Examining Buffett's 'Indefinite' Stocks

To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What's needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework." - Warren Buffett (Trades, Portfolio)

In his recent letter to Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) shareholders, Warren Buffett (Trades, Portfolio) identified three stocks as well as five Japanese companies which the conglomerate intends to hold "indefinitely." This is close enough to "forever" as far as I am concerned for the purpose of this discussion. The reason is these companies are hugely successful in their base businesses, are enduring, scalable and leave him feeling "comfortable." The last point is an important if underappreciated quality in choosing stocks to own. You want to avoid investments that cause you stress and keep you up at night. This discussion explores these Buffett "forever" stocks using GuruFocus data and I offer my opinion if they are still worth buying at current prices.

Additionally, as he recalled Charlie Munger advising him, after he took control of Berkshire and relocated it from New England to Omaha, that he should forget about "owning fair stocks at wonderful prices," but focus on "owning wonderful stocks at fair prices." I think we can be certain these businesses are wonderful as Berkshire owns them, but are the prices still "fair?" And if so, does it make sense to still buy them?

Coca-Cola

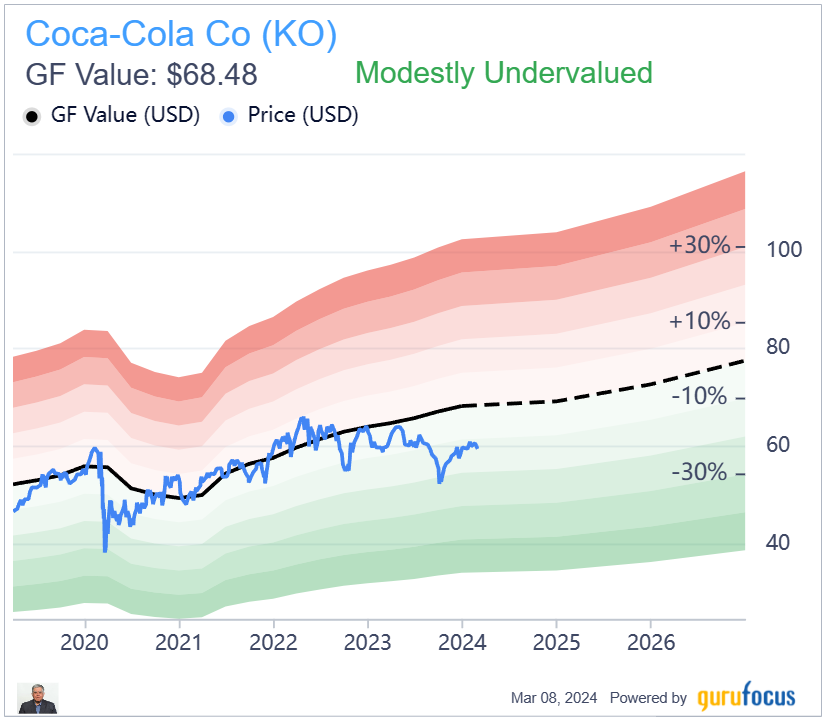

The first company Buffett identified is Coca-Cola Co. (NYSE:KO). GuruFocus data shows the stock to be modestly undervalued and fits with Munger's definition of a wonderful business at a fair price.

Buffett mentioned in his letter that Coca-Cola was launched in an Atlanta drug store in 1886, quipping that Berkshire is not big on newcomers.

Coca-Cola is a business with high predictability and low capital intensity. It is global in its scope. People are used to drinking its products and are expected to keep on consuming them for decades to come. Drinking carbonated beverages is unlikely to go out of fashion. Technological disruptions such as artificial intelligence do not fundamentally threaten the business, but can enhance it. The company's return on invested capital consistently exceeds its weighted average cost of capital. Berkshire owns about 9% of Coke's outstanding shares.

Overall, I think Coca-Cola is still a buy. It is a "sleep well at night" stock that will continue compounding in the future.

