Exact Sciences' (EXAS) Solid Cologuard Sales, Innovation Aid

Exact Sciences EXAS continues to make significant progress with its Cologuard test. New launches also buoy optimism. The stock carries a Zacks Rank #2 (Buy) currently.

The Exact Sciences team is currently focusing on three areas to enhance Cologuard growth. Its first strategy involves building the best and most effective commercial organization in healthcare by investing in the leadership team, training and sales force effectiveness. It is also working on improving customer experience by making it simpler to order Cologuard electronically and continue rescreening patients every three years.

Further, it looks to screen more people, starting at age 45, to catch cancer earlier. More than 9,000 new healthcare professionals ordered Cologuard during the second quarter and more than 321,000 have ordered it since its launch. About 75% of all U.S. primary care physicians have ordered Cologuard.

Following the acquisitions of Paradigm and Ashion, Exact Sciences is now offering therapy selection tests for patients with advanced cancer, providing even more value to oncologists, researchers and pharma partners. In terms of the latest development, more than 10,000 new healthcare professionals ordered Cologuard during the third quarter, totaling more than 331,000 orders since its launch. About 75% of all U.S. primary care physicians have ordered Cologuard.

With regard to advancing new solutions, Exact Sciences is planning several key milestones to bring six innovative cancer diagnostics from its pipeline to patients in need.

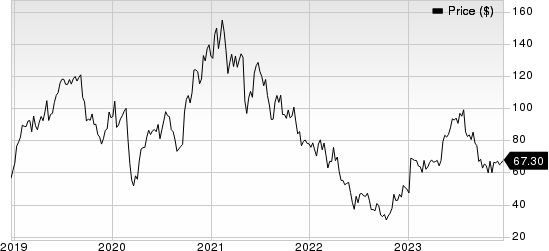

Exact Sciences Corporation Price

Exact Sciences Corporation price | Exact Sciences Corporation Quote

In August 2023, Exact Sciences presented new data confirming Exact Sciences' approach to multi-cancer early detection, real-world outcomes using the Oncotype DX Breast Recurrence Score and modeling comparisons between Cologuard and potential blood-based screening tests for colorectal cancer.

In June 2023, Exact Sciences entered into a separate collaboration with two renowned healthcare organizations at the forefront of cancer research. The agreements aim to improve patient care by increasing access to genomic information.

The company is also planning to transform cancer care by providing patients with valuable insights at every step of their diagnosis and treatment. The company is currently working to build the best digital infrastructure and diagnostics.

In terms of the latest developments, the company has made progress in its three most impactful pipeline programs — colon cancer screening, molecular residual disease, and multi-cancer screening. For Next Generation Cologuard, the data presentation at ACG in October demonstrated the pivotal head-to-head BLUE-C study, which is the new gold standard for evidence in colon cancer screening. The study was designed to validate a pre-specified algorithm. BLUE-C enrolled over 20,000 people, including 98 with cancer and more than 2,000 with precancerous polyps.

Over the past year, shares of EXAS have increased 28.5% against the industry’s 18.5% decline.

On the flip side, Exact Sciences has been grappling with escalated expenses for a while. Although the company is gradually coming out of the impact of the two-and-a-half-year-long healthcare crisis, deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor costs as well as freight charges, and rising interest rates, have put the medical device space in a tight spot. All these are creating significant pressure on the company’s profitability.

The company has also adopted several strategies to improve its revenue performance. These include portfolio expansion and penetration in the international arena. So far, this has escalated costs and operating expenses for the company.

In the third quarter of 2023, Exact Sciences’ general and administrative expenses rose 13.2% year over year. Adjusted operating expenses in the third quarter were up 6.7% year over year. The escalating costs are putting significant pressure on the company’s bottom line.

Other Key Picks

A few other top-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. Insulet sports a Zacks Rank #1 (Strong Buy), while Haemonetics and DexCom presently carry a Zacks Rank #2 each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have moved up from $1.90 to $1.91 in the past 30 days. Shares of the company have plunged 28.8% in the past year compared with the industry’s decline of 2.2%.

PODD’s earnings surpassed estimates in each ofthe trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 10.8% in the past year. Earnings estimates for Haemonetics have increased from $3.86 to $3.89 for 2023 and from $4.11 to $4.15 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.43 to $1.44 in the past 30 days. Shares of the company have increased 7.4% in the past year compared with the industry’s rise of 2.2%.

DXCM’s earnings surpassed estimates in each ofthe trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report