EVP & Chief Customer Officer Ansa Sekharan Sells Over 150,000 Shares of Informatica Inc

In a notable insider transaction, Ansa Sekharan, the Executive Vice President & Chief Customer Officer of Informatica Inc (NYSE:INFA), sold 150,841 shares of the company on December 7, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's performance and future prospects.

Who is Ansa Sekharan of Informatica Inc?

Ansa Sekharan has been a key figure at Informatica Inc, serving as the Executive Vice President & Chief Customer Officer. In this role, Sekharan is responsible for ensuring customer success and satisfaction, a critical aspect of the company's overall strategy. With a deep understanding of the company's operations and market position, Sekharan's actions and decisions are closely watched by investors for indications of the company's health and trajectory.

Informatica Inc's Business Description

Informatica Inc is a leader in enterprise cloud data management, providing software and services that enable organizations to effectively manage, integrate, and analyze a vast amount of data across various systems. With the rise of big data and the increasing importance of data-driven decision-making, Informatica's solutions are more relevant than ever. The company's offerings are designed to help businesses gain a competitive edge by unlocking the full potential of their data assets.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by Ansa Sekharan is part of a broader pattern of insider selling at Informatica Inc. Over the past year, Sekharan has sold a total of 238,579 shares and has not made any purchases. This one-sided transaction history could signal a lack of confidence among insiders in the company's short-term growth prospects or simply a decision to realize gains or diversify personal portfolios.

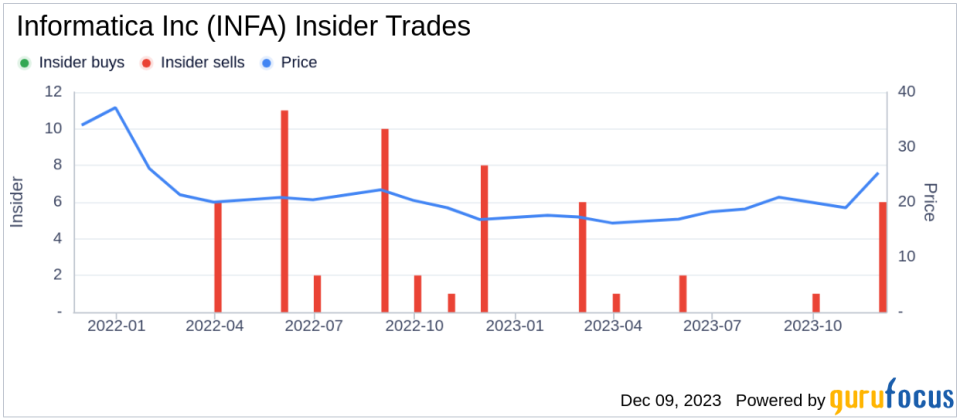

When analyzing insider transactions, it's important to consider the context and magnitude of the trades. While a single insider selling shares is not necessarily indicative of a problem within a company, a trend of multiple insiders selling can raise red flags. In the case of Informatica Inc, there have been 17 insider sells and no insider buys over the past year. This trend could suggest that those with the most intimate knowledge of the company's workings see limited upside potential or expect headwinds that could affect the stock price.

On the day of Sekharan's recent sale, shares of Informatica Inc were trading at $27.3, giving the company a market cap of $7.956 billion. Insider sales can sometimes lead to a decrease in stock price due to perceived negative sentiment. However, the impact of insider transactions on stock prices can vary and is also influenced by broader market conditions, the company's performance, and other news.

It's also worth noting that insiders may sell shares for reasons unrelated to their outlook on the company, such as personal financial planning, estate management, or charitable giving. Therefore, while insider transactions are a valuable piece of the puzzle, they should not be the sole factor in making investment decisions.

The insider trend image above provides a visual representation of the selling and buying activities of insiders at Informatica Inc. The absence of insider buying over the past year, coupled with consistent selling, could be interpreted as a cautious or bearish signal by market observers.

Conclusion

In conclusion, the recent insider sale by EVP & Chief Customer Officer Ansa Sekharan is part of a larger pattern of insider selling at Informatica Inc. While this activity may raise questions about the company's future prospects, it is essential to consider the broader context, including the company's market position, the competitive landscape, and overall market conditions. Investors should use insider transaction data as one of many tools in their investment decision-making process, always ensuring a diversified approach to mitigate risk.

For those interested in following Informatica Inc's stock and insider transactions, it is advisable to keep an eye on the company's financial performance, industry trends, and any significant changes in insider trading patterns. As always, a well-researched and balanced investment strategy is the best defense against market volatility and uncertainty.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.