Everbridge (NASDAQ:EVBG) Reports Q3 In Line With Expectations But Stock Drops

Critical event management software company Everbridge (NASDAQ:EVBG) reported results in line with analysts' expectations in Q3 FY2023, with revenue up 2.5% year on year to $114.2 million. On the other hand, next quarter's revenue guidance of $114.8 million was less impressive, coming in 3% below analysts' estimates. Turning to EPS, Everbridge made a non-GAAP profit of $0.46 per share, improving from its profit of $0.27 per share in the same quarter last year.

Is now the time to buy Everbridge? Find out by accessing our full research report, it's free.

Everbridge (EVBG) Q3 FY2023 Highlights:

Revenue: $114.2 million vs analyst estimates of $113.7 million (small beat)

EPS (non-GAAP): $0.46 vs analyst estimates of $0.42 (8.8% beat)

Revenue Guidance for Q4 2023 is $114.8 million at the midpoint, below analyst estimates of $118.3 million

Free Cash Flow of $10.23 million, up from $9,000 in the previous quarter

Customers: 405, up from 373 in the previous quarter

Gross Margin (GAAP): 71%, up from 68.4% in the same quarter last year

“We delivered solid third quarter results as we continue to improve our go-to-market execution and overall operating efficiency,” said David Wagner, President and CEO of Everbridge.

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

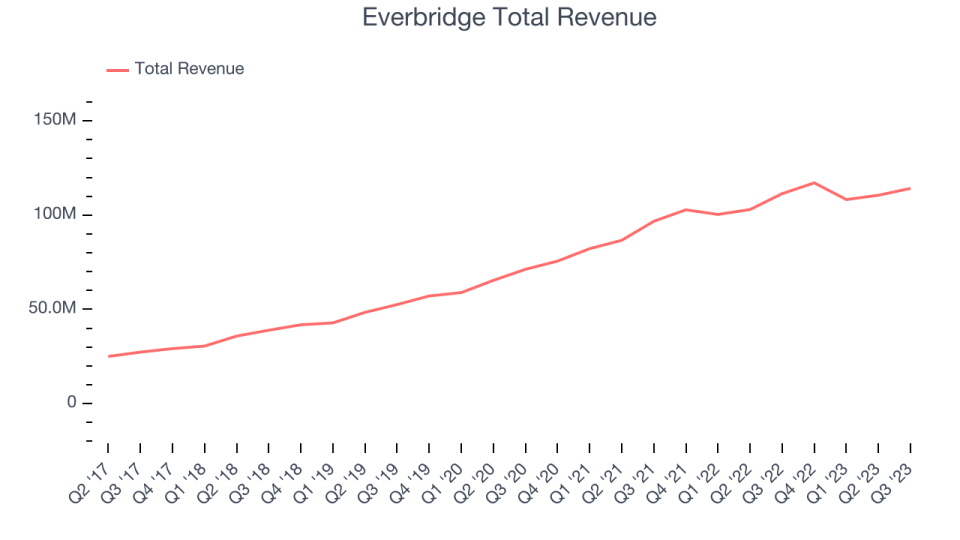

As you can see below, Everbridge's revenue growth has been mediocre over the last two years, growing from $96.75 million in Q3 FY2021 to $114.2 million this quarter.

Everbridge's quarterly revenue was only up 2.5% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $3.62 million quarter on quarter, re-accelerating from $2.30 million in Q2 2023.

Next quarter, Everbridge is guiding for a 2% year-on-year revenue decline to $114.8 million, a further deceleration from the 13.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 3.9% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Cash Is King

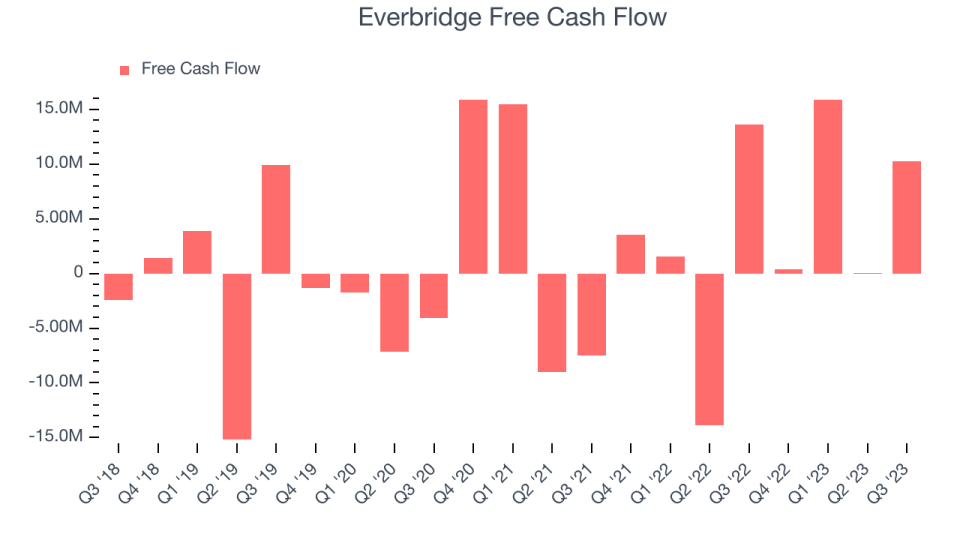

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Everbridge's free cash flow came in at $10.23 million in Q3, down 25% year on year.

Everbridge has generated $26.51 million in free cash flow over the last 12 months, a decent 6% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Everbridge's Q3 Results

Sporting a market capitalization of $844.6 million, Everbridge is among smaller companies, but its more than $99.76 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We were impressed by Everbridge's adjusted EBITDA and EPS beats this quarter. That stood out as a positive in these results. On the other hand, its revenue, adjusted EBITDA, and EPS guidance for next quarter missed Wall Street's estimates. Overall, this was a mixed quarter for Everbridge. The company is down 9.4% on the results and currently trades at $18.28 per share.

Everbridge may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.