Exelixis' Growth Trajectory Depends on Leading Innovations in Cancer Treatments

Exelixis Inc. (NASDAQ:EXEL) is a pharmaceutical company headquartered in Alameda, California that focuses on developing medicines to treat patients with various types of cancer.

Investment thesis

In recent years, the company's management has continued to delight investors with significant growth in its commercial business and expansion of its drug development pipeline, making Exelixis a leading player in the renal cell carcinoma market.

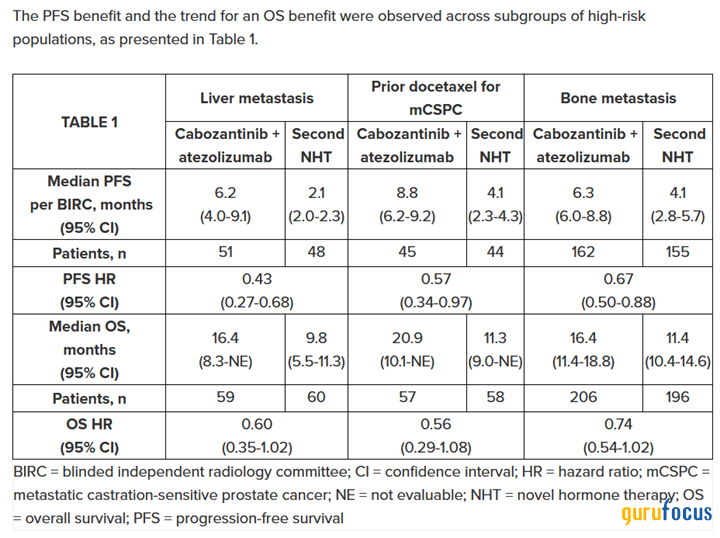

The first investment thesis we highlight is the detailed results of a pivotal clinical trial published on Jan. 25, which assessed the effectiveness of Cabometyx (cabozantinib) in combination with atezolizumab for the treatment of patients with metastatic castration-resistant prostate cancer. So, in CONTACT-02, it was demonstrated that the group of patients taking a combination of these medicines led to a statistically significant improvement in progression-free survival relative to the group of patients taking one of the second novel hormonal therapies (NHTs), such as abiraterone, prednisolone and enzalutamide.

Source: Exelixis

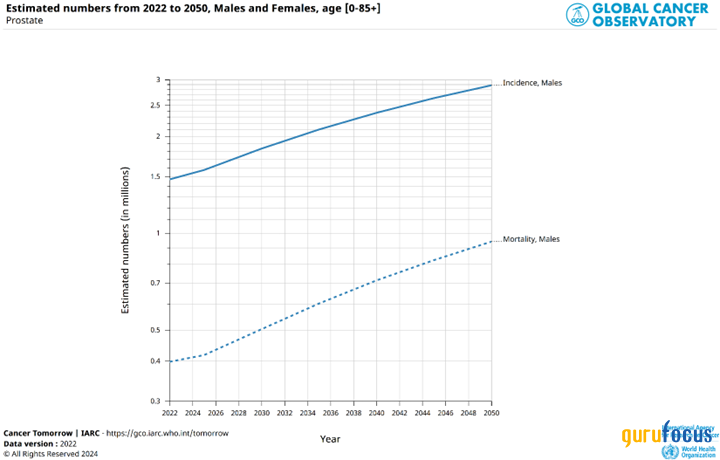

The Global Cancer Observatory estimates the global number of prostate cancer cases will rise from 1.50 million in 2022 to 2.90 million by 2050, creating a significant commercial opportunity for Exelixis and its partners.

