EVP, CFO Laura Felice Sells 46,586 Shares of BJ's Wholesale Club Holdings Inc

On October 10, 2023, Laura Felice, the Executive Vice President and Chief Financial Officer of BJ's Wholesale Club Holdings Inc (NYSE:BJ), sold 46,586 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 46,586 shares and purchased none.

BJ's Wholesale Club Holdings Inc is a leading operator of membership warehouse clubs in the Eastern United States. The company provides a curated assortment of merchandise, including perishable products, general merchandise, gasoline, and other ancillary services. BJ's Wholesale Club Holdings Inc operates clubs and BJ's Gas locations in several states.

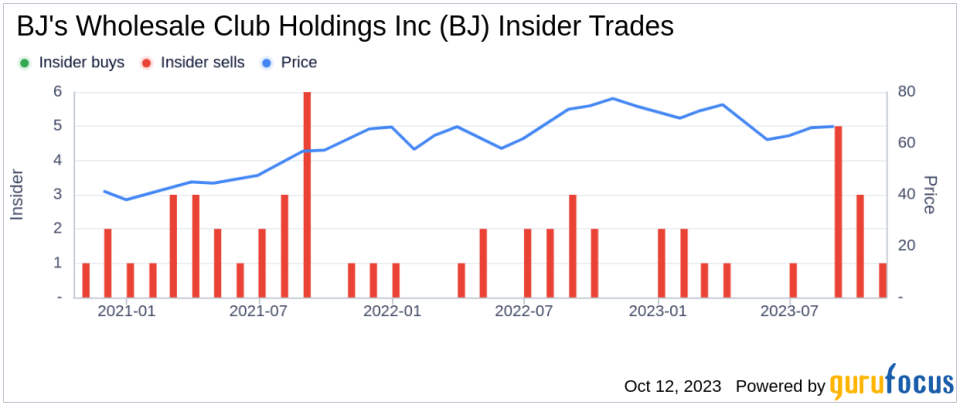

The insider's recent sell has raised questions about the company's stock performance and its relationship with insider trading activities. Over the past year, there have been 16 insider sells and no insider buys. This trend might suggest a lack of confidence in the company's future performance among insiders.

On the day of the insider's recent sell, BJ's Wholesale Club Holdings Inc's shares were trading at $70.54 each, giving the company a market cap of $9.25 billion. The price-earnings ratio stands at 18.59, higher than the industry median of 16.89 but lower than the company's historical median price-earnings ratio.

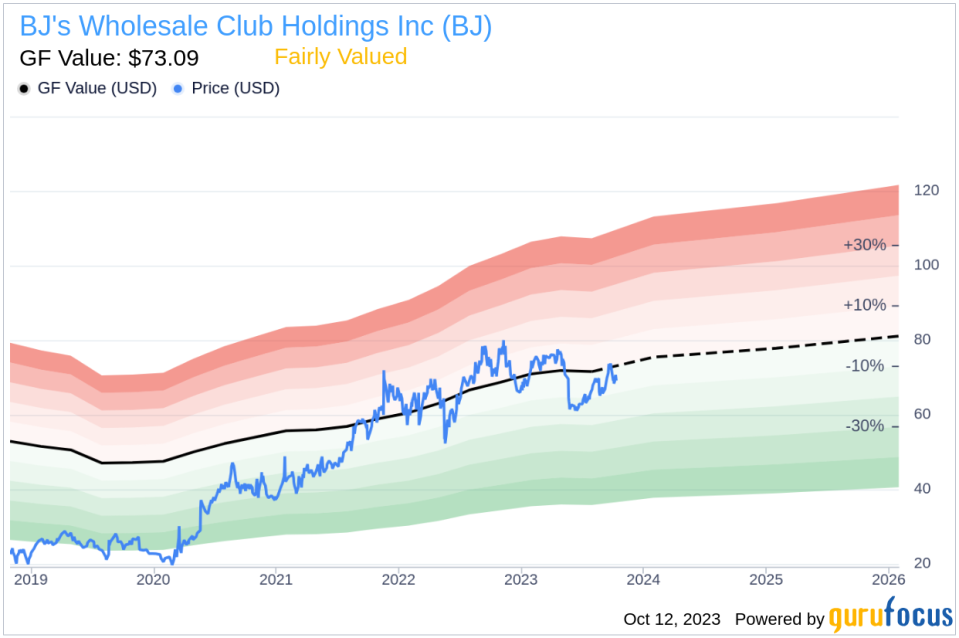

The company's price-to-GF-Value ratio is 0.97, based on a GuruFocus Value of $73.09. This suggests that the stock is fairly valued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider's decision to sell a significant number of shares could be based on a variety of factors. It could be a personal financial decision or a response to the company's current valuation. However, potential investors should not solely rely on insider trading activities when making investment decisions. It is crucial to consider other factors such as the company's financial health, market conditions, and industry trends.

In conclusion, while the insider's recent sell might raise some eyebrows, it does not necessarily indicate a negative outlook for BJ's Wholesale Club Holdings Inc. The company's stock appears to be fairly valued, and its market performance remains in line with industry standards. As always, potential investors should conduct thorough research and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.