EVENTIDE ASSET MANAGEMENT, LLC Bolsters Position in Xometry Inc

EVENTIDE ASSET MANAGEMENT, LLC (Trades, Portfolio) has recently increased its investment in Xometry Inc (NASDAQ:XMTR), signaling a strategic move by the firm. On October 31, 2023, the firm added 2,539,649 shares to its holdings, resulting in a significant trade impact of 0.62% on its portfolio. This transaction has brought EVENTIDE's total share count in Xometry to 5,730,339, which now represents 1.4% of its portfolio and 12.65% of the company's outstanding shares. The shares were acquired at a price of $14.55, reflecting the firm's confidence in the potential of Xometry Inc.

Insight into EVENTIDE ASSET MANAGEMENT, LLC (Trades, Portfolio)

EVENTIDE ASSET MANAGEMENT, LLC (Trades, Portfolio), based in Boston, MA, is known for its investment philosophy that often focuses on healthcare and technology sectors. With an equity portfolio valued at $5.92 billion, the firm's top holdings include Exact Sciences Corp (NASDAQ:EXAS), Old Dominion Freight Line Inc (NASDAQ:ODFL), and Palo Alto Networks Inc (NASDAQ:PANW), among others. The firm's approach to investing is underscored by a keen eye for value and growth within its preferred sectors.

Understanding Xometry Inc

Xometry Inc operates within the industrial products sector in the USA, offering AI-enabled manufacturing equipment. The company's business model caters to a diverse clientele, including engineers, product designers, and supply chain professionals. Xometry's manufacturing processes span across CNC Machining, Injection Molding, and 3D Printing, primarily serving the U.S. market. As of the date of this article, Xometry Inc boasts a market capitalization of $898.446 million, with a current stock price of $18.69, reflecting a significant gain of 28.45% since EVENTIDE's recent transaction.

Financial and Market Performance of Xometry Inc

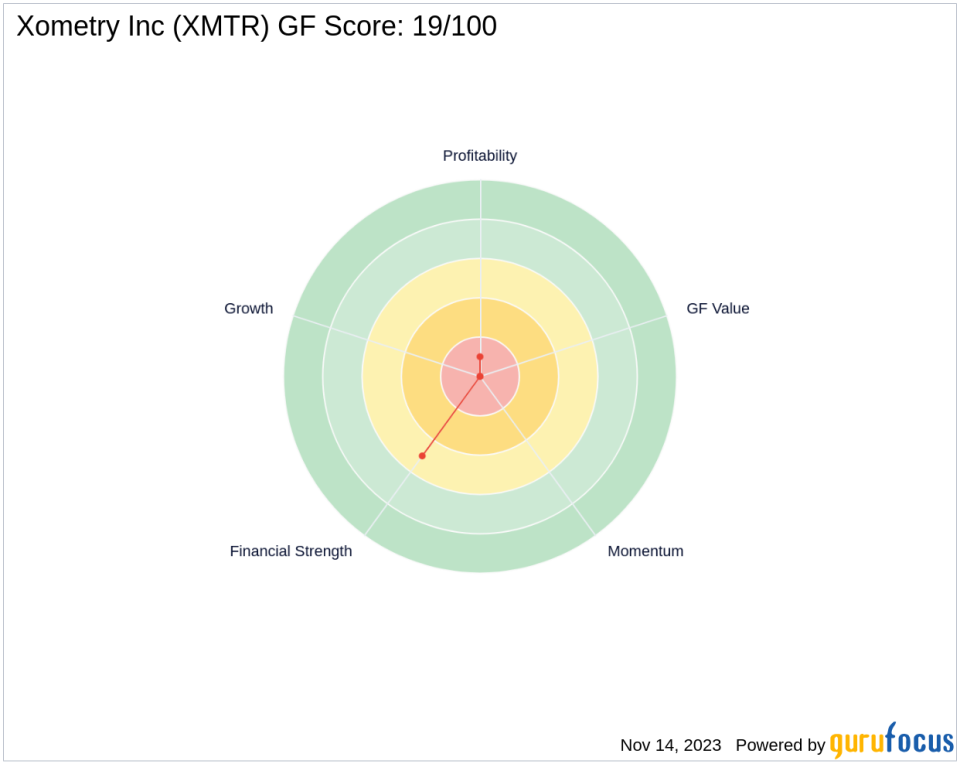

Despite the company's growth, Xometry Inc's stock performance has been turbulent, with a year-to-date decline of 42.19% and a substantial drop of 72.11% since its IPO. The absence of GF Value and GF Valuation data indicates that the intrinsic value of Xometry cannot be evaluated through GuruFocus's exclusive method. However, the stock's GF Score stands at 19 out of 100, suggesting potential challenges in future performance.

Xometry Inc's Financial Health and Growth Prospects

Xometry's financial health is reflected in its cash to debt ratio of 0.92, ranking it at 1612 among its peers. The company's return on equity (ROE) and return on assets (ROA) are at -22.55% and -11.22%, respectively, placing it at lower ranks within the industry. Growth indicators show a mixed picture, with a three-year revenue growth rate at -13.90%, but EBITDA and earnings growth over the same period are at 33.30% and 29.80%, respectively.

Market Momentum and Valuation Metrics

The momentum index and relative strength index (RSI) indicators for Xometry Inc present a nuanced view of the stock's recent performance. With a 14-day RSI of 47.26 and momentum indexes for the past 1 and 12 months at -5.98 and -59.18, respectively, the stock shows signs of volatility. These figures, coupled with the company's low GF Score and ranks in profitability, growth, and momentum, suggest that investors should exercise caution.

Conclusion: EVENTIDE's Strategic Move

EVENTIDE ASSET MANAGEMENT, LLC (Trades, Portfolio)'s increased stake in Xometry Inc reflects a strategic decision that may align with the firm's investment philosophy. While Xometry's current financial health and market performance exhibit some challenges, EVENTIDE's move could be based on long-term growth prospects or a belief in the company's potential to rebound. Value investors will be watching closely to see how this investment plays out in the context of the broader market and within EVENTIDE's diverse portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.