Source: International Agency for Research on Cancer

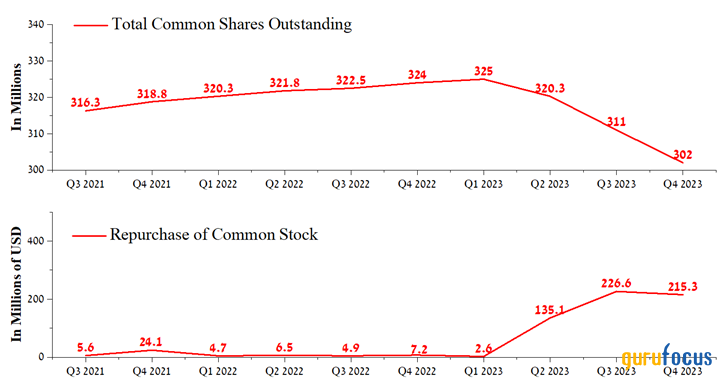

Financial results for the fourth quarter of 2023, released on Feb. 6, were excellent. Its non-GAAP earnings per share for the three months ended Dec. 31 were 33 cents, a significant increase from both the previous quarter and the previous year, thanks to higher sales of Cabometyx worldwide and the repurchase of its shares.

Over the past three months, Exelixis management has continued to actively resort to using a share buyback program. It spent $215.30 million in the fourth quarter of 2023, which is $208.1 million more than the previous year. At the same time, in January, it was announced that the board of directors had decided to spend up to $450 million on repurchasing company shares throughout 2024. In our estimation, this is sufficient to minimize the impact of short sellers in the imminent onset of increased volatility of the U.S. stock ahead of the Federal Reserve's interest rate decision in March.

Source: Author's elaboration, based on GuruFocus data.

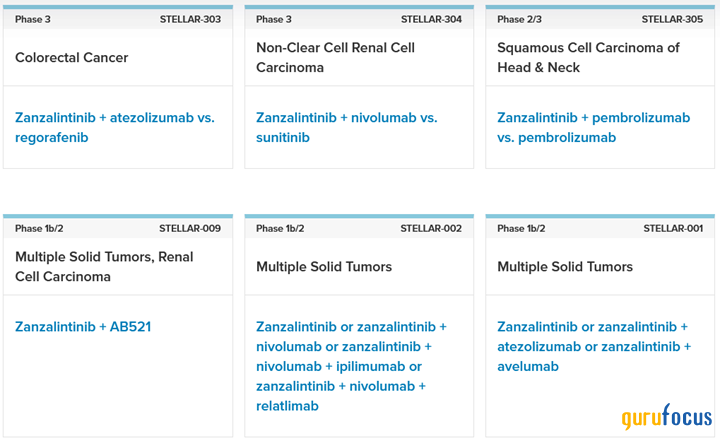

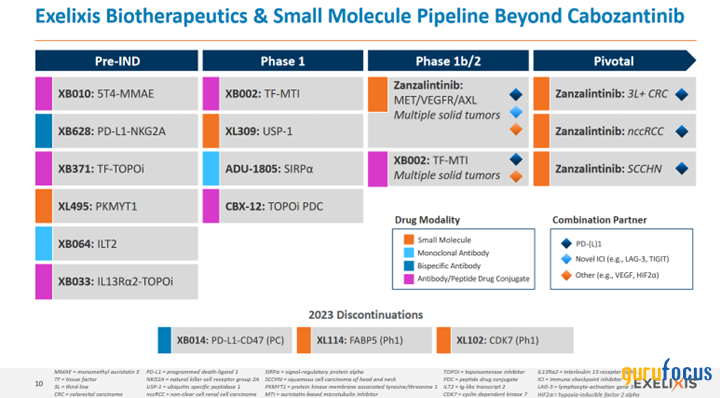

In addition, Exelixis continues to develop zanzalintinib, which is an experimental drug whose mechanism of action is based on the inhibition of multiple receptor tyrosine kinases.

Based on Phase 1 and 2 clinical studies, we believe that it will not only effectively combat head and neck squamous cell carcinoma, non-clear cell renal cell carcinoma, colorectal cancer and solid tumors, but will also minimize the negative impact of the launch of generic versions of Cabometyx from 2031.

Source: Exelixis

We initiate our coverage of Exelixis with an outperform rating for the next 12 months.

