Exelixis (EXEL) Gets Rights for Tumor Candidate From Insilico

Exelixis, Inc.’s EXEL efforts to develop its oncology pipeline took another step forward when it entered into an exclusive license agreement with clinical-stage biotechnology company Insilico Medicine.

Insilico has developed artificial intelligence platforms that utilize deep generative models, reinforcement learning, transformers and other modern machine learning techniques for novel target discovery and the generation of novel molecular structures with desired properties.

Per the terms, Exelixis obtained global rights to develop and commercialize ISM3091, a potentially best-in-class small molecule inhibitor of USP1, which has emerged as a synthetic lethal target in the context of BRCA-mutated tumors. In exchange, Insilico will get an upfront payment of $80 million (anticipated in the third quarter of 2023).

Insilico will also receive future development, commercial and sales-based milestone payments, as well as tiered royalties on net sales.

In April 2023, the FDA cleared Insilico’s investigational new drug application (IND) for ISM3091 in patients with solid tumors.

The candidate, ISM3091, proved its efficacy against multiple tumor cell lines and in vivo models with BRCA mutations in preclinical studies. It was also found to be potently efficacious in homologous recombination DNA repair-proficient models, both as a single agent and in combination with PARP inhibitors. The candidate was well tolerated in different species with a high margin of safety.

Per Exelixis, the encouraging preclinical data on ISM3091’s potent anti-tumor activity, tolerability and pharmacokinetics sets the compound apart from competing USP1 inhibitors and makes it an important addition to its growing pipeline.

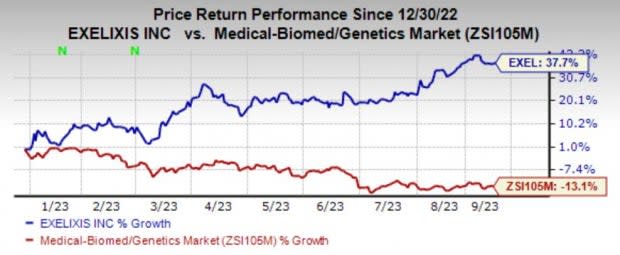

Exelixis shares have gained 37.7% in the year so far against the industry’s decline of 13.1%.

Image Source: Zacks Investment Research

Exelixis’ lead drug, Cabometyx, maintains momentum for the company on the back of strong demand for the drug for treating patients with advanced renal cell carcinoma (RCC) and hepatocellular carcinoma (HCC) who have been previously treated with sorafenib and for patients with advanced RCC as a first-line treatment in combination with Opdivo.

Cabometyx maintained its status as the leading tyrosine kinase inhibitor (TKI) in the second quarter for the treatment of RCC, driven by its use in combination with Opdivo in the first-line setting and the second-line monotherapy setting for the HCC indication.

Per the company, Cabometyx, in combination with Opdivo, remains the number one TKI plus immuno-oncology combination in first-line RCC.

Exelixis, Inc. Price, Consensus and EPS Surprise

Exelixis, Inc. price-consensus-eps-surprise-chart | Exelixis, Inc. Quote

The pipeline progress has been impressive as the company strives to expand Cabometyx’s label and concurrently develop its portfolio beyond its lead drug with promising candidates - zanzalintnib, XB002, XL102 and CBX-12.

To that end, the company has been actively entering into strategic agreements with other companies to obtain innovative and promising compounds.

Exelixis earlier entered into a clinical development and option agreement with Sairopa, which gives it the option to obtain an exclusive, worldwide license to develop and commercialize ADU-1805 and other anti-SIRPα antibodies. The FDA has cleared Sairopa’s IND application to evaluate the safety and pharmacokinetics of ADU-1805 in adults with advanced solid tumors.

Exelixis also entered into an exclusive collaboration agreement with Cybrexa, providing Exelixis the right to acquire CBX-12 (alphalex exatecan), a clinical-stage, first-in-class PDC that utilizes Cybrexa’s proprietary alphalex technology to enhance the delivery of exatecan to tumor cells.

Zacks Rank & Other Stocks to Consider

Exelixis currently carries a Zacks Rank #2 (Buy).

Other well-placed stocks in the industry include Eton Pharmaceuticals ETON and Dynavax Technologies DVAX. While Eton carries a Zacks Rank #1 (Strong Buy), Dynavax carries the same rank as Exelixis. You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss estimates for Eton for 2023 have narrowed to 10 cents from 31 cents in the past 60 days, while earnings estimates for 2024 are pegged at 26 cents per share.

Loss estimates for Dynavax for 2023 have narrowed to 24 cents from 56 cents in the past 90 days, while earnings estimates for 2024 are pegged at 2 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Eton Pharmaceuticals, Inc. (ETON) : Free Stock Analysis Report