EVP & Chief Product Officer Jitesh Ghai Sells 14,884 Shares of Informatica Inc (INFA)

In a notable insider transaction, EVP & Chief Product Officer Jitesh Ghai sold 14,884 shares of Informatica Inc (NYSE:INFA) on November 15, 2023. This sale has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's prospects. Insider transactions can provide valuable insights into the company's health and management's confidence in the future of the business.

Before delving into the analysis of this insider sell and its potential implications, let's explore who Jitesh Ghai is and the business of Informatica Inc.

Who is Jitesh Ghai?

Jitesh Ghai has been serving as the Executive Vice President and Chief Product Officer at Informatica Inc. With a background in software product management and a track record of driving product strategy, Ghai has been instrumental in shaping Informatica's product offerings in the data management space. His role involves overseeing the development and innovation of Informatica's products, ensuring they meet the evolving needs of customers in a data-centric world.

Informatica Inc's Business Description

Informatica Inc is a leader in enterprise cloud data management, providing software and services that enable organizations to effectively manage, integrate, and analyze a vast amount of data across various systems. The company's offerings are designed to help businesses gain a competitive edge by unlocking the power of their data, ensuring data quality, and providing data governance. Informatica's solutions are critical for businesses undergoing digital transformation, as they help to streamline operations, improve customer experiences, and drive better decision-making through data insights.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. In the case of Informatica Inc, the recent sale by EVP & Chief Product Officer Jitesh Ghai of 14,884 shares could signal various things to investors. It's important to note that Ghai has sold a total of 117,489 shares over the past year and has not made any purchases during the same period.

When an insider like Ghai sells a significant number of shares, it may raise questions about his confidence in the company's future performance. However, it's also common for executives to sell shares for personal financial planning reasons, unrelated to their outlook on the company. Without additional context, it's challenging to draw definitive conclusions from a single transaction.

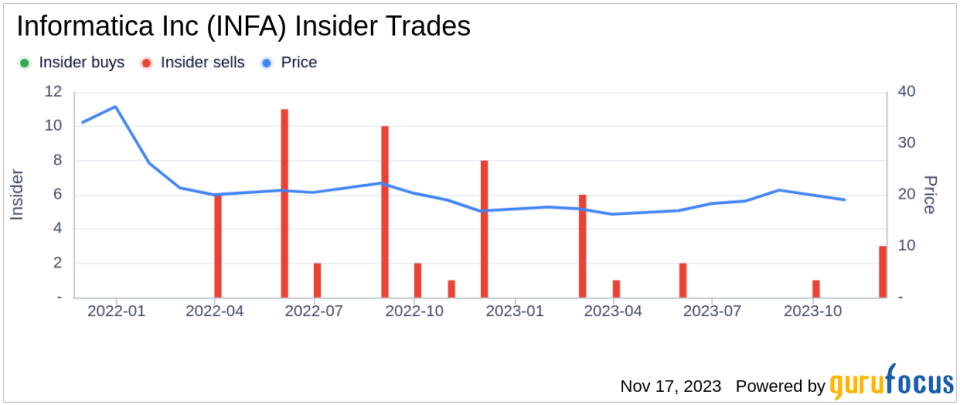

Looking at the broader insider trends, Informatica Inc has seen 0 insider buys and 15 insider sells over the past year. This pattern of more insider selling than buying could be interpreted as a lack of confidence among insiders about the company's future growth prospects or stock price appreciation. However, it's also possible that insiders are simply taking profits after a period of stock price increase or diversifying their personal investment portfolios.

On the day of Ghai's recent sale, shares of Informatica Inc were trading at $24.4, giving the company a market cap of $7.126 billion. This valuation places Informatica in the mid-cap category, which can be subject to more volatility and market sentiment shifts than larger-cap stocks. The relationship between insider selling and stock price can be complex, as various factors, including market conditions, company performance, and broader economic trends, can influence stock prices.

It's also worth considering the stock's performance leading up to the sale. If the stock has appreciated significantly, the insider might be selling to lock in gains. Conversely, if the stock has been underperforming, the sale could be seen as a lack of confidence in a near-term recovery.

The insider trend image above provides a visual representation of the buying and selling activities of insiders at Informatica Inc. This chart can help investors identify patterns and trends that may inform their investment decisions.

Conclusion

While insider sales can be a valuable piece of the puzzle when evaluating a stock, they should not be the sole factor in making investment decisions. It's essential to consider the broader context, including the company's financial health, market conditions, and industry trends. For Informatica Inc, the consistent pattern of insider selling over the past year warrants attention, but investors should also look at the company's growth prospects, competitive position, and the broader market environment before drawing conclusions.

As always, investors are encouraged to conduct their own due diligence and consider multiple data points when assessing the investment potential of a company like Informatica Inc. Insider transactions are just one piece of the complex financial landscape that needs to be navigated when making informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.