Evertec Inc (EVTC) Reports Mixed Results for Q4 and Full Year 2023, Announces 2024 Outlook

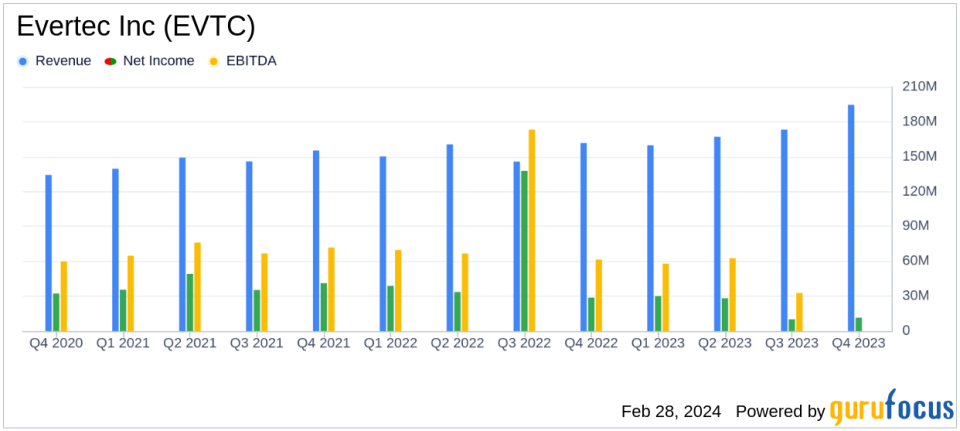

Revenue: Q4 revenue increased by 20% to $194.6 million, and full-year revenue grew by 12% to $694.7 million.

Net Income: GAAP Net Income for Q4 decreased by 61% to $11.5 million, while full-year net income decreased compared to the previous year.

Adjusted EBITDA: Q4 Adjusted EBITDA rose to $71.7 million, with a full-year increase of 6% to $292.0 million.

Earnings Per Share (EPS): Q4 Adjusted EPS decreased by 6% to $0.62, but full-year Adjusted EPS increased by 11% to $2.82.

Share Repurchase: Evertec intends to enter into an accelerated share repurchase agreement for $70 million.

2024 Outlook: The company forecasts total consolidated revenue between $844 million and $854 million and Adjusted EPS between $2.82 to $2.94.

On February 28, 2024, Evertec Inc (NYSE:EVTC) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading transaction processing business in Latin America and the Caribbean, operates across multiple segments, including Merchant Acquiring, Payment Services, and Business Solutions, serving a diverse customer base with secure technology solutions.

Financial Performance Overview

Evertec's Q4 revenue saw a significant increase, primarily due to growth in the Latin America business, benefiting from the Sinqia acquisition and strong organic growth. However, GAAP Net Income for common shareholders saw a sharp decline, attributed to increased selling, general, and administrative expenses, higher personnel costs, and increased interest expense related to the Sinqia acquisition financing.

The full-year results echoed a similar pattern, with revenue growth across key segments. The net income decrease for the year was primarily due to a gain recognized in the prior year from closing the Popular Transaction and a loss on foreign currency swap related to the Sinqia acquisition in 2023.

Challenges and Financial Achievements

Despite the revenue growth, Evertec faced challenges, including increased expenses and integration costs from its acquisitions, which impacted net income and Adjusted EBITDA margins. The company's financial achievements, particularly in revenue growth and Adjusted EBITDA, are crucial in demonstrating its ability to expand and integrate new acquisitions effectively, which is vital for maintaining competitiveness in the software and payment solutions industry.

Key Financial Metrics

Adjusted EBITDA and Adjusted EPS are important metrics for Evertec, reflecting the company's operational efficiency and profitability. The Adjusted EBITDA margin, although decreased, still represents a strong performance in operational profitability. The share repurchase program is also a significant indicator of the company's confidence in its financial health and commitment to delivering shareholder value.

"We are pleased to deliver another year of strong results as we continue to execute in our core markets and benefit from strong organic growth. As we look to 2024 we will continue to focus on delivering great solutions to our clients that will drive growth and on integrating our most recent acquisitions as we become the true provider of Latin America Payments and Solutions," said Mac Schuessler, President and Chief Executive Officer.

2024 Outlook and Strategic Moves

Looking ahead, Evertec's 2024 outlook is optimistic, with expected revenue growth and a stable to moderate increase in Adjusted EPS. The planned $70 million ASR agreement reflects a strategic move to enhance shareholder value. The company's focus on integrating acquisitions and delivering solutions to drive growth is pivotal for its success in the evolving Latin American payments landscape.

Evertec's performance in 2023, marked by revenue growth amidst net income challenges, sets a complex backdrop for 2024. The company's strategic focus on acquisitions and market execution will be key to achieving its optimistic outlook and maintaining its position as a leading provider in the region.

For detailed financial tables and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Evertec Inc for further details.

This article first appeared on GuruFocus.