American Express

The GF Value chart shows American Express Co. (NYSE:AXP) to be fairly valued after the recent surge of over 58% from its October 2023 lows. American Express is a great company that Buffett has owned for decades. Its ROIC consistently exceeds its WACC.

Founded in 1850, American Express is known principally for its charge cards but also extends credit and provides a suite of related services to businesses and merchants. The company is positioned at the higher end of the card business. Despite the competitive nature of the industry, it has averaged about 10% earnings per share growth over many years, through above-average revenue growth and ongoing share buybacks.

Overall, I think American Express is a weak buy if you do not already own it. If you own it, I think it is best to wait for a more opportunistic entry point to buy more. It is a proven compounder of shareholder capital and though right now its not a bargain, buying it now is unlikely to cause regret in the future. However, be aware that the best opportunity to buy American Express happens when the fear of a recession is in the air like last year. With a booming economy like at present, American Express is on the expensive side. Berkshire owns more than 20% of its stock.

Buffett said, "The lesson from Coke and AMEX? When you find a truly wonderful business, stick with it. Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable."

Occidental Petroleum

Berkshire owns 27.80% of Occidental Petroleum Corp. (NYSE:OXY) shares as well as holds options to increase its stake further, but Buffett emphasized that he has no desire to own the company outright. The guru likes Occidental's vast oil and gas holdings in the United States, as well as its leadership in carbon-capture initiatives, though the economic feasibility of the latter technique has yet to be proven. However, clearly it will be needed in the future due to the inevitability of climate change and societal pressure to do something about it. Both of these activities, he said, are very much in the country's interest, giving the investment a patriotic flavor. Buffett likes the fact that Occidental's holdings are in the U.S. (thus safe from a geopolitical turbulence) and very much needed to maintain U.S. energy independence from foreign oil, which he sees as a risk to the country. Thus, his holdings in Occidental somewhat of a hedge against global conflict and turbulence.

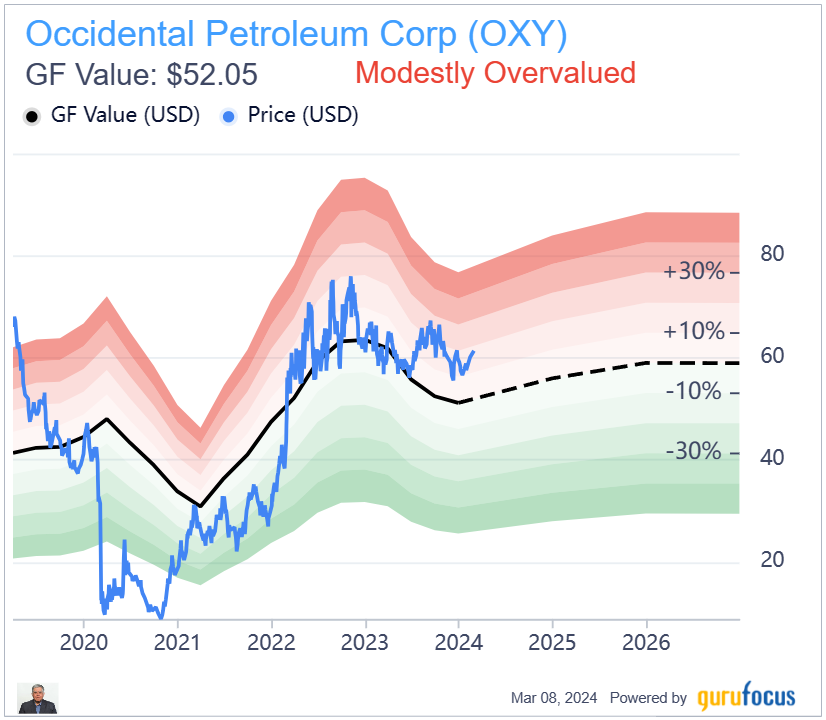

Occidental looks modestly overvalued according to the GF Value Line. However, I think we should look at the stock from the lens Buffett is using that it is a domestic oil and gas major, and thus much safer than other large multinational oil and gas companies with comparable reserves outside the U.S. Further, like all oil and gas companies, it is very cyclical.

