Everbridge Inc CFO Patrick Brickley Sells 6,360 Shares

On February 1, 2024, Patrick Brickley, the EVP and CFO of Everbridge Inc (NASDAQ:EVBG), sold 6,360 shares of the company's stock, according to a recent SEC Filing. The transaction was executed with the shares priced at $22.79 each, resulting in a total sale amount of $144,874.40.

Everbridge Inc is a software company that provides enterprise software applications that automate and accelerate organizations operational response to critical events in order to keep people safe and businesses running. During public safety threats such as active shooter situations, terrorist attacks or severe weather conditions, as well as critical business events including IT outages, cyber-attacks or other incidents such as product recalls or supply-chain interruptions, Everbridges Critical Event Management platform provides the agility, scalability, and reliability to help clients mitigate or eliminate the impact of such events.

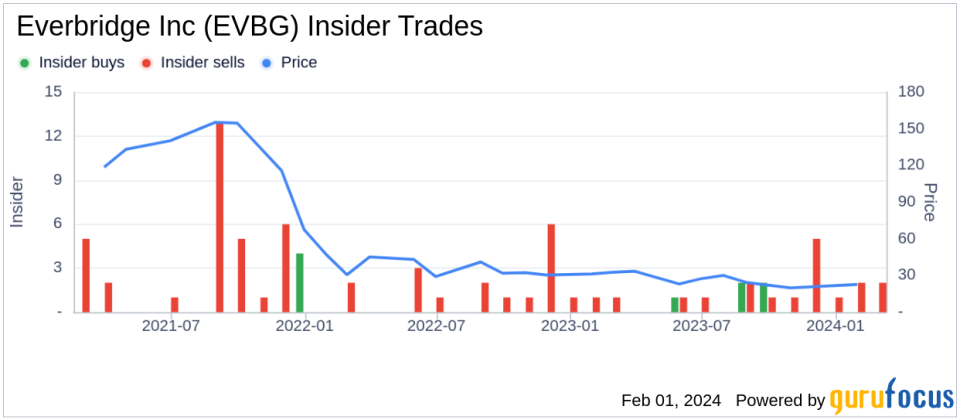

Over the past year, the insider has sold a total of 19,747 shares of Everbridge Inc and has not made any purchases. The company's insider transaction history indicates a pattern of more insider sales than buys over the past year, with 16 insider sells and 5 insider buys recorded.

As of the date of the insider's recent transaction, Everbridge Inc had a market capitalization of $981.55 million. The stock's trading price on the day of the sale was $22.79.

The stock's price-to-GF-Value ratio stood at 0.55, with a GuruFocus Value of $41.31, indicating that the stock might be a possible value trap and warrants caution before investing.

The GF Value is determined by considering historical trading multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, along with a GuruFocus adjustment factor based on the company's historical returns and growth, and future business performance estimates provided by Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.