Everspin Technologies Inc (MRAM) Achieves Record Annual Revenue and Profitability in 2023

Q4 Revenue: $16.7 million with EPS of $0.09, surpassing expectations.

Annual Performance: Record revenue and profitability achieved in 2023.

Design Wins: Closed the year with 217 design wins, indicating future growth potential.

Financial Position: Strongest cash balance in history, with no debt.

Q1 2024 Outlook: Revenue expected to be between $13.5 million to $14.5 million with GAAP net income per diluted share between breakeven and $0.05.

Non-GAAP Measure: Adjusted EBITDA for the year 2023 stands at $15.3 million.

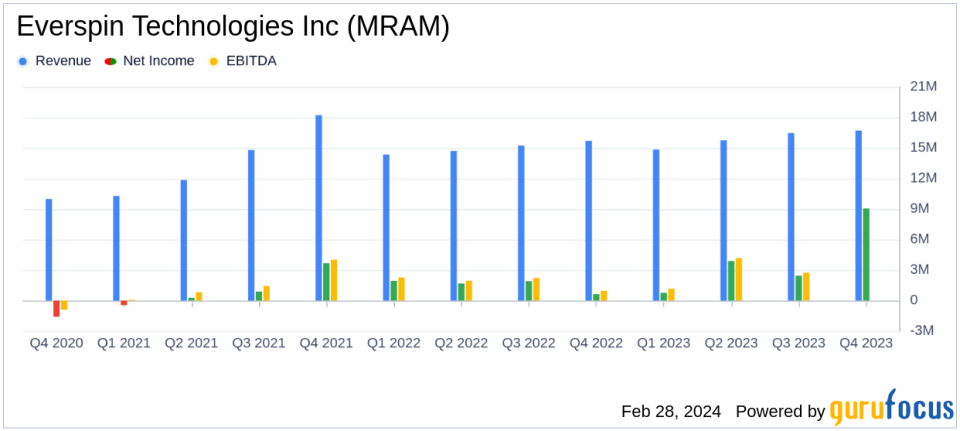

On February 28, 2024, Everspin Technologies Inc (NASDAQ:MRAM), a leading provider of Magnetoresistive Random Access Memory (NASDAQ:MRAM) products, released its 8-K filing, announcing unaudited financial results for the fourth quarter and full year ended December 31, 2023. The company reported a robust fourth quarter with revenue of $16.7 million and earnings per share (EPS) of $0.09, exceeding its guidance and reflecting a strong demand for its products and technology.

Company Overview

Everspin Technologies Inc is at the forefront of MRAM technology, offering high-performance non-volatile memory solutions essential for industrial IoT, data centers, and other mission-critical applications. The company's revenue streams include product sales, licensing, royalties, and design services, with a global presence across North America, EMEA, and APAC regions.

Financial Highlights and Challenges

The company's financial achievements in 2023 are particularly noteworthy, with record annual revenue and profitability. Everspin reported a net income of $9.052 million for the year, a significant increase from the previous year's $6.129 million. This performance underscores the company's operational excellence and ability to improve gross margins. However, Everspin's management cautions that external factors such as the ongoing COVID-19 pandemic, supply chain constraints, and geopolitical tensions could impact future performance.

Despite these challenges, Everspin's financial position remains robust, with the highest cash balance in the company's history at $36.946 million and no outstanding debt. This financial strength is crucial for the semiconductor industry, where research and development, as well as rapid adaptation to market changes, are vital for sustained growth.

Income Statement and Balance Sheet Analysis

For the full year 2023, Everspin's total revenue reached $63.765 million, with product sales contributing $53.123 million and licensing, royalty, patent, and other revenue accounting for $10.642 million. The company managed to reduce the cost of product sales slightly, contributing to an improved gross profit of $37.245 million compared to $33.945 million in the previous year.

Operating expenses totaled $31.360 million, with research and development, general and administrative, and sales and marketing expenses all witnessing modest increases. The company's focus on operational efficiency is evident in its income from operations, which stood at $5.885 million.

On the balance sheet, Everspin's total assets increased to $67.303 million, up from $55.333 million in the previous year. The increase in assets is primarily due to a significant rise in cash and cash equivalents and a modest increase in inventory and other assets.

Key Financial Metrics and Commentary

Adjusted EBITDA, a non-GAAP financial measure used by Everspin to evaluate its operating performance, reached $15.309 million for the year 2023, an increase from $11.807 million in the previous year. This metric is important as it provides insights into the company's profitability, excluding non-operational expenses such as interest, taxes, depreciation, and amortization.

"We are pleased that our fourth quarter results exceeded our expectations across the board, led by strong product and RAD Hard revenue," said Sanjeev Aggarwal, President and Chief Executive Officer. "For the full year, our team delivered record revenue and profitability, while driving improved gross margins through operational excellence, and we closed the year with 217 design wins."

"We reported another profitable quarter, marking our 11th consecutive quarter of profitability, a key focus for the company," said Anuj Aggarwal, Everspins Chief Financial Officer. "Our financial position remains strong, with no debt and the highest cash balance in the companys history."

Conclusion and Outlook

Everspin Technologies Inc (NASDAQ:MRAM) has demonstrated a strong financial performance in 2023, with significant achievements in revenue and profitability. The company's strategic focus on operational excellence and its robust financial position without debt bode well for its future, despite potential external challenges. With a positive outlook for Q1 2024, Everspin continues to solidify its leadership in the MRAM market.

Explore the complete 8-K earnings release (here) from Everspin Technologies Inc for further details.

This article first appeared on GuruFocus.