EVP Angela Busch Sells 5,488 Shares of Ecolab Inc (ECL)

In a notable insider transaction, Angela Busch, the Executive Vice President of Corporate Strategy and Business Development at Ecolab Inc, sold 5,488 shares of the company on November 14, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's financial health and future prospects.

Who is Angela Busch of Ecolab Inc?

Angela Busch is a key executive at Ecolab Inc, holding the position of Executive Vice President of Corporate Strategy and Business Development. In her role, Busch is responsible for shaping the company's strategic direction, identifying growth opportunities, and overseeing business development initiatives. Her actions and decisions are closely watched by investors, as they can have a significant impact on Ecolab's performance and stock valuation.

Ecolab Inc's Business Description

Ecolab Inc is a global leader in water, hygiene, and infection prevention solutions and services. The company delivers comprehensive solutions, data-driven insights, and personalized service to advance food safety, maintain clean environments, optimize water and energy use, and improve operational efficiencies for customers in the food, healthcare, energy, hospitality, and industrial markets in more than 170 countries around the world. Ecolab's innovative products and services help businesses achieve cleaner, safer, and healthier environments, which is critical in today's world.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly sales, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future, it is also possible that insiders might sell shares for personal reasons, such as diversifying their investment portfolio or financing personal expenses. Therefore, it is essential to consider the context and magnitude of the transactions.

Over the past year, Angela Busch has sold a total of 11,948 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that the insider is gradually reducing her stake in the company. However, without additional context, it is difficult to draw definitive conclusions about her outlook on the company's future performance.

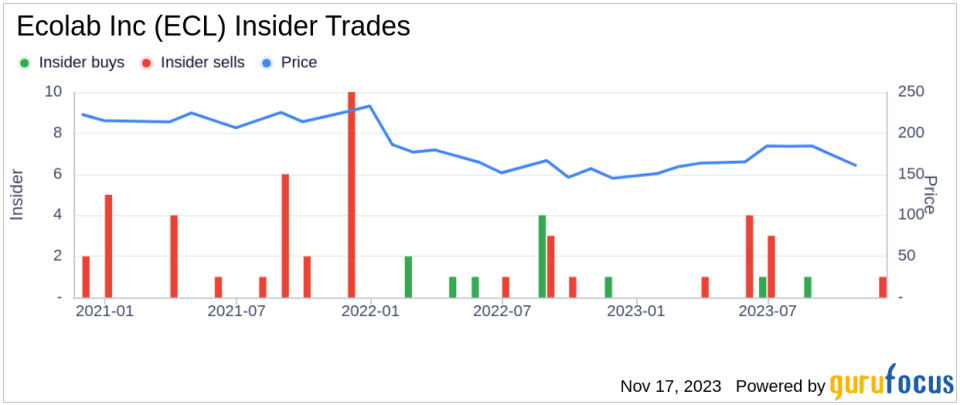

The insider transaction history for Ecolab Inc shows a trend of more insider sells (9) than buys (2) over the past year. This could indicate that insiders, on balance, are choosing to cash in on their investments rather than increase their positions. This trend warrants attention as it may signal insiders' collective sentiment about the stock's valuation or future prospects.

On the day of Angela Busch's recent sale, Ecolab Inc's shares were trading at $184.36, giving the company a market cap of $52.787 billion. The price-earnings ratio of 42.95 is higher than both the industry median of 22.25 and Ecolab's historical median, suggesting that the stock is trading at a premium compared to its peers and its own historical valuation.

However, with a price-to-GF-Value ratio of 0.93, Ecolab Inc is considered Fairly Valued based on its GF Value of $198.04. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation metric indicates that the stock is trading close to its fair value, which may provide some reassurance to investors concerned about overvaluation.

The insider trend image above provides a visual representation of the buying and selling activities of Ecolab's insiders. This chart can help investors identify patterns and trends that may influence their investment decisions.

The GF Value image offers a graphical view of Ecolab's stock price in relation to its intrinsic value, as estimated by GuruFocus. This comparison can be a useful tool for investors trying to determine whether the stock is undervalued or overvalued at its current trading price.

Conclusion

Angela Busch's recent sale of 5,488 shares of Ecolab Inc is a transaction that investors and analysts will likely scrutinize for its implications on the company's valuation and future prospects. While the insider selling trend and the stock's high price-earnings ratio might raise some concerns, the Fairly Valued status based on the GF Value suggests that the stock is not significantly overpriced. As always, investors should consider insider transactions as one of many factors in their investment decision-making process and conduct thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.