EVP & Chief Information Officer Carman Wenkoff Buys 2,000 Shares of Dollar General Corp

On September 29, 2023, Carman Wenkoff, the Executive Vice President and Chief Information Officer of Dollar General Corp (NYSE:DG), purchased 2,000 shares of the company. This move is significant as insider buying can often be a positive indicator for the company's future performance.

Carman Wenkoff has been with Dollar General Corp for several years, serving in a key executive role. His responsibilities include overseeing the company's information technology initiatives, which are crucial to the company's operations and strategic goals. His decision to increase his stake in the company is a strong vote of confidence in its future prospects.

Dollar General Corp is a leading American chain of variety stores. The company operates over 15,000 stores in the continental United States, with its business model focusing on selling a variety of products at low costs. The company's offerings include food, snacks, health and beauty aids, cleaning supplies, family apparel, housewares, seasonal items, paper products, and much more.

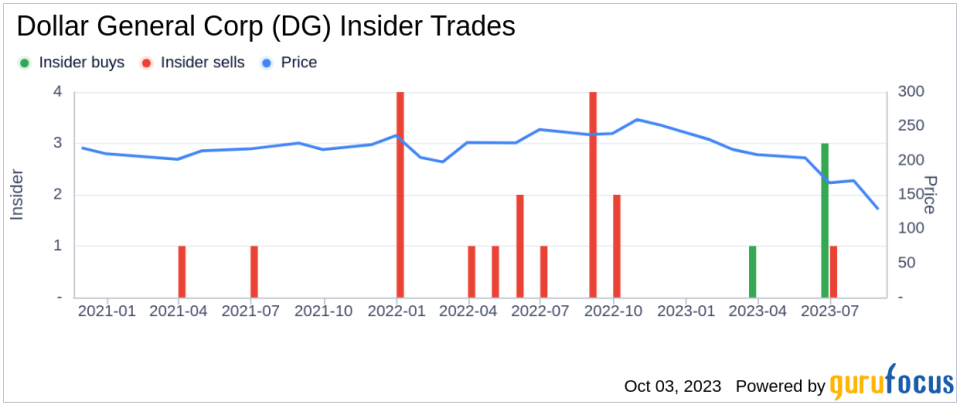

Over the past year, the insider has purchased 2,000 shares in total and sold 0 shares in total. This recent purchase by Wenkoff is part of a broader trend of insider buying at Dollar General Corp. Over the past year, there have been 5 insider buys in total, compared to just 1 insider sell.

The relationship between insider buying and selling and the stock price is often complex. However, it is generally believed that insiders have the most up-to-date information about their company's prospects. Therefore, when insiders buy shares, it can be seen as a positive signal about the company's future performance.

On the day of the insider's recent buy, shares of Dollar General Corp were trading for $106.25 apiece. This gives the stock a market cap of $22.78 billion. The price-earnings ratio is 10.63, which is lower than the industry median of 17.25 and lower than the companys historical median price-earnings ratio.

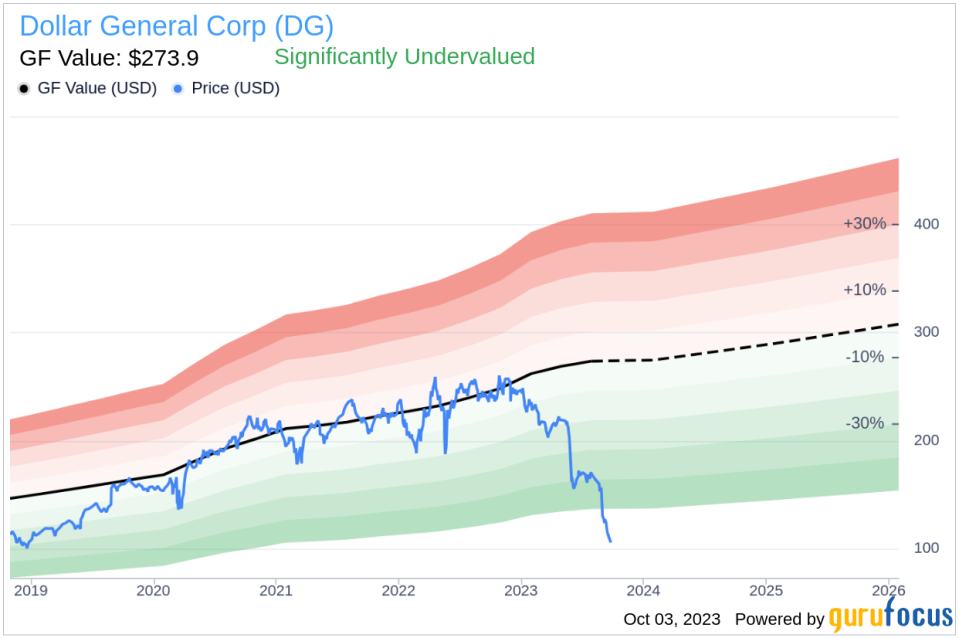

With a price of $106.25 and a GuruFocus Value of $273.90, Dollar General Corp has a price-to-GF-Value ratio of 0.39. This means the stock is significantly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider buying activity at Dollar General Corp, coupled with the company's undervalued status according to its GF Value, suggests that the company could be a promising investment opportunity.

This article first appeared on GuruFocus.