Everbridge's (NASDAQ:EVBG) Q4 Sales Top Estimates

Critical event management software company Everbridge (NASDAQ:EVBG) reported results ahead of analysts' expectations in Q4 FY2023, with revenue down 1.2% year on year to $115.8 million. It made a non-GAAP profit of $0.47 per share, improving from its profit of $0.39 per share in the same quarter last year.

Is now the time to buy Everbridge? Find out by accessing our full research report, it's free.

Everbridge (EVBG) Q4 FY2023 Highlights:

Revenue: $115.8 million vs analyst estimates of $114.6 million (1% beat)

EPS (non-GAAP): $0.47 vs analyst expectations of $0.49 (4.5% miss)

Free Cash Flow of $24.69 million, up 59.3% from the previous quarter

Gross Margin (GAAP): 71.2%, in line with the same quarter last year

Market Capitalization: $1.17 billion

Everbridge has agreed in to be taken private by Thoma Bravo for $28.60 a share in cash ($1.5B in total).

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

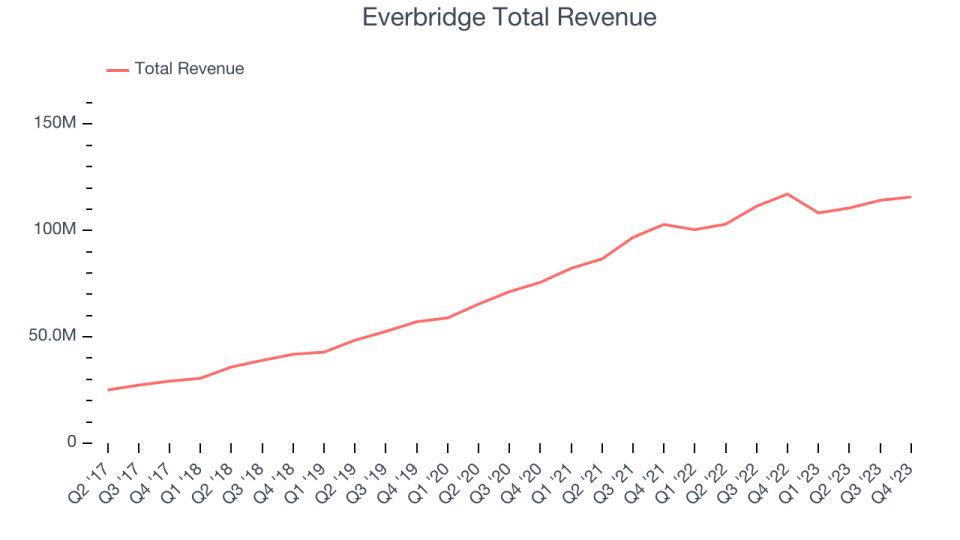

As you can see below, Everbridge's revenue growth has been unremarkable over the last two years, growing from $102.8 million in Q4 FY2021 to $115.8 million this quarter.

This quarter, Everbridge's revenue was down 1.2% year on year, which might disappointment some shareholders.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

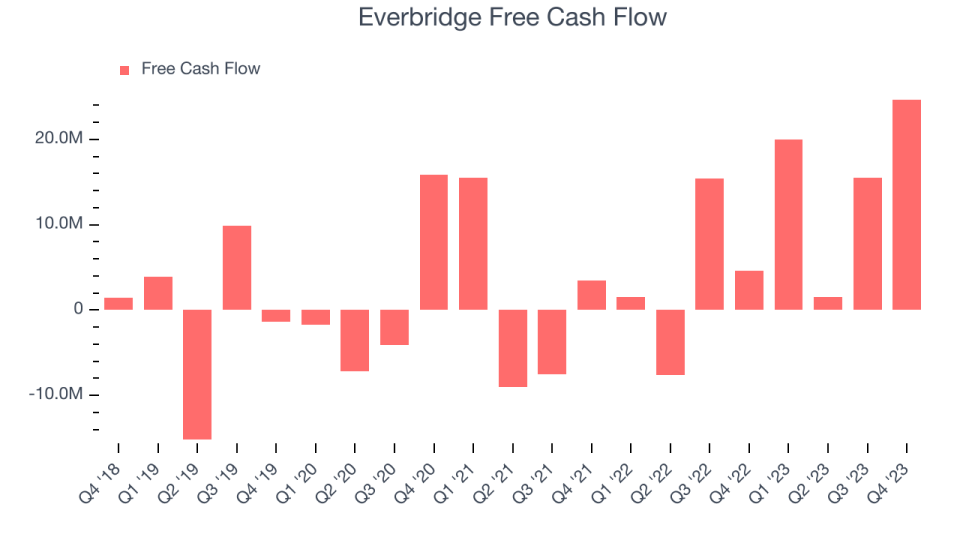

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Everbridge's free cash flow came in at $24.69 million in Q4, up 440% year on year.

Everbridge has generated $61.77 million in free cash flow over the last 12 months, a decent 13.8% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Everbridge's Q4 Results

Overall, we think this was a decent quarter. The stock is flat after reporting, as the price is now determined by the likelihood of the take private deal going through rather than fundamentals or market sentiment and currently trades at $28.33 per share.

So should you invest in Everbridge right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.