EVP Engineering & CTO David Bass Sells 150,000 Shares of Varonis Systems Inc (VRNS)

On November 2, 2023, David Bass, the EVP Engineering & CTO of Varonis Systems Inc (NASDAQ:VRNS), sold 150,000 shares of the company. This move has sparked interest among investors and analysts alike, as insider trading activities often provide valuable insights into a company's prospects.

David Bass is a key figure in Varonis Systems Inc, holding the position of EVP Engineering & CTO. His role involves overseeing the technical aspects of the company's operations, making his trading activities particularly noteworthy.

Varonis Systems Inc is a software company that specializes in data security and analytics. The company provides a platform that allows enterprises to analyze, secure, manage, and migrate their volumes of unstructured data. This platform enables users to protect enterprise data, manage risk and compliance, and optimize their operations.

Over the past year, David Bass has sold a total of 184,000 shares and has not made any purchases. This recent sale of 150,000 shares is a significant portion of his trading activities over the past year.

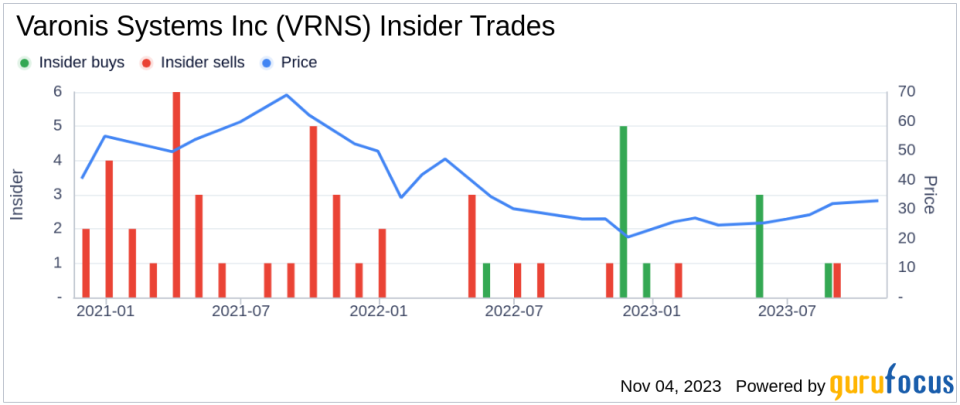

The insider transaction history for Varonis Systems Inc shows a total of 8 insider buys and 3 insider sells over the past year. This suggests a mixed sentiment among the insiders of the company.

On the day of the insider's recent sale, shares of Varonis Systems Inc were trading at $33 apiece, giving the company a market cap of $3.75 billion.

With a price of $33 and a GuruFocus Value of $41.96, Varonis Systems Inc has a price-to-GF-Value ratio of 0.79. This indicates that the stock is modestly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The recent sale by the insider could be interpreted in various ways. It could be a personal financial decision or a response to the company's current valuation. However, given that the stock is currently considered modestly undervalued, it may be worth keeping an eye on Varonis Systems Inc for potential investment opportunities.

As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.