Executive VP and CFO Robert Anderson Buys 8,750 Shares of USCB Financial Holdings Inc

USCB Financial Holdings Inc (NASDAQ:USCB) has recently witnessed a significant insider transaction that has caught the attention of investors and market analysts. Executive Vice President and Chief Financial Officer Robert Anderson has made a notable purchase of company shares, indicating potential confidence in the firm's future prospects. This article will delve into the details of the transaction, provide an overview of Robert Anderson's role within the company, and offer an objective analysis of USCB Financial Holdings Inc's business and the implications of insider trading activities.

Who is Robert Anderson of USCB Financial Holdings Inc?

Robert Anderson serves as the Executive Vice President and Chief Financial Officer of USCB Financial Holdings Inc. In his role, Anderson is responsible for overseeing the financial operations of the company, including financial planning and analysis, treasury, accounting, and investor relations. His position places him in a strategic role where he has a comprehensive understanding of the company's financial health and growth strategies. Anderson's decision to invest in the company's stock is often interpreted as a signal of his belief in the company's value and future performance.

USCB Financial Holdings Inc's Business Description

USCB Financial Holdings Inc is a financial institution that operates primarily through its subsidiary, USCB Bank. The company provides a range of banking services, including personal and business banking solutions, loans, and investment services. With a focus on serving the needs of individuals, families, and businesses, USCB Financial Holdings Inc aims to deliver personalized service and build long-term relationships with its clients. The company's commitment to financial integrity and community involvement positions it as a trusted partner for its customers' banking needs.

Description of Insider Buy/Sell

Insider buying and selling refer to the transactions made by company insiders such as executives, directors, and major shareholders in the company's own stock. Insider buying can be seen as a positive sign, as insiders may buy shares because they believe the stock is undervalued or that there are positive developments on the horizon. Conversely, insider selling might raise concerns among investors, as it could suggest that insiders are less optimistic about the company's future or that they perceive the stock to be overvalued.

It is important to note that insider transactions are subject to strict regulations to prevent illegal insider trading. Insiders are required to report their transactions to the Securities and Exchange Commission (SEC) in a timely manner, and these transactions are closely monitored by investors and analysts for insights into the company's internal perspective.

Insider Transaction Analysis

On December 14, 2023, Robert Anderson, the Executive VP and CFO of USCB Financial Holdings Inc, purchased 8,750 shares of the company's stock. This transaction is particularly noteworthy as it represents a significant investment by a top executive, suggesting a strong belief in the company's potential for growth or undervaluation by the market.

Over the past year, Anderson has accumulated a total of 8,750 shares, with no recorded sales of company stock. This one-sided activity in favor of buying could be interpreted as a positive indicator of the insider's confidence in the company's future performance.

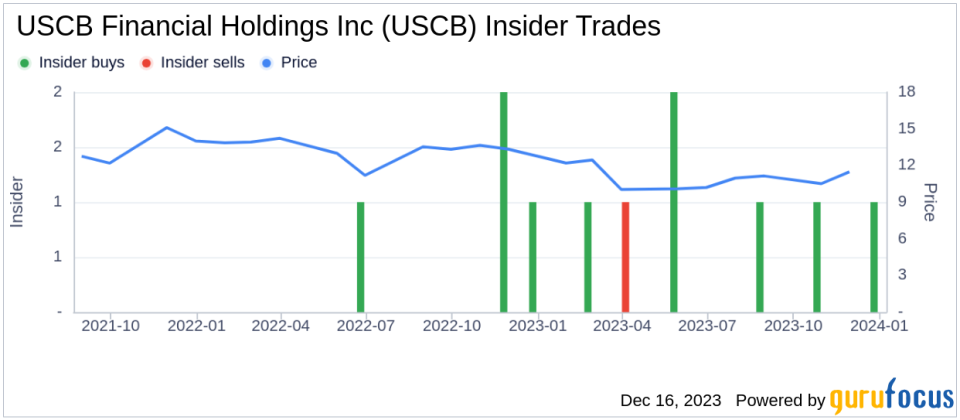

The insider transaction history for USCB Financial Holdings Inc shows a pattern of more insider buying than selling over the past year, with 6 insider buys and only 1 insider sell. This trend may signal a general optimism among insiders about the company's direction and valuation.

Shares of USCB Financial Holdings Inc were trading at $12.35 on the day of Anderson's recent purchase, giving the company a market capitalization of $240.37 million. The price-earnings (P/E) ratio at the time of the transaction stood at 13.57, which is higher than the industry median of 8.74 and also above the company's historical median P/E ratio. This higher P/E ratio could suggest that the market has higher expectations for the company's earnings growth compared to its peers or its own past performance.

However, it is essential to consider that a higher P/E ratio does not necessarily indicate overvaluation. It could also reflect the market's confidence in the company's future earnings potential, possibly due to strategic initiatives, market position, or other factors that may not be immediately evident from the financial statements alone.

The insider trend image above provides a visual representation of the buying and selling activities of insiders at USCB Financial Holdings Inc. This graphical data can be a useful tool for investors to gauge the sentiment of company insiders and to make more informed investment decisions.

Conclusion

Robert Anderson's recent purchase of 8,750 shares of USCB Financial Holdings Inc is a transaction that merits attention from the investment community. As the CFO of the company, Anderson's actions may reflect his intimate knowledge of the company's financial standing and future prospects. The overall trend of insider buying over the past year, coupled with the company's current valuation metrics, provides a complex picture that investors should consider as part of their broader analysis of USCB Financial Holdings Inc.

While insider transactions can offer valuable insights, they should not be the sole basis for investment decisions. Investors are encouraged to consider a wide range of factors, including market conditions, industry trends, and the company's financial performance, before making any investment. As always, due diligence and a diversified investment strategy are key components of a sound approach to stock market investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.