Exclusive: Half of companies say they’d hire more if Trump cuts their taxes

Will they or won’t they?

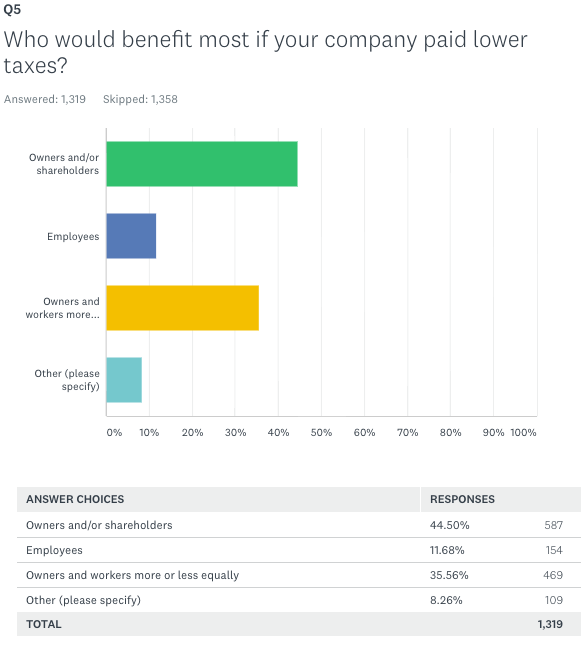

As a major tax cut for businesses comes closer to reality, perhaps the biggest looming question involves who will benefit. Will businesses share the forthcoming windfall with workers, making everybody better off? Or will owners and shareholders pocket most of the money?

The apparent answer: A mix of both.

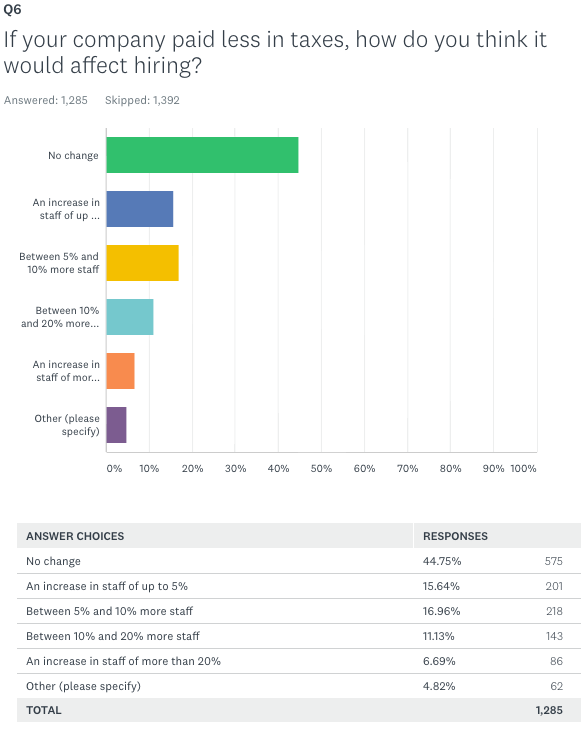

Yahoo Finance surveyed more than 1,200 business owners November 20–22 and found that many plan to use the savings from tax cuts to spend more and hire more workers. Fifty percent of respondents told us tax cuts would make it more likely that their firms would hire new workers, and 51% said they’d be more likely to increase investment in the United States. Fifty-two percent expected worker pay to rise if their taxes go down, with 11% expecting pay raises of 10% or more. Full survey results are at the end of this story.

Business owners also felt optimistic about their employees’ futures. Fifty-three percent said tax cuts would make their employees better off in 5 years, and just 40% said the tax cuts would not make employees better off. Some 16% weren’t sure.

[See how the Trump tax plan would help one business, but hurt another.]

What business owners say—and do—about the impending tax cuts is important, because voters generally dislike the bill Republicans are proposing. A majority of American voters (52%) said in a recent Quinnipiac poll that they disapprove of the tax cuts, mainly because they seem to overwhelmingly favor businesses and the wealthy. Just 25% of respondents approve of the plan, leaving voters 2-to-1 against.

Benefit the broader economy?

There’s undoubtedly a trickle-down element in the Tax Cuts and Jobs Act, or TCJA, as the different plans in the House and Senate are each known. Of $1.5 trillion in tax cuts over a decade, roughly 75% would benefit businesses, with 25% or so going to individuals. Trump and his fellow Republicans say that’s okay, because businesses will spend and hire more, benefiting the broader economy.

Trickle-down tax cuts generally have a poor record, never generating the robust economic growth supporters claim they will. So business owners who are enthusiastic about spending and hiring now, with tax cuts imminent, could end up scaling back their plans.

More harm than good?

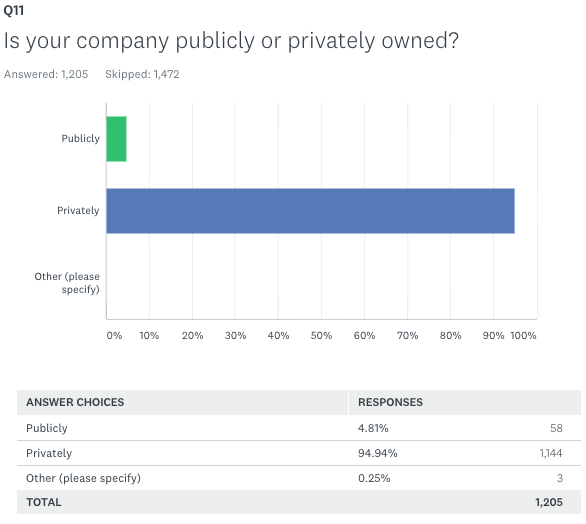

There’s also a significant minority of business owners who think the Trump tax cuts will do more harm than good. Nearly 12% of respondents told us the GOP plan would make it less likely their firms would invest in the United States, for instance. At least part of that concern is due to an expected rollback in the deductibility of state and local taxes, which will hurt some privately-owned businesses by killing or curtailing a valuable tax break worth many thousands of dollars per year. Hurting some businesses in order to help others could also cause unintended political blowback for Republicans, since media stories are more likely to focus on victims of government policy than beneficiaries. If tax cuts ultimately pass, in fact, it will only be the beginning of the story.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Full results of the Yahoo Finance survey of business owners:

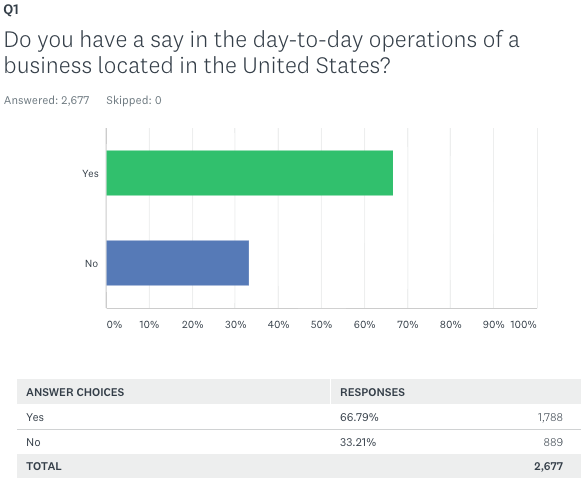

In an online survey that ran on Yahoo Finance from November 20 – 22, we asked more than 1,200 business owners how proposed tax cuts would affect hiring and investment at their firms. Methodology notes: Respondents answering No to Question 1 were eliminated from the survey, so that only respondents who said they helped run a U.S. business could answer the subsequent questions. And only respondents answering “more likely” to Question 4 were allowed to answer Question 5, with the others skipping to Question 6.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman