EVP & General Counsel Christine Reddy Sells 500 Shares of Beacon Roofing Supply Inc

On September 11, 2023, Christine Reddy, the Executive Vice President and General Counsel of Beacon Roofing Supply Inc (NASDAQ:BECN), sold 500 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

Beacon Roofing Supply Inc is a leading distributor of residential and non-residential roofing materials in the United States and Canada. The company also provides complementary building products, including siding, windows, specialty lumber, waterproofing, and insulation for builders, contractors, and home improvement professionals.

Over the past year, the insider has sold a total of 500 shares and has not made any purchases. This trend is reflected in the company's overall insider transaction history, which shows a total of 5 insider buys and 6 insider sells over the past year.

The relationship between insider transactions and the stock price is often a significant indicator of a company's health. In the case of Beacon Roofing Supply Inc, the stock was trading at $78.12 per share on the day of the insider's recent sell, giving the company a market cap of $4.872 billion.

The company's price-earnings ratio stands at 15.29, which is higher than the industry median of 13.55 but lower than the companys historical median price-earnings ratio. This suggests that the stock is currently trading at a fair value.

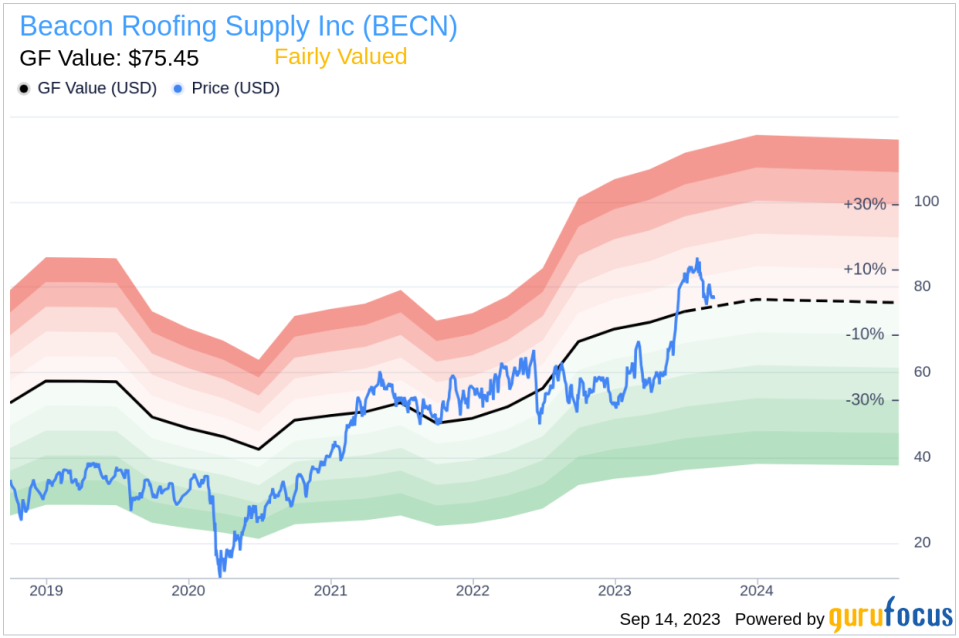

The GuruFocus Value of Beacon Roofing Supply Inc is $75.45, resulting in a price-to-GF-Value ratio of 1.04. This indicates that the stock is fairly valued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent sell by the insider may be a strategic move based on personal financial planning or a reflection of the insider's perception of the company's current valuation. However, given the company's fair valuation and the overall trend of insider transactions, it does not necessarily indicate a negative outlook for Beacon Roofing Supply Inc.

This article first appeared on GuruFocus.