Excelerate Energy Inc (EE) Reports Robust Full-Year 2023 Results and Launches New Share Buyback ...

Net Income: Excelerate Energy Inc (NYSE:EE) reported a substantial increase in net income to $126.8 million for 2023.

Adjusted EBITDA: The company achieved $346.8 million in Adjusted EBITDA for the full year.

Revenue: Total revenues reached $1,159.0 million for the year, with a notable contribution from FSRU and terminal services.

Dividends and Share Repurchases: EE declared a quarterly dividend and announced a new $50 million share repurchase program.

Strategic Contracts: Secured long-term LNG supply contracts with QatarEnergy and Petrobangla, enhancing future stability.

Liquidity: Strong liquidity position with $555.9 million in cash and cash equivalents as of December 31, 2023.

2024 Outlook: Adjusted EBITDA expected to range between $315 million and $335 million for the full year.

On February 28, 2024, Excelerate Energy Inc (NYSE:EE) released its 8-K filing, detailing a strong financial performance for the full year ended December 31, 2023. The company, known for its flexible LNG solutions and integrated services along the LNG value chain, reported significant growth in net income and Adjusted EBITDA, reflecting the success of its core regasification business and strategic contracts.

Financial Performance Highlights

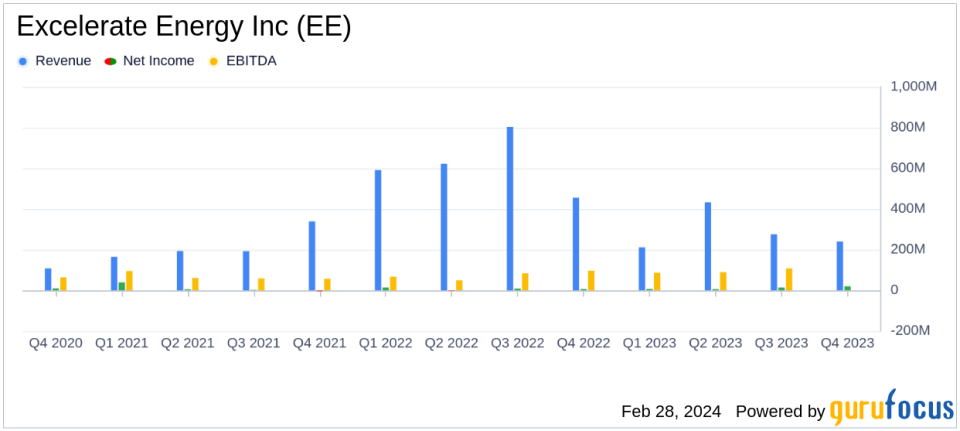

EE's net income for the full year 2023 stood at $126.8 million, a notable increase from the previous year's $80.0 million. This growth was primarily driven by new charters in Finland and Germany, higher rates on charters in Brazil, Argentina, and the UAE, and a lower operating lease expense due to the acquisition of the FSRU Sequoia. Adjusted EBITDA also saw a significant rise to $346.8 million, up from $296.4 million in the prior year.

However, the fourth quarter of 2023 saw a sequential decrease in net income and Adjusted EBITDA, mainly due to drydocking expenses for the FSRU Excellence, the absence of spot LNG cargo sales that occurred in the third quarter, and planned vessel repairs and maintenance.

Strategic Developments and Shareholder Returns

EE's strategic moves in 2023 included securing a long-term contract to purchase LNG from QatarEnergy, which will support the company's SPA with Petrobangla in Bangladesh. This move is expected to provide reliable LNG supply and enhance the company's stability and growth prospects.

In a move to return capital to shareholders, EE's Board of Directors authorized a share repurchase program of up to $50 million of its Class A common stock through February 2026. Additionally, a quarterly dividend of $0.025 per share was declared, payable on March 28, 2024.

"Excelerate Energy delivered an exceptionally strong year of financial results in 2023," said Steven Kobos, President and Chief Executive Officer of Excelerate. He emphasized the company's commitment to executing its growth strategy and optimizing the business to deliver superior returns for shareholders.

Liquidity and Capital Resources

As of December 31, 2023, EE reported a robust liquidity position with $555.9 million in cash and cash equivalents. The company also made significant debt repayments, including a $55.2 million discretionary repayment of debt on its Term Loan, demonstrating its commitment to maintaining a strong balance sheet.

Looking Ahead

For the full year 2024, EE expects Adjusted EBITDA to range between $315 million and $335 million. The company plans to continue investing in growth opportunities, with committed growth capex expected to range between $70 million and $80 million.

Excelerate Energy Inc's strong financial results and strategic initiatives in 2023 position the company well for continued growth and shareholder value creation. Investors and stakeholders can anticipate a focused approach to executing the company's growth strategy and optimizing its business operations in the coming year.

For more detailed information on Excelerate Energy Inc's financial performance and strategic outlook, investors are invited to access the live webcast of the conference call or visit the Investor Relations page on the company's website.

For further insights and analysis on Excelerate Energy Inc (NYSE:EE) and other key players in the LNG industry, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Excelerate Energy Inc for further details.

This article first appeared on GuruFocus.