EVP & Chief Revenue Officer John Schweitzer Sells 5,952 Shares of Informatica Inc (INFA)

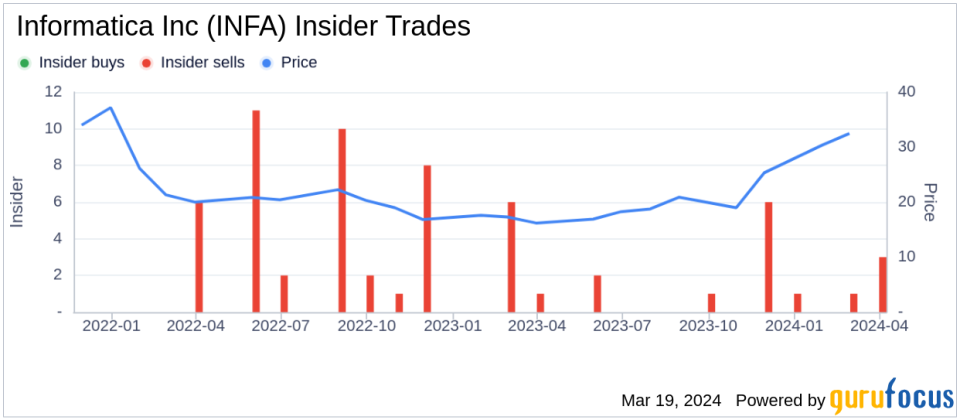

John Schweitzer, the Executive Vice President and Chief Revenue Officer of Informatica Inc (NYSE:INFA), has sold 5,952 shares of the company on March 15, 2024, according to a recent SEC filing. The transaction was executed at an average price of $33.87 per share, resulting in a total value of $201,635.44.Informatica Inc is a leading provider of enterprise cloud data management solutions. The company helps organizations accelerate their data-driven digital transformations. Informatica provides a comprehensive suite of data integration, quality, and governance services, all unified on a cloud-native platform.Over the past year, John Schweitzer has sold a total of 147,228 shares of Informatica Inc and has not made any purchases of the stock. The insider transaction history for Informatica Inc reveals a pattern of 14 insider sells and no insider buys over the past year.

The stock's valuation on the day of the insider's recent sale was $33.87 per share, giving Informatica Inc a market capitalization of $10.245 billion.For more detailed information on insider transactions at Informatica Inc, interested individuals can refer to the SEC filing through the provided link.SEC Filing

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.