EVP Laurie Marsh Sells 11,917 Shares of Ecolab Inc (ECL)

In a notable insider transaction, Laurie Marsh, Executive Vice President of Human Resources at Ecolab Inc, sold 11,917 shares of the company's stock on December 4, 2023. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its senior executives.

Who is Laurie Marsh of Ecolab Inc?

Laurie Marsh is a key executive at Ecolab Inc, holding the position of Executive Vice President of Human Resources. In her role, Marsh is responsible for overseeing the company's global human resources strategy, which includes talent management, leadership development, and organizational effectiveness. Her decisions and strategies are crucial for fostering a productive and engaged workforce, which in turn can impact the company's overall performance.

Ecolab Inc's Business Description

Ecolab Inc is a global leader in water, hygiene, and infection prevention solutions and services. The company provides a wide range of products and services that serve a diverse set of end markets, including foodservice, food and beverage processing, healthcare, and industrial markets. Ecolab's solutions are essential for ensuring clean water, safe food, abundant energy, and healthy environments, making it a critical player in public health and safety.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving sales or purchases of a company's stock by its executives, can be a strong indicator of the company's health and future performance. In the case of Ecolab Inc, the insider transaction history over the past year shows a pattern of more insider sells (12) than buys (3). This could suggest that insiders, including Laurie Marsh, may believe that the stock is fully valued or that they see potential headwinds for the company.

On the day of Marsh's recent sale, Ecolab Inc's shares were trading at $191.41, giving the company a market cap of $54.18 billion. This valuation places the company at a price-earnings ratio of 44.08, which is higher than both the industry median of 22.69 and the company's historical median price-earnings ratio. A higher price-earnings ratio can indicate that the stock is overvalued relative to its earnings, which may be another reason why insiders like Marsh are choosing to sell their shares.

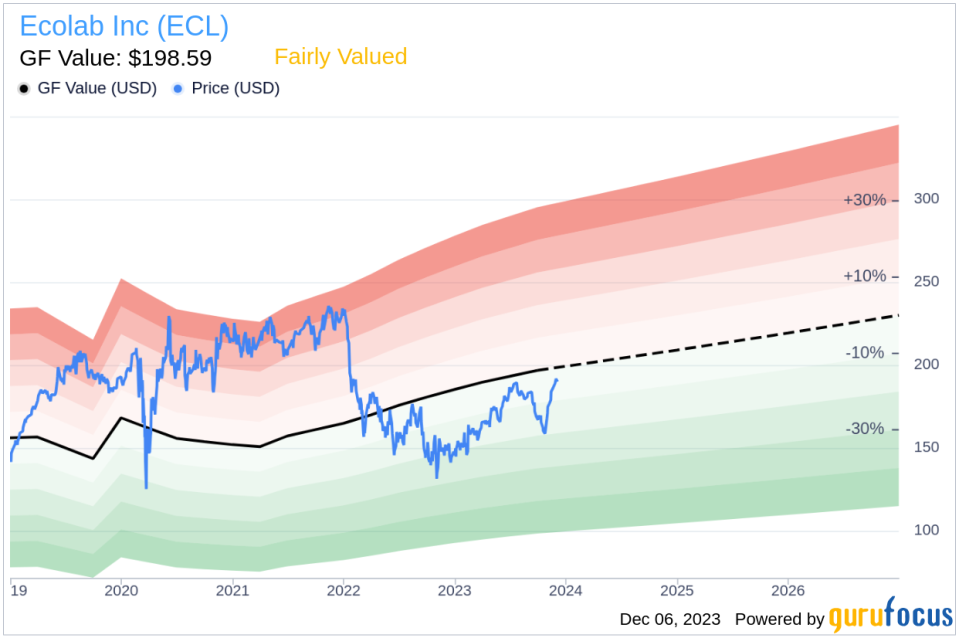

However, it's important to consider the price relative to the GF Value, which is an intrinsic value estimate developed by GuruFocus. With a price of $191.41 and a GF Value of $198.59, Ecolab Inc has a price-to-GF-Value ratio of 0.96, indicating that the stock is Fairly Valued. This suggests that while the stock may not be undervalued, it is not significantly overpriced either, based on the intrinsic value estimate.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This comprehensive approach to valuation provides a more nuanced view of the stock's worth.

The insider trend image above illustrates the recent insider transactions at Ecolab Inc. The visual representation of buys and sells can help investors discern patterns or shifts in insider sentiment over time.

The GF Value image provides a graphical representation of Ecolab Inc's stock price in relation to its GF Value. Observing the stock's price in the context of its intrinsic value can be a useful tool for investors considering whether to buy, hold, or sell.

Conclusion

The sale of 11,917 shares by EVP Laurie Marsh is a significant event that warrants attention from Ecolab Inc's investors. While the insider selling trend over the past year and the high price-earnings ratio might raise some concerns, the stock's fair valuation according to the GF Value suggests that the company's fundamentals may still be strong. Investors should consider these insider transactions as part of a broader analysis, taking into account Ecolab Inc's market position, growth prospects, and overall financial health before making investment decisions.

As always, it's important to remember that insider transactions are just one piece of the puzzle when evaluating a stock. They should be weighed alongside other financial data, industry trends, and market conditions to form a comprehensive view of the company's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.