Exelixis (EXEL) Q3 Earnings and Sales Miss, Annual View Updated

Exelixis, Inc. EXEL reported earnings of 10 cents per share in the third quarter of 2023, which missed the Zacks Consensus Estimate of 17 cents and were down from 31 cents per share in the year-ago quarter.

Including stock-based compensation expense, earnings per share were breakeven compared with 23 cents per share in the year-ago quarter due to a significant increase in R&D expenses.

Net revenues came in at $471.9 million, marginally missing the Zacks Consensus Estimate of $476 million. Revenues were, however, up 14.6% year over year.

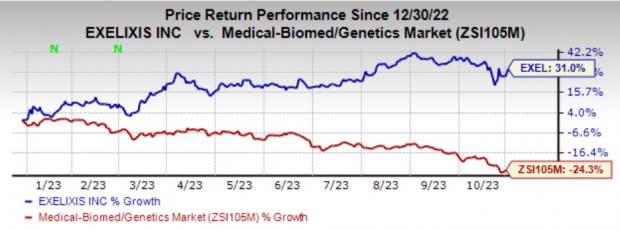

Exelixis’ shares have gained 31% in the year so far against the industry’s decline of 24.3%.

Image Source: Zacks Investment Research

Quarter in Detail

Net product revenues came in at $426.5 million, up 16.4% year over year. The increases in net product revenues were primarily due to a rise in sales volume and the average net selling price.

Cabometyx (cabozantinib) generated revenues of $422.2 million and beat the Zacks Consensus Estimate and our model estimate of $416 million and $417.6 million, respectively. The drug is approved for advanced renal cell carcinoma (“RCC”) and previously treated hepatocellular carcinoma (“HCC”). Cometriq generated $4.3 million in net product revenues (cabozantinib capsules) for treating medullary thyroid cancer.

Collaboration revenues, comprising license revenues and collaboration services revenues, were $45.4 million in the quarter compared with $45.3 million in the year-ago quarter.

In the reported quarter, research and development expenses were $332.6 million, up 67.2% year over year. The significant surge was primarily related to the $80 million up-front payment associated with the in-licensing of XL309, increases in license and other collaboration costs, personnel expenses and manufacturing costs to support development candidates. Selling, general and administrative expenses were $138.1 million, up 20% due to an increase in personnel expenses.

In March, Exelixis announced that its board authorized the repurchase of up to $550 million of the company’s common stock before the end of 2023. Under this program, Exelixis repurchased 16.943 million shares of the company’s common stock for a total of $344.8 million as of Sep 30.

Litigation Update

In July, Exelixis announced that it entered into a settlement and license agreement with Teva Pharmaceuticals TEVA. This settlement resolves patent litigation brought by Exelixis in response to Teva’s abbreviated new drug application seeking approval to market a generic version of Cabometyx prior to the expiration of the applicable patents. Per the settlement terms, Exelixis will grant Teva a license to market its generic version of the drug in the United States beginning on Jan 1, 2031, upon the FDA’s approval. Consequently, both companies will terminate the ongoing litigation.

Pipeline Updates

In August, Exelixis and partner Ipsen announced that the phase III CONTACT-02 pivotal trial met one of two primary endpoints, demonstrating a statistically significant improvement in progression-free survival (“PFS”) at the primary analysis. The study is evaluating cabozantinib in combination with atezolizumab compared with a second novel hormonal therapy (“NHT”) in patients with metastatic castration-resistant prostate cancer and measurable soft-tissue disease who have been previously treated with one NHT. At a prespecified interim analysis for the primary endpoint of overall survival (“OS”), a trend toward improvement of OS was observed, but the data was immature and did not meet the threshold for statistical significance.

Therefore, the trial will continue to the next analysis of OS, as planned.

Exelixis plans to discuss a potential regulatory submission when the results of the next OS analysis are available based on feedback from the FDA.

Detailed results from the late-stage CABINET study evaluating cabozantinib in advanced pancreatic and extra-pancreatic neuroendocrine tumors demonstrated a statistically significant and clinically meaningful improvement in PFS in those patients treated with cabozantinib. Earlier, The Alliance for Clinical Trials in Oncology’s independent Data and Safety Monitoring Board unanimously recommended to unblind and stop the trial early due to a dramatic improvement in efficacy observed at an interim analysis.

In September, Exelixis received global rights to develop and commercialize XL309 from Insilico. The candidate is a potentially best-in-class small-molecule inhibitor of USP1, which has emerged as a synthetic lethal target in the context of BRCA-mutated tumors. Under the terms of the agreement, Insilico granted Exelixis an exclusive, worldwide license to develop and commercialize XL309 and other USP1-targeting compounds in exchange for an upfront payment of $80 million and potential future development and commercial milestone payments, as well as tiered royalties on net sales.

2023 Guidance Updated

Revenues are now projected between $1.825 billion and $1.850 billion compared with the previous estimate of $1.775 billion and $1.875 billion.

Product revenues are estimated in the range of $1.625-$1.650 billion, compared with the earlier guidance of $1.575-1.675 billion.

R&D expenses are now projected between $1.050 billion and $1.075 billion, up from the previous guidance of $1.0 billion and $1.050 billion.

Exelixis, Inc. Price, Consensus and EPS Surprise

Exelixis, Inc. price-consensus-eps-surprise-chart | Exelixis, Inc. Quote

Our Take

Exelixis missed both metrics in third-quarter results as higher R&D expenses impacted the bottom line. While revenues were marginally short of the consensus estimate, Cabometyx maintained its status as the leading tyrosine kinase inhibitor for the treatment of RCC, driven by its use in combination with Bristol Myers’ BMY Opdivo in the first-line setting. The drug also maintained growth in the HCC indication. Exelixis is also striving hard to develop its portfolio beyond Cabometyx.

Bristol-Myers’ Opdivo, one of its leading revenue generators, is approved for various oncology indications.

Zacks Rank & Stock to Consider

Exelixis currently carries a Zacks Rank #3 (Hold).

A top-ranked stock in the biotech sector is Ligand Pharmaceuticals LGND, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Ligand Pharmaceuticals’ 2023 earnings per share have increased from $5.09 to $5.10. During the same period, earnings estimates for 2024 rose from $4.56 to $4.59. Shares of Ligand have lost 20.2% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report