EVP Research & Development Fady Malik Sells 2,500 Shares of Cytokinetics Inc

On September 14, 2023, Fady Malik, the Executive Vice President of Research & Development at Cytokinetics Inc (NASDAQ:CYTK), sold 2,500 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

Cytokinetics Inc is a biopharmaceutical company focused on the discovery and development of novel small molecule therapeutics that modulate muscle function for the potential treatment of serious diseases and medical conditions. The company's drug candidates are designed to improve the healthspan of people with diseases characterized by impaired or declining muscle function.

Over the past year, the insider has sold a total of 71,300 shares and has not made any purchases. This trend is consistent with the overall insider transaction history for Cytokinetics Inc, which shows zero insider buys and 42 insider sells over the same timeframe.

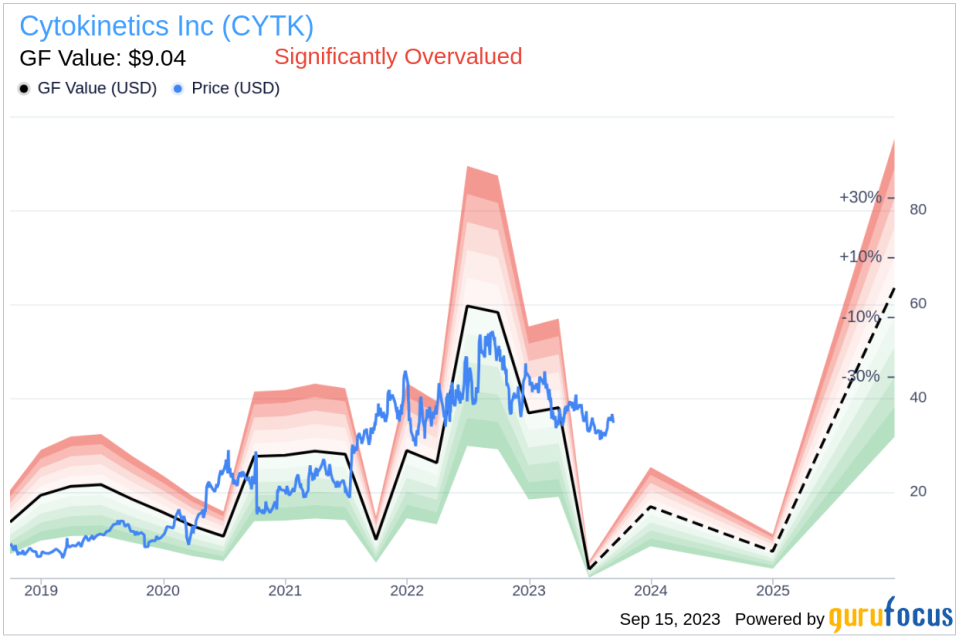

The recent sale by the insider occurred when the shares of Cytokinetics Inc were trading at $34.86 apiece, giving the stock a market cap of $3.284 billion. This price is significantly higher than the GuruFocus Value of $9.04, resulting in a price-to-GF-Value ratio of 3.86. This indicates that the stock is significantly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's decision to sell shares could be influenced by the current overvaluation of the stock. It is important for investors to consider this information when making investment decisions. While insider selling does not necessarily indicate a bearish outlook, it is a factor that can provide insight into the insider's perception of the company's current valuation.

As always, it is recommended that investors conduct their own thorough research before making any investment decisions. Insider transactions are just one of many factors to consider when evaluating a potential investment.

This article first appeared on GuruFocus.