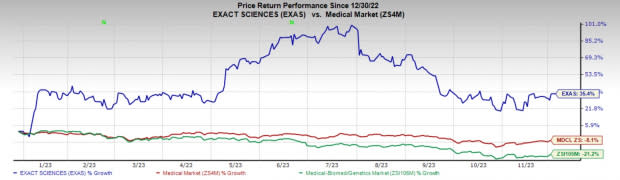

Exact Sciences (EXAS) Up 35.4% YTD: Will the Rally Continue?

Exact Sciences Corporation‘s EXAS shares have surged 35.4% year to date against the industry’s decline of 21.2%. The Medical sector has dropped 8.1% in the said time frame. The company has a market capitalization of $12.12 billion.

The upside in the Screening and Precision Oncology segments is likely to have driven this Zacks Rank 2 (Buy) stock. Its earnings are expected to have surged by 58.2% in the next year.

Will the Upside Continue?

The Zacks Consensus Estimate for EXAS’ 2023 earnings indicates a 58.2% increase from the year-ago reported figure. The consensus estimate for 2023 revenues is pegged at $2.48 billion, indicating a year-over-year improvement of 19.1%.

Exact Sciences is focusing on three areas to enhance Cologuard growth. Building the best and most effective commercial organization in healthcare by investing in the leadership team, training and sales force effectiveness is the first strategy. Improving the customer experience by making it simpler to order Cologuard electronically and continue rescreening patients every three years is the next strategy. Screening more people starting at age 45 to catch cancer earlier is the final strategy. In terms of the latest development, more than 9,000 new healthcare professionals ordered Cologuard during the second quarter and more than 321,000 have ordered since launch. About 75% of all U.S. primary care physicians have ordered Cologuard.

The company’s Precision Oncology portfolio guides treatment decisions for more than 200,000 cancer patients annually. The Oncotype DX test helps early-stage breast cancer patients determine whether they will benefit from chemotherapy. The OncoExTra test helps late-stage cancer patients determine their best treatment options. A consistent focus on high-quality tests, top-tier clinical evidence and physician education cemented Oncotype DX as the standard of care.

In terms of the latest developments, the company has made progress in its three most impactful pipeline programs, colon cancer screening, molecular residual disease and multi-cancer screening. For Next Generation Cologuard, the data presentation at ACG in October demonstrated the pivotal head-to-head BLUE-C study is the new gold standard for evidence in colon cancer screening. The study was designed to validate a pre-specified algorithm. BLUE-C enrolled over 20,000 people, including 98 with cancer and more than 2,000 with precancerous polyps.

Image Source: Zacks Investment Research

Exact Sciences exited the third quarter of 2023 with cash and cash equivalents and marketable securities of $733.4 million compared with $604.4 million at the end of the second quarter of 2023. The company had no long-term debt on its balance sheet at the end of the third quarter. This is good news, particularly during an overall tough macroeconomic scenario when the company is faced with a global manufacturing and supply halt.

The raised guidance is an indicator of future growth. For 2023, the company expects revenues in the range of $2.476-$2.486 billion (from the earlier-provided range of $2.441-$2.466 billion). The Zacks Consensus Estimate for the same is pegged at $2.26 billion. For 2023, the company expects its Screening revenues to be in the range of $1.820-$1.835 billion. The company expects Precision Oncology revenues in the range of $615-$625 million.

Estimate Trends

The Zacks Consensus Estimate for EXAS’ 2023 has moved from a loss of $1.90 to a loss of $1.48 in the past 90 days, reflecting analysts’ optimism.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom carry a Zacks Rank #2 (Buy), Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ shares have moved up 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share (EPS) have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have declined 40.9% in the past year compared with the industry’s fall of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 EPS have increased from $1.23 to $1.41 in the past 30 days. The company’s shares have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report