EVP & GENERAL COUNSEL Paul Mahon Sells 6,000 Shares of United Therapeutics Corp

On September 21, 2023, Paul Mahon, the Executive Vice President and General Counsel of United Therapeutics Corp (NASDAQ:UTHR), sold 6,000 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 140,500 shares and purchased none.

United Therapeutics Corp is a biotechnology company that focuses on the development and commercialization of unique products to address the unmet medical needs of patients with chronic and life-threatening conditions. The company has a diverse portfolio of products and product candidates, with a focus on pulmonary arterial hypertension (PAH) and other pulmonary conditions.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. The relationship between insider trading activities and stock price performance is often considered a crucial factor in investment decisions.

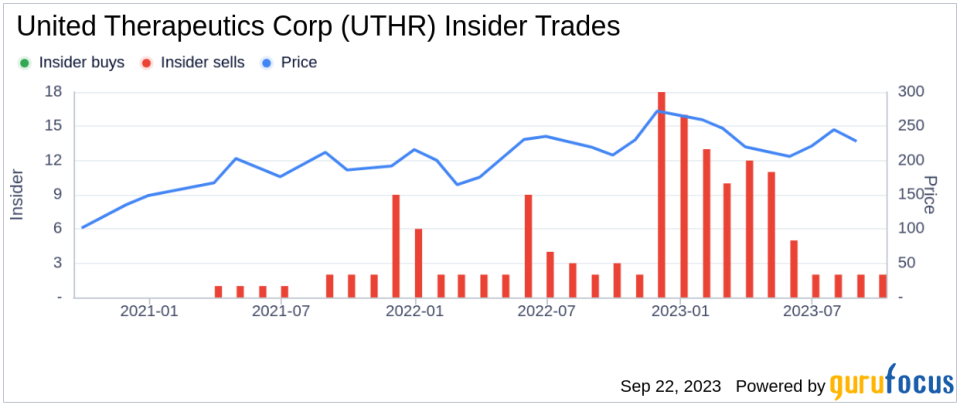

The above chart shows the trend of insider trading activities at United Therapeutics Corp. Over the past year, there have been 97 insider sells and no insider buys. This could be interpreted as a bearish signal, suggesting that insiders may have a pessimistic outlook on the company's future performance.

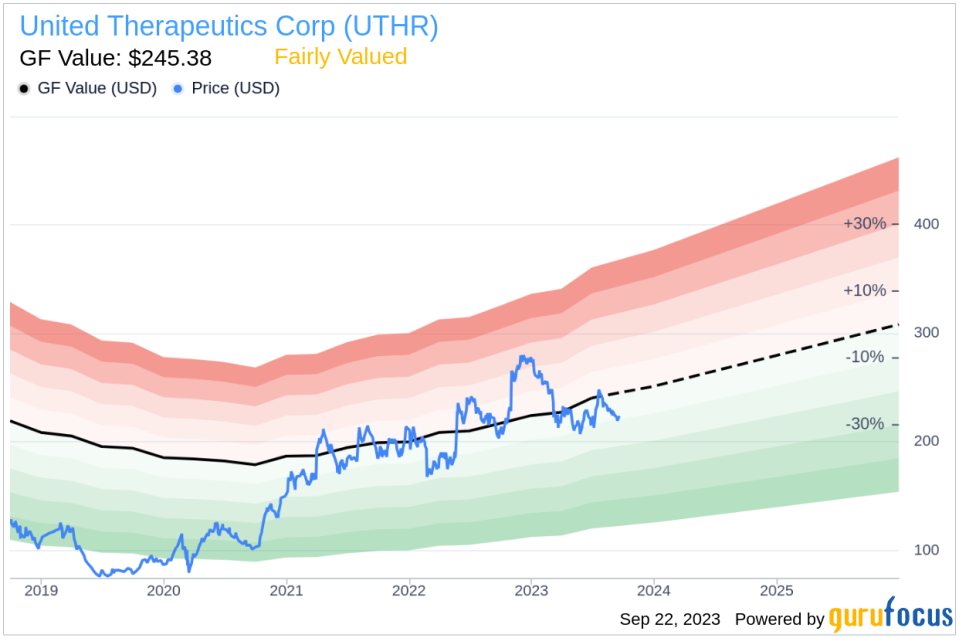

On the day of the insider's recent sell, shares of United Therapeutics Corp were trading at $222.19, giving the company a market cap of $10.45 billion. The price-earnings ratio stands at 12.60, which is lower than both the industry median of 31.49 and the company's historical median price-earnings ratio.

The GuruFocus Value of United Therapeutics Corp is $245.38, resulting in a price-to-GF-Value ratio of 0.91. This suggests that the stock is fairly valued. The GF Value is an intrinsic value estimate developed by GuruFocus, based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

In conclusion, the recent sell-off by the insider, coupled with the company's valuation metrics, suggests a cautious outlook for United Therapeutics Corp. Investors should closely monitor the company's performance and insider trading activities for further insights.

This article first appeared on GuruFocus.