eXp World Holdings (NASDAQ:EXPI) Is Paying Out A Dividend Of $0.045

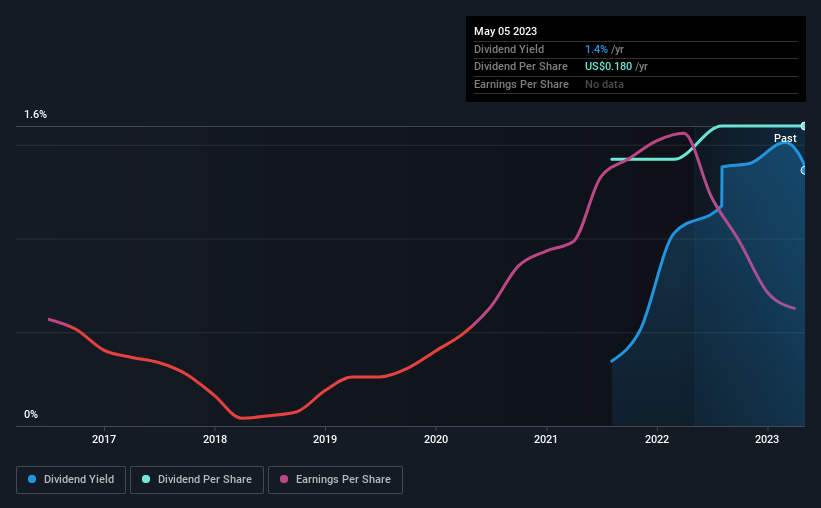

eXp World Holdings, Inc.'s (NASDAQ:EXPI) investors are due to receive a payment of $0.045 per share on 31st of May. The dividend yield is 1.4% based on this payment, which is a little bit low compared to the other companies in the industry.

Check out our latest analysis for eXp World Holdings

eXp World Holdings Is Paying Out More Than It Is Earning

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, the company was paying out 332% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 19%. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Over the next year, EPS is forecast to grow rapidly. If recent patterns in the dividend continues, we would start to get a bit worried, with the payout ratio possibly reaching 96%.

eXp World Holdings Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The dividend has gone from an annual total of $0.16 in 2021 to the most recent total annual payment of $0.18. This works out to be a compound annual growth rate (CAGR) of approximately 6.1% a year over that time. eXp World Holdings has a nice track record of dividend growth but we would wait until we see a longer track record before getting too confident.

Dividend Growth Could Be Constrained

The company's investors will be pleased to have been receiving dividend income for some time. eXp World Holdings has seen EPS rising for the last five years, at 59% per annum. Although earnings per share is up nicely eXp World Holdings is paying out 332% of its earnings as dividends, which we feel is borderline unsustainable without extenuating circumstances.

Our Thoughts On eXp World Holdings' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for eXp World Holdings that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here