Buffett is a multibillionaire and is not bothered by volatility. However, most investors are not multibillionaires, so factor that in. All in all, I would wait for a better entry point.

Japanese holdings

Berkshire currently holds approximately 9% ownership in each of five Japanese companies. Buffett said in his letter that Berkshire has made a commitment to these companies that it will not acquire shares exceeding a 9.90% stake. The total cost of these holdings amounts to 1.60 trillion yen ($10.75 billion), while the year-end market value stands at 2.90 trillion yen. However, due to the yen's recent weakening, Berkshire's unrealized gain in dollars reached 61%, equivalent to $8 billion.

These companies are often referred to as Sogo-Shosha, which translates to "general trading companies," and form a crucial part of the Japanese economy. However, they have greatly evolved from their trading roots and are now conglomerates of many trading, real estate and industrial businesses.

The first is Itochu Corp. (TSE:8001), a diversified conglomerate with interests spanning various sectors. Historically, it played a crucial role in importing energy, minerals and food into Japan. Today, its portfolio extends beyond trade activities to include logistics, real estate, frozen foods and even investments in electric vehicles and renewable energy.

Next is Marubeni Corp. (TSE:8002), another significant player in Japan's trading landscape. Like its peers, it has a diverse portfolio, including energy, agriculture and infrastructure. The company has adapted to changing market dynamics and expanded into non-trade areas such as real estate and aerospace.

Third, Mitsubishi Corp. (TSE:8058) has a rich history and has been instrumental in Japan's economic development. Traditionally, it focused on importing raw materials and exporting finished products. Today, the company's interests span various industries, including automotive, machinery and finance. It has also ventured into newer areas like EVs and renewable energy.

Mitsui & Co. Ltd. (TSE:8031) is one of the oldest sogo-shosha companies, with its roots tracing back to the Edo period. Over time, it has diversified its business lines, including investments in infrastructure, chemicals and health care. Mitsui's very long-term approach aligns with Buffett's investment philosophy.

Last but not least is Sumitomo Corp. (TSE:8053). It has a storied history dating back centuries. The company has been involved in copper mining, banking and trade. In recent years, Sumitomo has expanded into diverse sectors, such as real estate, logistics and telecommunications. Its focus on value and cash flow resonates with Buffett's investment principles.

The table below provides a snapshot of these companies basic fundamentals:

Ticker | Company | Current Price (Yen) | Market Cap ($M) | EV-to- EBITDA | PE Ratio | FCF Yield % | Dividend Yield % |

