EVP Jennifer Lee Sells 6,166 Shares of Rhythm Pharmaceuticals Inc (RYTM)

On September 5, 2023, Jennifer Lee, the Executive Vice President and Head of North America at Rhythm Pharmaceuticals Inc (NASDAQ:RYTM), sold 6,166 shares of the company. This recent insider activity has sparked interest in the financial community and warrants a closer look.

About Jennifer Lee

Jennifer Lee is a seasoned executive with extensive experience in the pharmaceutical industry. As the EVP and Head of North America at Rhythm Pharmaceuticals, she plays a crucial role in the company's strategic planning and operations. Her insider trading activities often provide valuable insights into the company's financial health and future prospects.

About Rhythm Pharmaceuticals Inc

Rhythm Pharmaceuticals Inc is a biopharmaceutical company focused on the development and commercialization of therapeutics for the treatment of rare genetic disorders of obesity. The company's mission is to transform the care of people living with rare genetic disorders of obesity by discovering, developing, and commercializing life-changing therapies.

Insider Trading Analysis

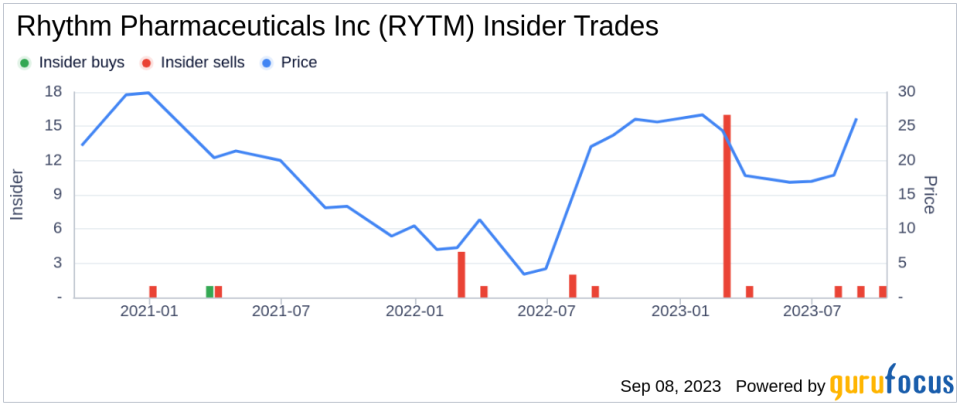

Over the past year, Jennifer Lee has sold a total of 19,107 shares and has not made any purchases. This recent sale of 6,166 shares is part of this larger trend. The insider's trading activities can often be a reflection of their perception of the company's future performance.

The insider transaction history for Rhythm Pharmaceuticals Inc shows zero insider buys over the past year, while there have been 20 insider sells during the same period. This trend could indicate that insiders may perceive the stock as overvalued, leading them to sell their shares.

Stock Price and Valuation

On the day of the insider's recent sale, shares of Rhythm Pharmaceuticals Inc were trading at $28.05 each. This gives the company a market cap of approximately $1.45 billion. The relationship between insider selling and the stock price can be complex. While it's not uncommon for insiders to sell shares for personal reasons, such as diversifying their investment portfolio, consistent selling could be a red flag.

In conclusion, while the insider's recent sale of shares is noteworthy, it is essential to consider the broader context of the company's financial performance, market valuation, and other insider trading activities. Investors should continue to monitor Rhythm Pharmaceuticals Inc's insider transactions closely as part of their investment strategy.

This article first appeared on GuruFocus.