The current financial position and outlook of Exelixis

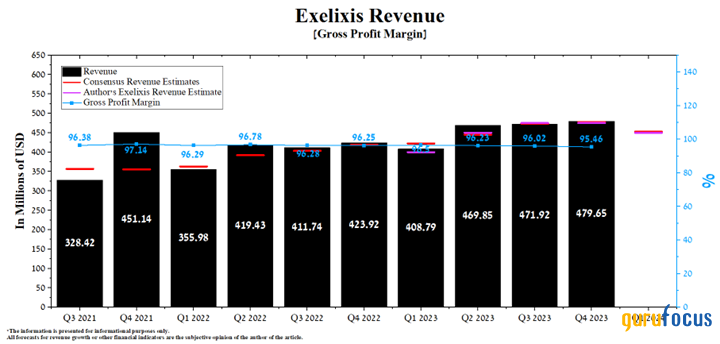

Exelixis' revenue for the fourth quarter of 2023 was about $479.7 million, exceeding our expectations by about $5 million and, more importantly, growing 13.10% year over year.

On the other hand, the company's actual revenue beat analysts' consensus estimates in seven of the last 10 quarters, which is one of the crucial factors indicating analysts continue to remain conservative on the commercial prospects of Cabometyx, its flagship product, as well as zanzalintinib, on which its management has high hopes.

Cabometyx is a medicine whose mechanism of action is based on the inhibition of multiple receptor tyrosine kinases, including MET, vascular endothelial growth factor and stem cell factor receptor, and rearranged during transfection, which ultimately helps slow tumor growth and metastatic progression of cancer.

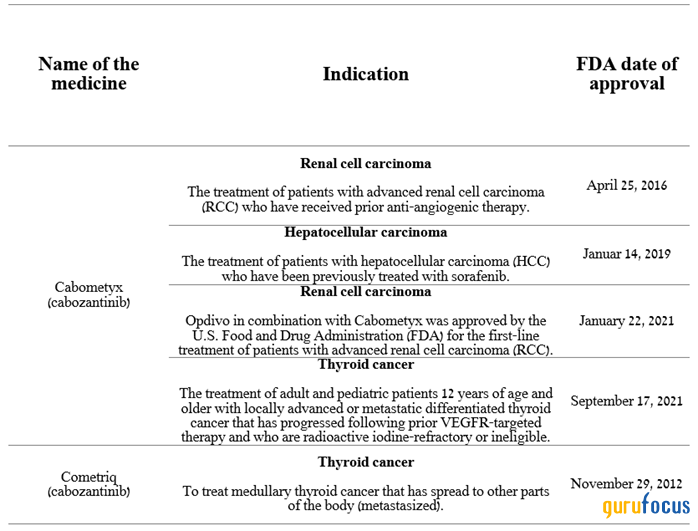

As a result of the demonstrated favorable safety profile and high efficacy of Exelixis' product in multiple clinical trials, it has been approved by the Food and Drug Administration for the treatment of patients for the following indications:

Source: Author's elaboration, based on Exelixis press releases.

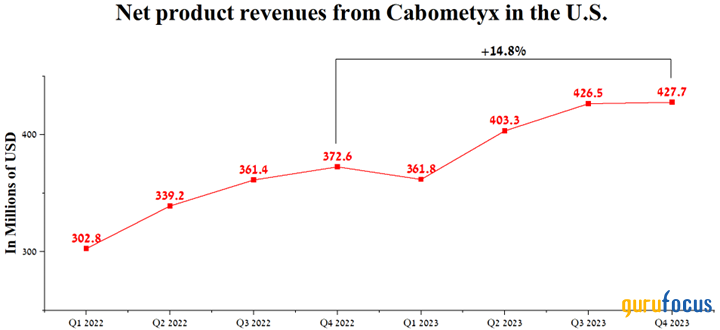

Sales of Cabometyx were $427.70 million in the United States, up 14.8% year over year due to higher prices and increased demand for the drug to treat patients with advanced renal cell carcinoma, one of the most common types of kidney cancer.

Source: Author's elaboration, based on quarterly securities reports.