TSE:8001 | Itochu Corp | 6,385 | 62,439.73 | 8.32 | 12.71 | 7.86 | 2.43 |

TSE:8031 | Mitsui & Co Ltd | 6,522 | 66,234.07 | 7.41 | 9.75 | 8.75 | 2.45 |

TSE:8058 | Mitsubishi Corp | 3,235 | 90,633.05 | 8.53 | 14.95 | 7.47 | 2.14 |

TSE:8053 | Sumitomo Corp | 3,462 | 28,690.40 | 7.92 | 8.42 | 9.93 | 3.47 |

TSE:8002 | Marubeni Corp | 2,434 | 27,650.44 | 7.24 | 9.14 | 8.07 | 3.37 |

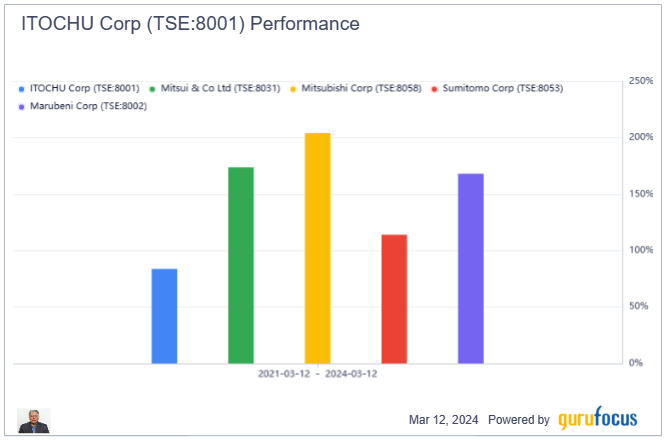

Since Buffett purchased the five companies about three years ago, they are up substantially in yen terms and even more in U.S. dollar terms as the yen has weakened. The following chart shows the price appreciation over the last three years.

While the five companies may not be household names globally, they play critical roles in Japan's economic landscape, which is similar to the role Berkshire plays in the U.S. Buffett's interest in these Japanese companies reflects their stability, diversified portfolios and long-term vision. He appreciates their similarities to Berkshire Hathaway, emphasizing value and understanding the businesses they operate.

Buffett said in his letter that because he cannot accurately forecast major currency market prices, Berkshire had financed a significant portion of its Japanese stock position using the proceeds from 1.30 trillion yen in bond sales. This debt issue has been well-received in Japan, and Berkshire likely holds more yen-denominated debt than any other American company. The weakened yen since then has resulted in a year-end gain of $1.90 billion for Berkshire, which, in accordance with GAAP rules, has been recognized in income over the 2020 to 2023 period. Thus, not only have the stock prices of the Japanese companies gone up substantially, but the debt Berkshire took on has diminished in U.S. dollar terms, resulting in a one-two punch in favor of Berkshire.

Buffett said in his letter that all five Japanese companies adhere to shareholder-friendly policies that surpass typical U.S. practices. Since Berkshire initiated its purchases, each of these companies has reduced their outstanding shares at attractive prices. Additionally, he says, their management teams exhibit "less aggressiveness" regarding compensating themselves compared to U.S. norms. Furthermore, each allocates only about one-third of its earnings to dividends, retaining substantial sums for business expansion and share repurchases. Like Berkshire, these companies are cautious about issuing new shares. From the tone of the letter, it looks like Buffett is really pleased with his ownership of the Japanese sogo-soshas and are companies he intends to hold indefinitely.

Other potential "forever" stocks

Buffett had surprisingly little to say about Apple Inc. (NASDAQ:AAPL) in his letter, given the extremely large part of Berkshire's portfolio invested in the stock. Apple now constitutes over 50% of Berkshire's non-controlled equity investment portfolio. It own 5.86% of Apple's outstanding shares.

The tech giant looks fairly valued on the GF Value Line. I don't think we can go wrong with Apple at the present time given its dominance in mobile tech and wide competitive moat.

Another stock is Bank of America Corp. (NYSE:BAC), which is Buffett's second-highest conviction stock after Apple and over 10% of his portfolio is in it. Berkshire owns about 13% of the bank's outstanding stock. It is also in fairly valued territory.

Conclusion

So that's it folks. These are Buffett's "indefinite hold" or "close enough to forever" stocks gleaned from his latest letter. At present, I think only Coca-Cola is a clear buy and the rest are weak buys. I like Apple and if it comes down a bit more, I may take the plunge.

Buffett's Japanese investments are very interesting, but I would rather hold them indirectly through my ownership of Berkshire stock to avoid the foreign exchange risk. The purchase of the five conglomerates was a master stroke. It is interesting to note that while Buffett has been building up his Japanese exposure, he has been reducing his Chinese and Taiwanese exposure. He has been selling down his BYD (SZSE:002594) position and has exited his Taiwan Semiconductor (NYSE:TSM) position. While he did not disclose a reason, I think it may be because of geopolitical concerns.

The guru's approach is pretty much safety first and very long-term thinking. Watching his portfolio is like watching paint dry. Like he says, the first rule of investing is not to lose money and the second rule is to see the first rule. It is very interesting to see this philosophy in action with his biggest holdings.

This article first appeared on GuruFocus.