EVP, Chief Risk Officer Robert Smith Sells 8,500 Shares of NMI Holdings Inc

On November 3, 2023, Robert Smith, the Executive Vice President and Chief Risk Officer of NMI Holdings Inc (NASDAQ:NMIH), sold 8,500 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 8,500 shares and purchased none.

NMI Holdings Inc is a private mortgage insurer that serves lenders and mortgage investors by providing capital to mitigate default risk. The company generates revenue through insurance premiums and has a significant presence in the United States. With a market cap of $2.34 billion, NMI Holdings Inc is a key player in the mortgage insurance industry.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To understand the implications of this move, it's essential to analyze the insider's trading history and the company's stock performance.

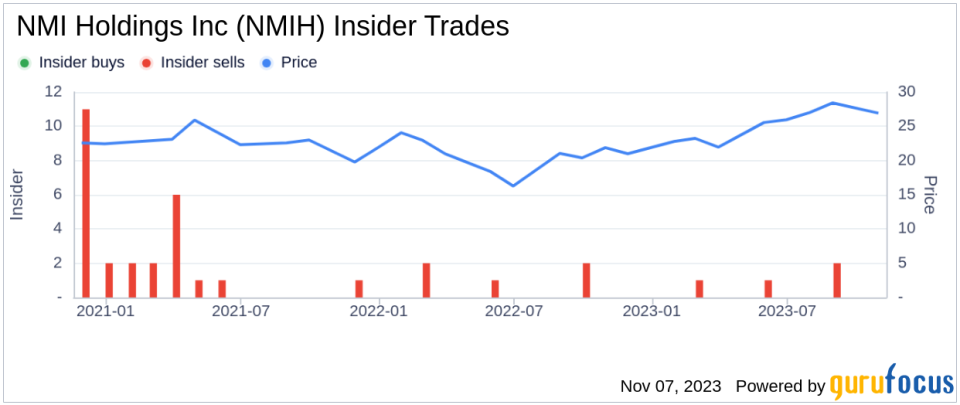

The insider transaction history for NMI Holdings Inc shows a clear trend of selling over the past year, with five insider sells and no insider buys. This could indicate that insiders believe the company's stock is currently overvalued, prompting them to sell their shares.

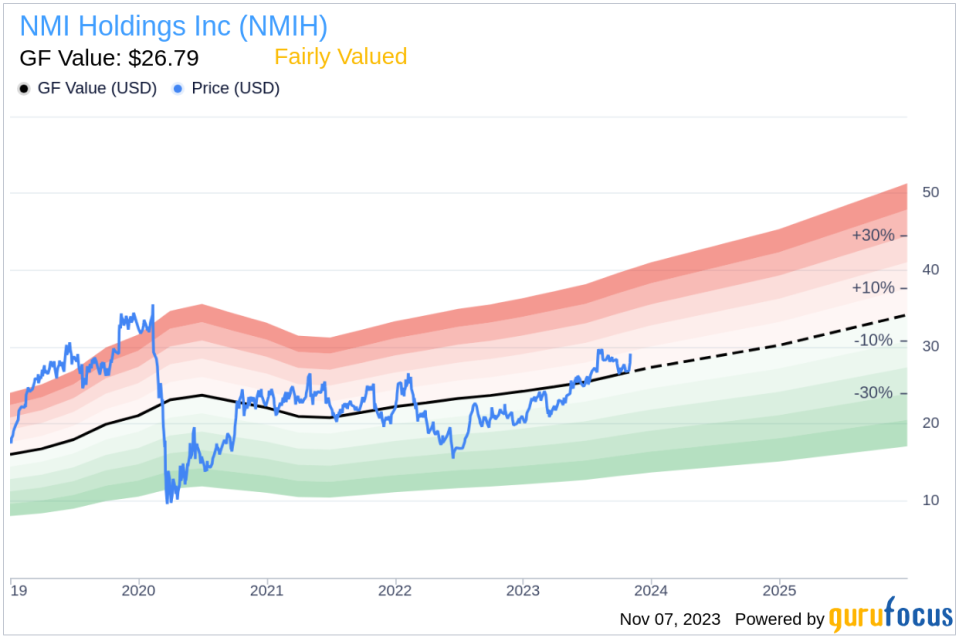

On the day of the insider's recent sell, NMI Holdings Inc's shares were trading at $28.67, giving the company a market cap of $2.34 billion. The price-earnings ratio stood at 8.05, lower than the industry median of 11.39 and the company's historical median price-earnings ratio. This suggests that the stock is undervalued compared to its peers and its historical performance.

However, the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, stands at $26.79. With a price-to-GF-Value ratio of 1.07, the stock appears to be fairly valued. This could explain why the insider decided to sell his shares.

In conclusion, the insider's recent sell-off, combined with the company's valuation metrics, suggests that NMI Holdings Inc's stock is currently fairly valued. Investors should keep a close eye on the company's future performance and any changes in insider trading activity to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.