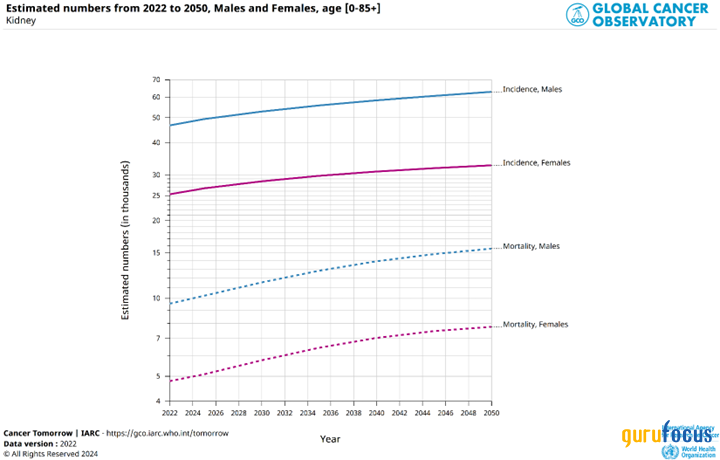

The Global Cancer Observatory estimates the number of kidney cancer cases in the United States will increase from 71,700 observed in 2022 to 95,400 by 2050. As a result, we highlight this fact as one of the key drivers that will positively impact sales of the company's product until its generics appear on the market.

Source: International Agency for Research on Cancer

The company is anticipated to report first-quarter 2024 financial results on May 2. Exelixis' revenue for the quarter is expected to range from $409.2 million to $483.4 million, up 10.8% year over year thanks in part to an increase in royalty revenues for the sales of cabozantinib received through partnerships with Takeda Pharmaceutical (NYSE:TAK) and Ipsen.

Source: Author's elaboration, based on GuruFocus data.

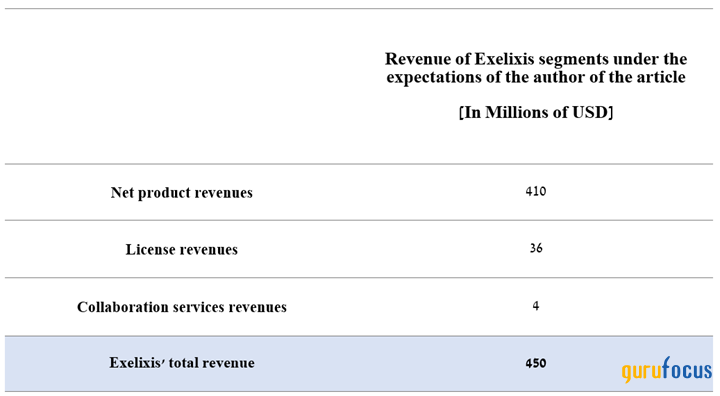

Nevertheless, we expect the company's total revenue to reach $450 million for the three months ended March 31, slightly below the median of the above range, primarily due to lower collaboration services revenues.

Source: Created by author.

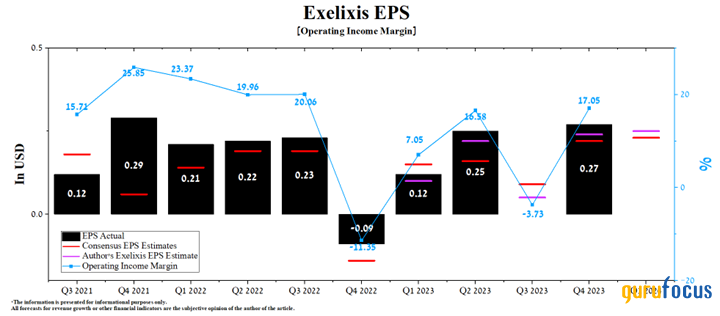

The company's operating income margin was 17.05% for the fourth quarter of 2023, continuing to grow over the past five quarters. According to our estimates, this financial metric will reach 18.50% in 2024 and increase to 21.40% by 2024, mainly due to increased sales of Cabometyx in the United States, the European Union and Japan, as well as the expansion of indications for its use.

These factors partially offset the expected continued increase in Exelixis' research and development spending caused by expensive clinical trials aimed at assessing the efficacy of zanzalintinib, XB002 and XL309 for the treatment of patients with solid tumors, colorectal cancer, advanced RCC and more.

Source: Exelixis presentation.

