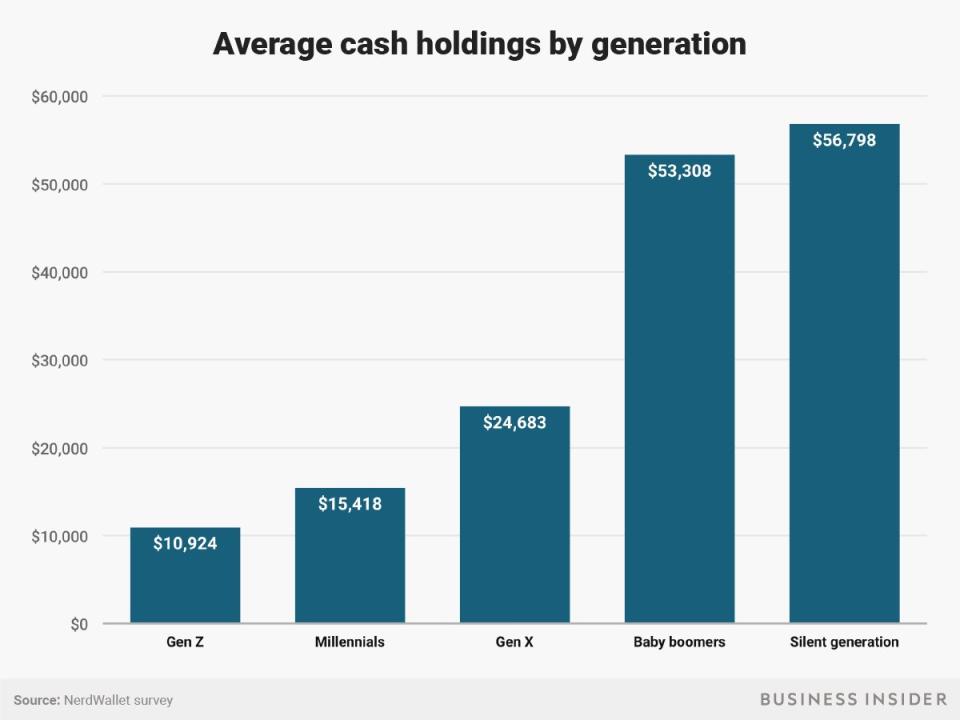

NerdWallet also found a connection between age and income when it comes to cash savings. Older generations tend to have a higher household income and thus more money in cash. For instance, Americans with a household income below $50,000 hold on average $6,069 in cash, while those earning more than $100,000 have $69,196 in cash.

Andy Kiersz/Business Insider

While it is important to have some cash available for emergencies — experts recommend a stockpile equal to three to six months' worth of expenses — any excess cash is best invested in the stock market, particularly if you're trying to build long-term wealth, said Arielle O'Shea, the investing and retirement specialist at NerdWallet.

After all, where you put your savings — whether in a traditional savings account, in a high-yield account, or in investments — could make a difference of millions by the time you retire, NerdWallet found in a previous study.

On average, Americans who invest are investing 13.1% of their annual income into an account tied to the stock market, and men are doing it more than women (14.2% versus 11.9%). Still, 24% of Americans are investing nothing.

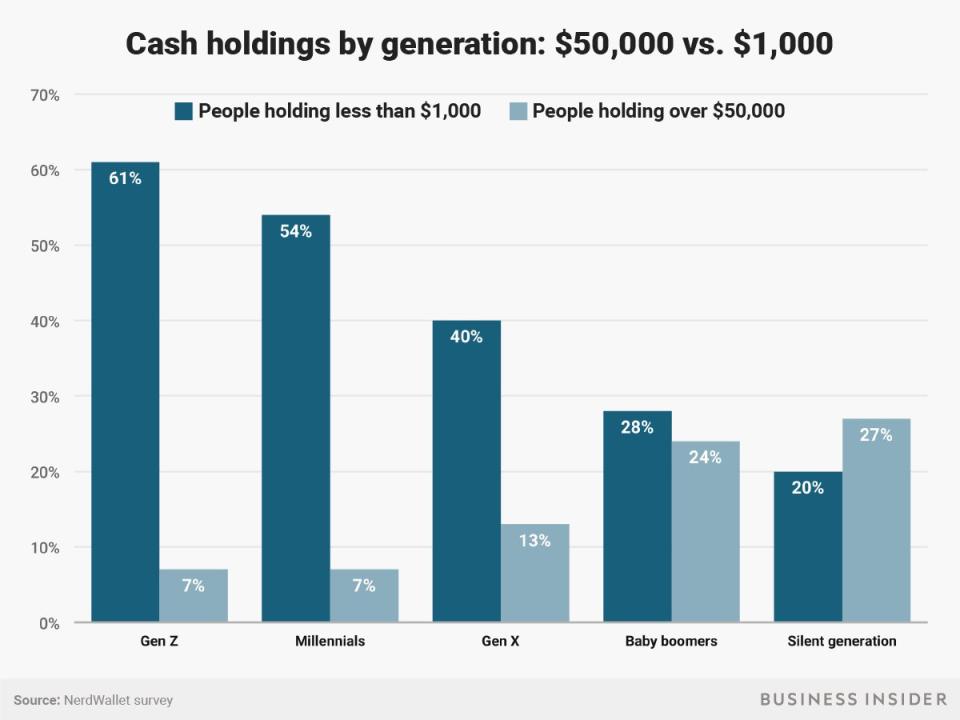

Andy Kiersz/Business Insider

But it doesn't have to be either/or when it comes to building an emergency fund and investing. If you have student loans to pay off or you're saving cash for a down payment, you can still put some of your money to work.

"The easiest way to wade into the stock market is through your 401(k) at work, or, if you don't have a 401(k), an individual retirement account," O'Shea told Business Insider. You can contribute a portion of your paycheck directly to a 401(k) — the money will come out of your paycheck pre-tax — and start earning returns now.

"Both should offer access to low-cost stock index funds or exchange-traded funds," O'Shea continued. "These funds roll a large number of companies — for example, all the companies in the S&P 500 — into a single investment, so you don't have to pick and choose individual stocks. If even that sounds like too heavy of a lift, consider a roboadviser service, which will select index funds and ETFs for you for a relatively low fee."

NerdWallet created a calculator to find out how much your cash savings could be worth if you invest it in the stock market — try it here.

NOW WATCH: This couple reveals their weaknesses when it comes to spending and how they manage to save

See Also:

SEE ALSO: There's almost no chance young investors will lose money over 40 years

DON'T MISS: There's a stronger relationship between getting a college degree and buying a home than ever before