EverQuote Inc (EVER) Faces Headwinds but Maintains Positive Adjusted EBITDA in 2023

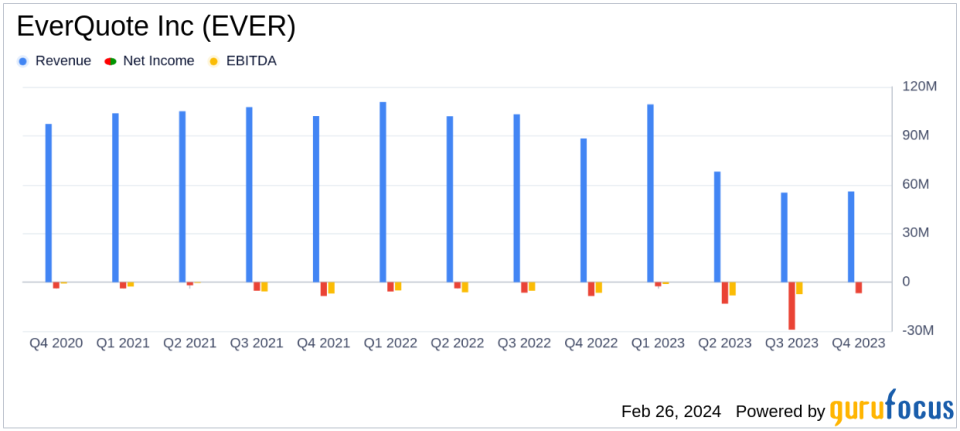

Revenue: Full-year revenue decreased by 28.8% to $287.9 million in 2023 from $404.1 million in 2022.

Net Loss: Net loss widened to $51.3 million in 2023 from $24.4 million in 2022.

Adjusted EBITDA: Adjusted EBITDA plummeted by 92.2% to $461,000 in 2023 from $5.9 million in 2022.

Balance Sheet: Cash and cash equivalents stood at $38 million as of December 31, 2023, compared to $30.8 million in 2022.

Outlook: EverQuote Inc (NASDAQ:EVER) aims to restore consistent positive quarterly cash flow from operations in the first half of 2024.

On February 26, 2024, EverQuote Inc (NASDAQ:EVER), a leading online insurance marketplace, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its data-driven platform that connects consumers with insurance providers, faced significant challenges throughout the year, including historically low carrier demand. Despite these obstacles, EverQuote managed to maintain positive Adjusted EBITDA for the year and improved its balance sheet.

EverQuote Inc (NASDAQ:EVER) operates an online marketplace for insurance shopping, offering consumers quotes for car, home, and life insurance. The platform's data and technology match consumers with insurance providers, primarily generating revenue through direct channels. In 2023, the company faced a transformative period, focusing on capital efficiency and streamlining operations amidst a tough auto carrier environment.

EverQuote's CEO, Jayme Mendal, expressed satisfaction with the company's fourth-quarter performance, which exceeded guidance on key financial metrics such as revenue, Variable Marketing Margin (VMM), and Adjusted EBITDA. CFO Joseph Sanborn highlighted the company's disciplined approach to managing expenses and driving incremental operating leverage. The company's focus for 2024 is on achieving consistent positive quarterly cash flow from operations and returning to pre-downturn Adjusted EBITDA margins.

Financial Performance Overview

EverQuote's financial performance in 2023 reflected the challenges it faced. The company's full-year revenue decreased by 28.8% to $287.9 million, down from $404.1 million in the previous year. This decline was partly due to the company's exit from the health insurance vertical at the end of the second quarter of 2023, which contributed $38.7 million in revenue in 2022. The net loss for the year widened to $51.3 million, compared to a net loss of $24.4 million in 2022. However, the company managed to maintain a positive Adjusted EBITDA of $461,000, although this was a significant drop from $5.9 million in the prior year.

EverQuote's balance sheet showed a cash and cash equivalents balance of $37.9 million as of December 31, 2023, an increase from $30.8 million at the end of 2022. The company's total assets stood at $110.9 million, with total liabilities of $30 million and total stockholders' equity of $80.9 million.

Key financial metrics for the fourth quarter of 2023 included a 36.9% decrease in total revenue to $55.7 million, compared to $88.3 million in the fourth quarter of 2022. The loss from operations improved by 22.1%, and the net loss decreased by 25.3%. The Variable Marketing Margin declined by 28.9%, and Adjusted EBITDA turned negative at $(886,000), compared to a positive $92,000 in the same quarter of the previous year.

Analysis and Future Outlook

EverQuote's performance in 2023 was marked by resilience in the face of industry-wide challenges. The company's ability to maintain positive Adjusted EBITDA despite a significant revenue drop and a challenging environment is noteworthy. The focus on streamlining operations and improving the balance sheet positions EverQuote for potential recovery as market conditions improve.

Looking ahead, EverQuote's management is optimistic about the company's prospects in 2024. With a disciplined approach to expense management and signs of an improving auto carrier environment, the company is poised to achieve its goal of restoring consistent positive quarterly cash flow from operations in the first half of the year. The aim to return to pre-downturn Adjusted EBITDA margins further underscores the company's commitment to financial stability and growth.

Investors and potential GuruFocus.com members should note that EverQuote's strategic adjustments and the potential uptick in the auto carrier environment could lead to improved performance in the coming year. The company's focus on capital efficiency and operational leverage may yield positive results, making it a company to watch in the Interactive Media industry.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and join the conference call and webcast hosted by EverQuote.

Explore the complete 8-K earnings release (here) from EverQuote Inc for further details.

This article first appeared on GuruFocus.