EVP & General Counsel Paul Mahon Sells 6,000 Shares of United Therapeutics Corp

On October 19, 2023, Paul Mahon, the Executive Vice President and General Counsel of United Therapeutics Corp (NASDAQ:UTHR), sold 6,000 shares of the company. This move is part of a trend for the insider, who over the past year has sold a total of 140,500 shares and purchased none.

United Therapeutics Corp is a biotechnology company that focuses on the development and commercialization of unique products to address the unmet medical needs of patients with chronic and life-threatening conditions. The company has a diverse portfolio of products and product candidates, with a focus on pulmonary arterial hypertension (PAH) and other pulmonary conditions.

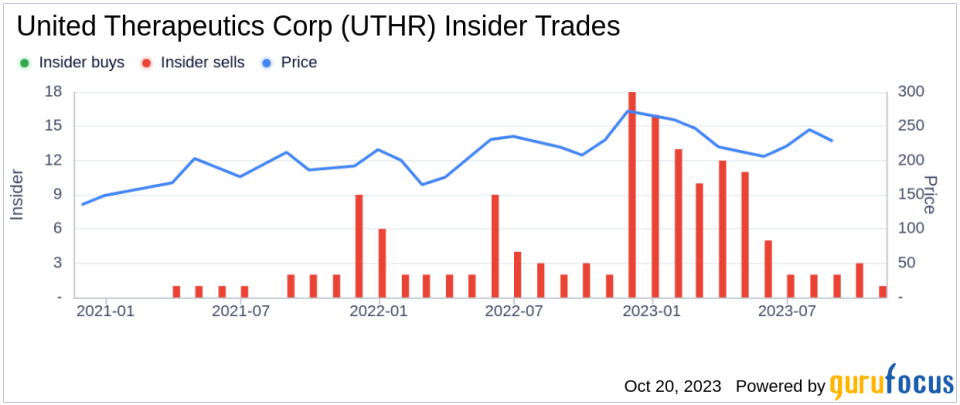

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been 96 insider sells and no insider buys. This trend is illustrated in the following image:

The relationship between insider trading and stock price is complex. While it's not uncommon for insiders to sell their shares, it can sometimes be a bearish signal. However, it's important to consider the context of these sales. In the case of United Therapeutics Corp, the insider's sales have not significantly impacted the stock's price, which was trading at $225.43 per share on the day of the insider's recent sell.

With a market cap of $10.58 billion, United Therapeutics Corp's price-earnings ratio is 12.75. This is lower than both the industry median of 29.94 and the companys historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own historical performance.

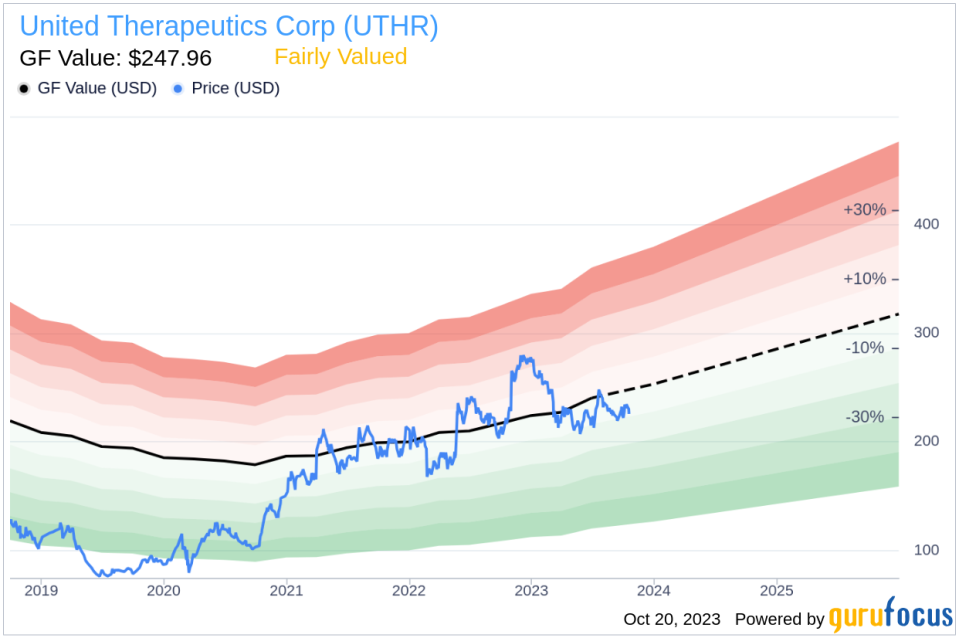

The company's price-to-GF-Value ratio is 0.91, indicating that the stock is fairly valued based on its GF Value of $247.96. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts. The GF Value is illustrated in the following image:

In conclusion, while the insider's recent sell-off may raise some eyebrows, it's important to consider the broader context. The stock's relatively low price-earnings ratio and fair GF Value suggest that United Therapeutics Corp may still be a solid investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.