EVP & CFO Gianluca Romano Sells 16,982 Shares of Seagate Technology Holdings PLC

On November 3, 2023, Gianluca Romano, the Executive Vice President and Chief Financial Officer of Seagate Technology Holdings PLC (NASDAQ:STX), sold 16,982 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

Seagate Technology Holdings PLC is a leading global provider of data storage technology and solutions. The company's products and services include hard disk drives, solid-state drives, and enterprise storage systems. Seagate's solutions are used in a variety of applications, including enterprise servers and storage, data centers, and consumer electronics.

Over the past year, the insider has sold a total of 16,982 shares and has not made any purchases. This trend is consistent with the overall insider transaction history for Seagate Technology Holdings PLC, which shows zero insider buys and seven insider sells over the past year.

The relationship between insider transactions and stock price can provide valuable insights into the company's performance and the insiders' confidence in its future prospects. In the case of Seagate Technology Holdings PLC, the insider's sell transactions coincide with a period of significant overvaluation of the company's stock.

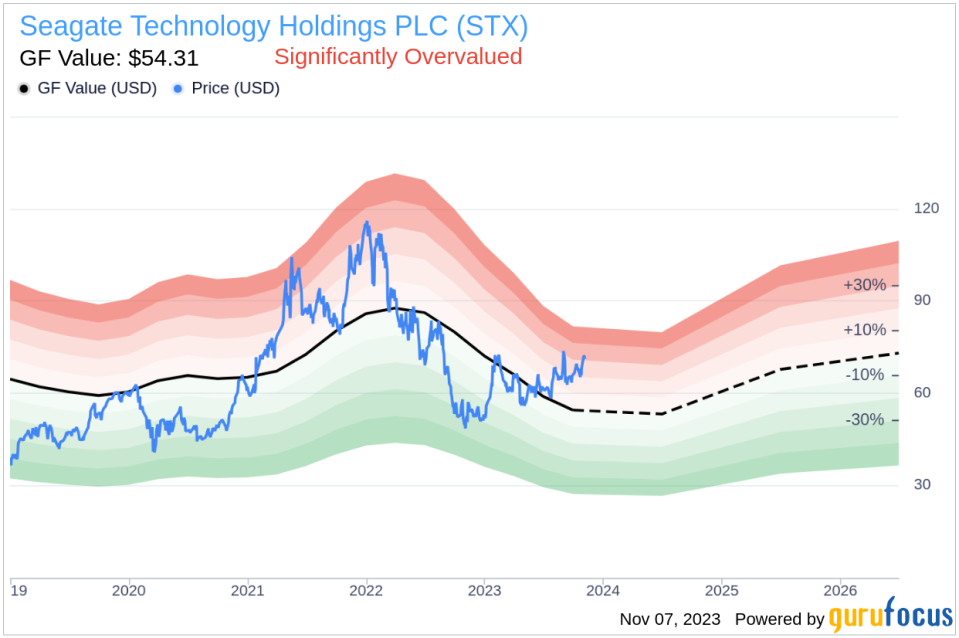

On the day of the insider's recent sell, shares of Seagate Technology Holdings PLC were trading for $73.34, giving the company a market cap of $14.88 billion. This price represents a significant premium to the company's GuruFocus Value of $54.31, resulting in a price-to-GF-Value ratio of 1.35. This indicates that the stock is significantly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's decision to sell shares at a time when the stock is significantly overvalued could be interpreted as a lack of confidence in the company's ability to sustain its current valuation. However, it's important to note that insider transactions can be influenced by a variety of factors, and they do not necessarily reflect the insider's view of the company's future performance.

Investors should always consider the broader context and conduct their own research before making investment decisions based on insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.