Eversource Energy (ES) to Post Q3 Earnings: What's in Store?

Eversource Energy ES is scheduled to release third-quarter 2023 results on Nov 6, before market open. The company delivered an earnings surprise of 8.7% in the last reported quarter.

Let’s discuss the factors that are likely to be reflected in the upcoming quarterly results.

Factors to Consider

During the third quarter, Eversource Energy completed its sale of the uncommitted lease area located 25 miles off the south coast of Massachusetts to Ørsted for $625 million in an all-cash transaction. This is expected to have boosted ES’ performance in the to-be-reported quarter.

The company’s third-quarter earnings are expected to have benefited from increased Electric Distribution capital investments and lower storm costs.

As part of the 2022 NSTAR Electric rate case decision, certain customer rates changed from seasonal demand charges to a single annual demand charge, effective Jan 1, 2023. This rate design change is expected to have lowered the company’s third-quarter revenues.

Higher interest expense is likely to have adversely impacted ES’ performance in the to-be-reported quarter.

Q3 Expectations

The Zacks Consensus Estimate for earnings is pegged at 99 cents per share, indicating a year-over-year decrease of 2%.

The consensus mark for revenues is pinned at $3.33 billion, implying a year-over-year improvement of 3.7%.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Eversource Energy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here, as you will see below.

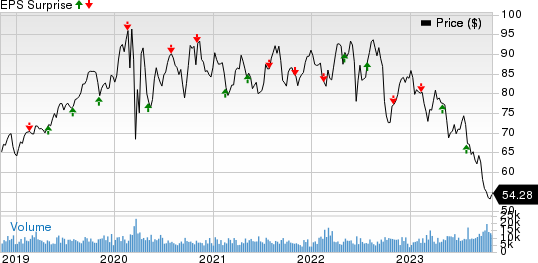

Eversource Energy Price and EPS Surprise

Eversource Energy price-eps-surprise | Eversource Energy Quote

Earnings ESP: The company’s Earnings ESP is -1.82%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, Eversource Energy carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few promising players from the same sector that have the right combination of elements to come up with an earnings beat this reporting cycle.

TransAlta TAC is likely to come up with an earnings beat when it reports third-quarter results on Nov 7, before market open. It has an Earnings ESP of +15.26% and a Zacks Rank #3 at present.

The Zacks Consensus Estimate for earnings is pegged at 32 cents per share, indicating a year-over-year increase of 88.2%. The consensus mark for 2023 earnings is pinned at $1.44 per share, implying a year-over-year improvement of 1,900%.

Ameren Corporation AEE is expected to come up with an earnings beat when it reports third-quarter results on Nov 8, after market close. It has an Earnings ESP of +0.22% and a Zacks Rank #3 at present.

AEE’s long-term earnings growth rate is 6.61%. The Zacks Consensus Estimate for earnings is pegged at $1.8 per share, indicating a year-over-year increase of 3.5%.

Spire Inc. SR is likely to report an earnings beat when it announces fiscal fourth-quarter results on Nov 16, before market open. It has an Earnings ESP of +4.58% and a Zacks Rank #3 at present.

SR’s long-term earnings growth rate is 4.22%. The Zacks Consensus Estimate for fiscal 2023 earnings is pegged at $4.16 per share, indicating a year-over-year improvement of 7.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

Spire Inc. (SR) : Free Stock Analysis Report