Everest Group (EG) to Report Q3 Earnings: What's in Store?

Everest Group, Ltd. EG is slated to report third-quarter 2023 earnings on Oct 25, after market close. The insurer delivered an earnings surprise in three of the last four quarters and missed in one, the average being 17.36%.

Factors to Consider

Premium growth is likely to have been driven by the solid performance of its Reinsurance segment, rate increases, exposure growth and strong underwriting. We expect net written premium to increase 8.9% to $3.6 billion in the third quarter.

The Insurance segment is likely to have benefited from an increase in property, short tail business, specialty casualty business and other specialty lines of business, as well as new business and strong renewal retention. We estimate premiums earned to increase 21.8% to $1 billion in the to-be-reported quarter.

Commission ratio is likely to have benefited from the business mix, as well as increased volume of ceding commissions and decreased gross commissions across multiple lines.

The Reinsurance segment is likely to have benefited from widespread growth across business lines and geographies, including marine and aviation, as well as solid international growth, higher property cat premiums and casualty and improved property pro-rata premiums. We expect the metric to improve 15.3% to $2.6 billion in the third quarter.

Net investment income is likely to have benefited from higher new money yields, investment in floating rate securities and higher assets under management. We expect net investment income to be $238.5 million, up 58% from the year-ago reported quarter.

The top line in the to-be-reported quarter is likely to have benefited from higher net written premiums and net investment income. The Zacks Consensus Estimate for revenues is currently pegged at $3.83 billion, indicating a 19.6% increase from the year-ago reported figure.

Higher-than-expected cat losses are likely to have weighed on underwriting profitability. Nonetheless, rate increase, exposure growth, prudent underwriting and traditional risk management capabilities are likely to have favored underwriting results and combined ratio in the to-be-reported quarter. We expect the combined ratio to be 95.6 in the to-be-reported quarter.

We estimate underwriting income in the Insurance segment to increase 416.7% to $91.8 million and 119.8% to $67.1 million in the Reinsurance segment in the to-be-reported quarter.

The Zacks Consensus Estimate for EG’s third-quarter earnings is currently pegged at $10.18, indicating an increase of 292.8% from the year-ago quarter’s reported figure.

What the Zacks Model Says

Our proven model does not conclusively predict an earnings beat for Everest Group this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Earnings ESP: Everest Group has an Earnings ESP of 0.00%. This is because both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at $10.18 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

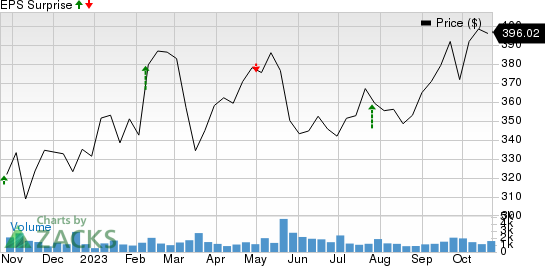

Everest Group, Ltd. Price and EPS Surprise

Everest Group, Ltd. price-eps-surprise | Everest Group, Ltd. Quote

Zacks Rank: Everest Group carries a Zacks Rank #2 at present.

Stocks to Consider

Some insurance stocks with the right combination of elements to deliver an earnings beat this time around are:

Enact Holdings, Inc. ACT has an Earnings ESP of +2.33% and a Zacks Rank #1 at present. The Zacks Consensus Estimate for third-quarter 2023 earnings is pegged at 86 cents, indicating a year-over-year decline of 26.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ACT’s earnings beat estimates in three of the last four quarters and missed in the other one.

The Hartford Financial Services Group, Inc. HIG has an Earnings ESP of +1.61% and a Zacks Rank #2 at present. The Zacks Consensus Estimate for third-quarter 2023 earnings is pegged at $1.95, indicating a year-over-year increase of 35.4%.

HIG’s earnings beat estimates in three of the last four quarters and matched in one.

American International Group, Inc. AIG has an Earnings ESP of +4.02% and a Zacks Rank #2 at present. The Zacks Consensus Estimate for third-quarter 2023 earnings is pegged at $1.55, indicating a year-over-year increase of 134.8%.

AIG’s earnings beat estimates in each of the last four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report