EverQuote, Inc. (NASDAQ:EVER) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the EverQuote, Inc. (NASDAQ:EVER) share price has dived 29% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

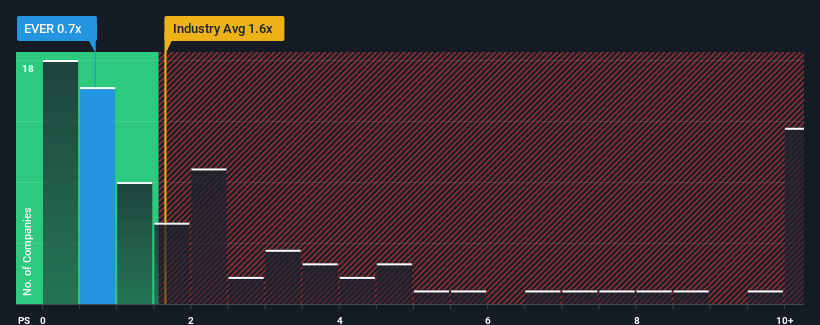

After such a large drop in price, EverQuote may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Interactive Media and Services industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for EverQuote

What Does EverQuote's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, EverQuote's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EverQuote.

Is There Any Revenue Growth Forecasted For EverQuote?

The only time you'd be truly comfortable seeing a P/S as low as EverQuote's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.4%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 62% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 12% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 10% per year, which is not materially different.

In light of this, it's peculiar that EverQuote's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does EverQuote's P/S Mean For Investors?

The southerly movements of EverQuote's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of EverQuote's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware EverQuote is showing 4 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here