Simultaneously, the company's earnings per share in the first quarter are expected to be in the range of 11 cents to 47 cents, which is 92.40% higher than the first quarter of 2023. In comparison, we expect its earnings to be 2 cents above this range due to its management's use of a share repurchase program and stronger sales of the cabozantinib franchise.

Source: Author's elaboration, based on GuruFocus data.

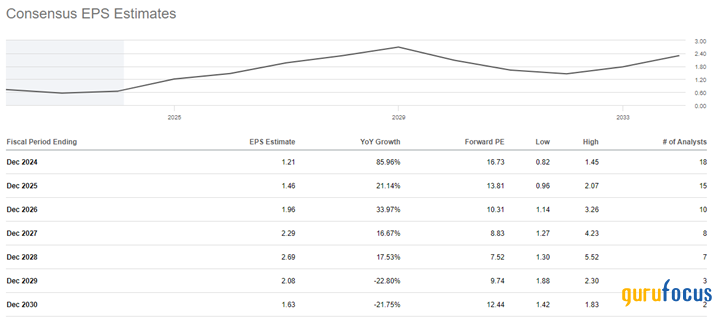

However, the company's trailing 12-month non-GAAP price-earnings ratio is 31.50, indicating it is trading at a premium to some of its larger peers, including AstraZeneca (NASDAQ:AZN), Regeneron Pharmaceuticals (NASDAQ:REGN) and Bristol-Myers Squibb (NYSE:BMY). However, Exelixis is a growth stock with relatively strong sales growth for its core product and a strong portfolio of investigational drugs through which it can significantly increase its share in the global advanced renal cell carcinoma market. As a result, we believe it is justifiable that Exelixis is trading at high multiples at the moment.

More globally, driven by increased sales of its products, its price-earnings ratio is expected to decline to 7.52 by 2028, which we estimate is an attractive value for long-term investors looking for undervalued pharmaceutical companies developing innovative drugs to combat cancer.

Source: Author's elaboration, based on GuruFocus data.

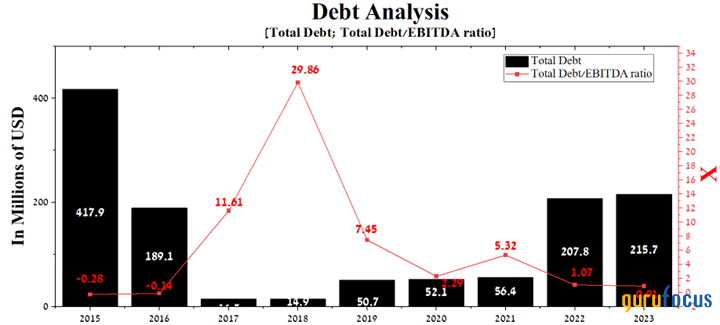

At the end of December, Exelixis' total debt was about $215.70 million, up slightly from the end of 2022.

Source: Author's elaboration, based on GuruFocus data.

Furthermore, given the company's total cash and short-term investments of about $1 billion, its growing free cash flow in recent quarters and its total debt/Ebitda ratio of 0.91, we believe Exelixis will not have any financial difficulties with debt servicing.

Conclusion

In conclusion, we would like to highlight the key risks that need to be taken into account by financial market participants. The first of these is the fact Exelixis is a pharmaceutical company that is almost entirely dependent on sales of Cabometyx. If generic versions of it appear earlier than 2031 in the U.S., this could significantly reduce investment in the development of its pipeline of product candidates. Secondly, due to the publication of higher U.S. inflation in February 2024 relative to the expectations of Wall Street analysts, this may lead not only to raised volatility of the U.S. stock market, but also may reduce the appetite of institutional investors to invest in the health care sector.

However, despite the impact of the risks described above, the company continues to be one of the key players in the global thyroid cancer and kidney cancer markets through its cabozantinib franchise. In addition, Exelixis' growing cash flow, coupled with its relatively low total debt, allows it not only to resort to a share repurchase program, but also to increase research and development spending to evaluate the efficacy of zanzalintinib, which could potentially significantly improve the quality of life of patients suffering from various types of cancer.

We initiate our coverage of Exelixis with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.