Everbridge Inc (EVBG) Reports Mixed Financial Results for Q4 and Full Year 2023

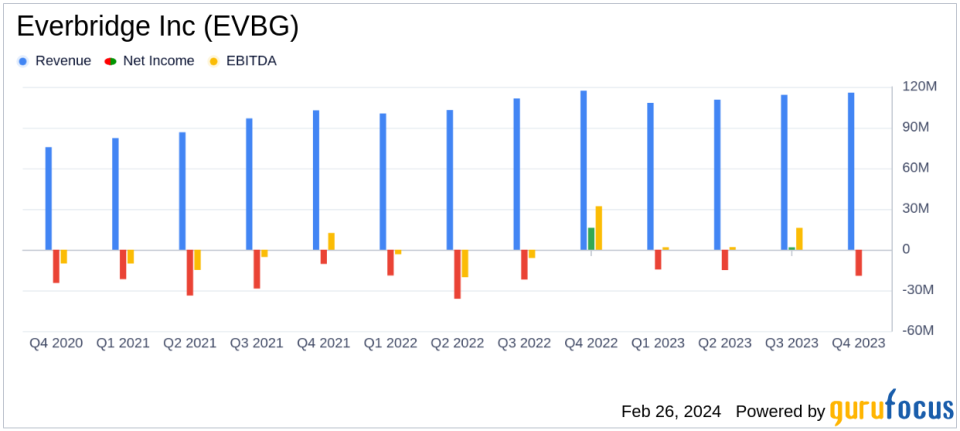

Q4 Revenue: Slight year-over-year decrease to $115.8 million.

Full Year Revenue: Increased by 4% year-over-year to $448.8 million.

GAAP Net Loss: Q4 net loss of $(19.3) million; full year net loss improved to $(47.3) million from $(61.2) million in 2022.

Non-GAAP Measures: Non-GAAP operating income and net income showed improvements in both Q4 and full year results.

Cash Flow: Operating cash flow significantly increased to $29.6 million in Q4 and $72.6 million for the full year.

Annualized Recurring Revenue (ARR): Reached $408 million with 55 new CEM customers added in Q4.

On February 26, 2024, Everbridge Inc (NASDAQ:EVBG), a global leader in critical event management (CEM) and national public warning solutions, disclosed its financial outcomes for the fourth quarter and full year ended December 31, 2023, through its 8-K filing. The company, known for its SaaS-based CEM platform, reported a slight year-over-year decrease in quarterly revenue but an increase in annual revenue, reflecting resilience in its subscription services despite broader market challenges.

Financial Performance Overview

Everbridge's fourth quarter saw a minor dip in revenue to $115.8 million, a 1% decrease from the previous year. However, the company's full-year revenue rose by 4% to $448.8 million. The GAAP net loss for the quarter was $(19.3) million, a stark contrast to the net income of $16.2 million in the same quarter of the previous year. The full-year GAAP net loss also improved to $(47.3) million from $(61.2) million in 2022.

The company's subscription services continued to grow, with a 4% increase in Q4 revenue, while professional services, software licenses, and other revenues saw a significant decrease. Everbridge's non-GAAP operating income for Q4 was $20.7 million, up from $15.6 million in the prior year, and the full-year non-GAAP operating income more than doubled to $62.1 million from $24.7 million in 2022.

Adjusted EBITDA for the quarter was $27.0 million, an increase from $20.6 million in Q4 of 2022. The company also reported strong cash flow from operations, with an inflow of $29.6 million in the fourth quarter, significantly higher than the $4.4 million in the same period last year. Adjusted free cash flow for the quarter was $26.7 million, compared to $4.6 million in Q4 of 2022.

Strategic and Operational Highlights

Everbridge's Annualized Recurring Revenue (ARR) reached $408 million, with the addition of 55 CEM customers during the quarter. The company also reported several large deals, including 48 deals over $100,000, three deals over $500,000, and one deal over $1 million.

The company's focus on subscription services aligns with the industry's shift towards recurring revenue models, which provide more predictable income streams and can enhance company valuations. Everbridge's ability to grow its ARR amidst economic headwinds demonstrates the critical nature of its services and the value it provides to customers.

Balance Sheet and Cash Flow Statements

Everbridge's balance sheet shows a healthy cash and cash equivalents position of $122.4 million as of December 31, 2023. The company's total assets amounted to $1.025 billion, while total liabilities stood at $723.6 million. The cash flow statements reflect the company's strong operational cash inflow, which is crucial for sustaining growth and investing in future initiatives.

Investor and Analyst Perspectives

Despite the mixed results, Everbridge's improvements in non-GAAP operating income and net income, as well as substantial cash flow growth, may be viewed positively by investors and analysts. The company's strategic realignment and focus on subscription services could position it well for long-term growth in the evolving software industry.

Everbridge's management team remains committed to driving operational efficiency and expanding its customer base. The company's resilience in the face of economic challenges and its strategic focus on recurring revenue streams could make it an attractive option for value investors looking for companies with solid fundamentals and growth potential.

For more detailed information on Everbridge Inc (NASDAQ:EVBG)'s financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Everbridge Inc for further details.

This article first appeared on GuruFocus.