EVP & CFO Jesus Llorca Sells 13,125 Shares of Seacor Marine Holdings Inc (SMHI)

On October 20, 2023, Jesus Llorca, the Executive Vice President and Chief Financial Officer of Seacor Marine Holdings Inc (NYSE:SMHI), sold 13,125 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen a total of 49,896 shares sold and no shares purchased.

Seacor Marine Holdings Inc is a company that provides global marine and support transportation services to offshore oil and gas exploration, development, and production facilities. The company operates a diverse fleet of offshore support and specialty vessels that deliver cargo and personnel to offshore installations. They also handle anchors and mooring equipment required to tether rigs to the seabed, tow rigs and assist in their positioning, anchor handling, and mooring operations.

The insider's recent sell-off has raised eyebrows among investors and analysts, prompting a closer look at the company's stock performance and insider trading trends.

The insider transaction history for Seacor Marine Holdings Inc shows a clear trend of insider selling over the past year, with 10 insider sells and no insider buys. This could be a potential red flag for investors as it might indicate that those with the most intimate knowledge of the company do not see the stock as a good investment.

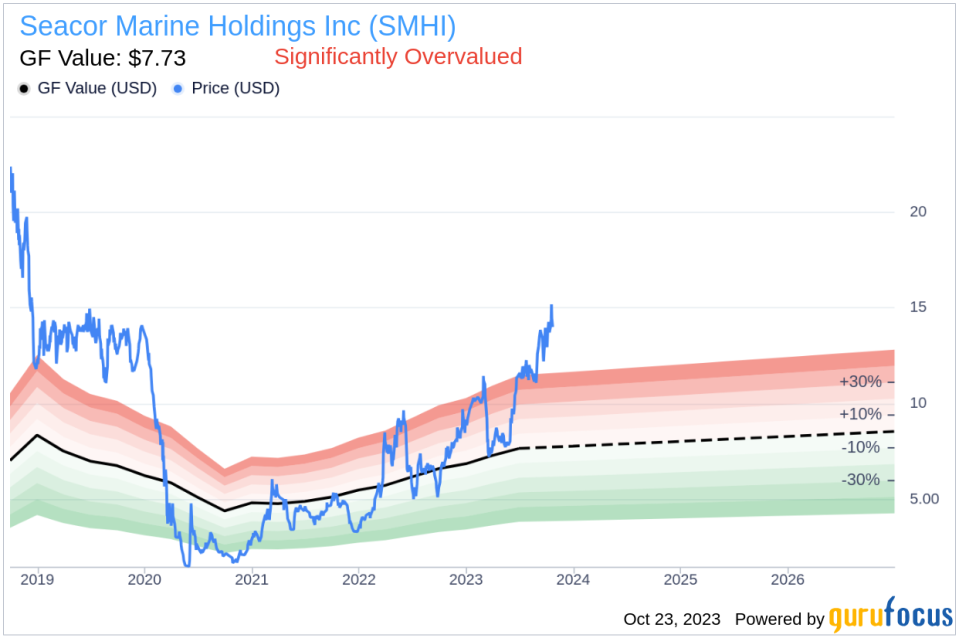

On the day of the insider's recent sell, shares of Seacor Marine Holdings Inc were trading for $15.1 apiece, giving the stock a market cap of $380.231 million. However, the GuruFocus Value of the stock stands at $7.73, indicating that the stock is significantly overvalued.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts. With a price-to-GF-Value ratio of 1.95, Seacor Marine Holdings Inc's stock appears to be significantly overvalued.

The recent sell-off by the insider, coupled with the stock's overvaluation, might suggest that the stock's current price does not reflect its intrinsic value. Investors should exercise caution and conduct further research before making investment decisions.

It's important to note that insider selling does not always indicate a bearish outlook by the company's executives. There could be various personal reasons behind such a move. However, the consistent selling trend by the insider over the past year could be a signal worth considering in the investment decision-making process.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.