EVP, Human Resources Shawn Powers Sells 10,000 Shares of TTM Technologies Inc

On August 22, 2023, Shawn Powers, the Executive Vice President of Human Resources at TTM Technologies Inc (NASDAQ:TTMI), sold 10,000 shares of the company. This move is part of a trend for the insider, who over the past year has sold a total of 18,000 shares and made no purchases.

TTM Technologies Inc is a leading global printed circuit board manufacturer, focusing on quick-turn and volume production of technologically advanced PCBs, backplane assemblies and electro-mechanical solutions as well as a global designer and manufacturer of high-frequency radio frequency (RF) and microwave components and assemblies.

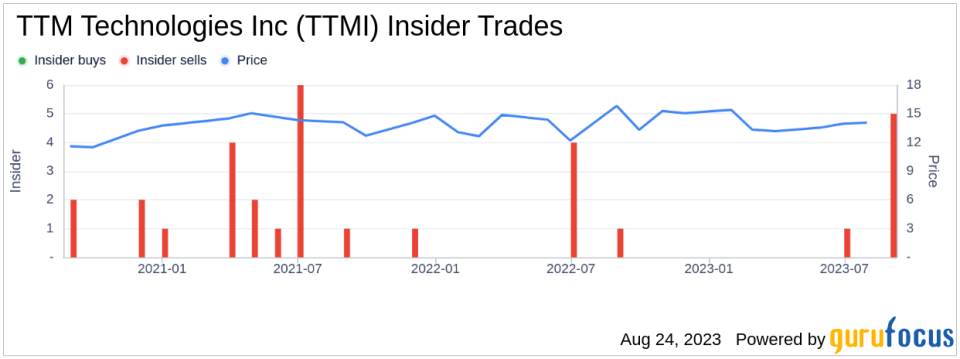

The insider's recent transaction history provides an interesting perspective on the company's stock performance. Over the past year, there have been no insider buys at TTM Technologies Inc, while there have been seven insider sells.

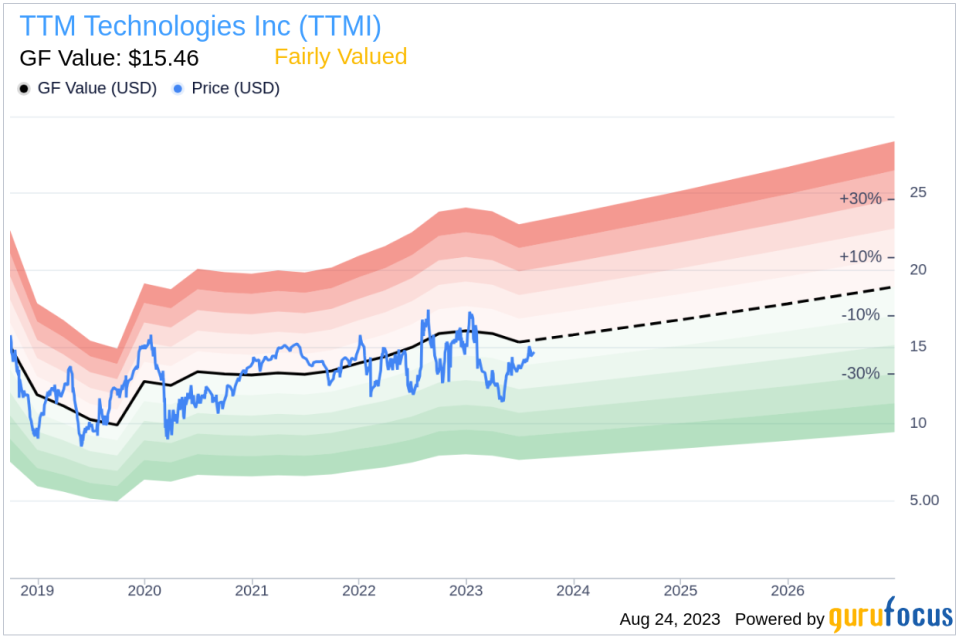

The insider's selling trend coincides with the company's stock price, which was trading at $14.95 per share on the day of the recent sell. This gives TTM Technologies Inc a market cap of $1.542 billion.

The company's price-earnings ratio stands at 30.31, which is higher than the industry median of 21.17 and also higher than the companys historical median price-earnings ratio. This suggests that the stock is currently trading at a premium compared to its peers and its own historical data.

However, when we look at the price-to-GF-Value ratio, which is 0.97, it indicates that the stock is fairly valued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent sell of 10,000 shares, along with the overall selling trend among insiders over the past year, could be a signal for investors to exercise caution. Despite the stock being fairly valued according to the GF Value, the higher price-earnings ratio compared to the industry median and the company's historical median suggests that the stock might be overpriced. As always, investors should conduct their own research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.