Expansion Efforts Aid Papa John's (PZZA), Dismal Comps Hurt

Papa John's International, Inc. PZZA is experiencing advantages from expansion endeavors, creative menu offerings and technological advancements. The company's loyalty program is showing an uptick in digital transactions. However, dismal comparable sales are concerning.

Although, PZZA has an impressive long-term earnings growth rate of 11.8%, the metric is likely to witness a decline of 8.2% in 2023. In the past 30 days, earnings estimate for 2023 has remained stable.

Let’s delve deeper to find out why investors should retain this stock.

Growth Drivers

Papa John’s continues to focus on expanding its presence in international markets. In first-quarter fiscal 2023, it announced a development agreement to enter India in partnership with PJP Investments Group. This partnership plans to open 650 new restaurants in India over the next 10 years.

During second-quarter fiscal 2023, it announced acquisition of the M25 division of Drake Food Service International in the U.K. The new restaurant portfolio will have 91 locations across London and other parts of the U.K.

To enhance sales and restaurant-level profitability, management is likely to implement operating model improvement, which includes revenue management abilities, product as well as technological innovation and operational efficiencies.

PZZA emphasized the barbell strategy, boosting its menu’s offer value and variety while limiting complexity to restaurant operations and supply chain. In May 2023, the company rolled out its new menu in collaboration with Pepsi and Frito Lay. This includes Doritos, Cool Ranch and Papadia. The initiative paved a path for improvement in weekly transactions and additional traffic to its digital channels.

This apart, PZZA expanded its pizza platform with the launch of Garlic Epic Stuffed Crust Pizza.

On the other hand, Papa John’s is investing heavily in technology-driven initiatives like digital ordering to boost sales. Its online and digital marketing activities have increased significantly over the past several years in response to rising use of online and mobile web technology.

Papa John’s loyalty program witnessed a rise in digital transactions during second-quarter fiscal 2023. Features like early access to new products, better targeting of offers and promotions, and higher frequency and ticket have benefited the company. During the quarter, digital channels contributed nearly 85% to its sales. Management focused on increasing investments in this channel to improve customer frequency and personalization, and attract new members.

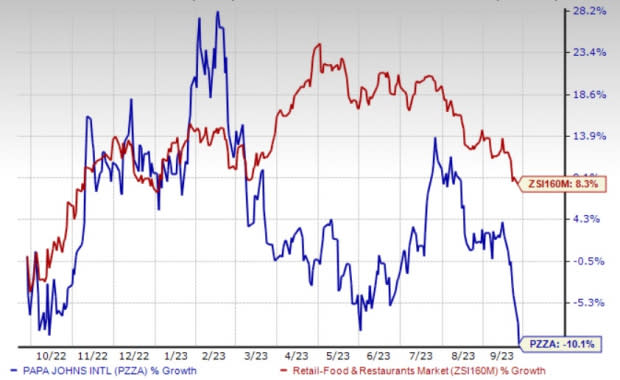

Image Source: Zacks Investment Research

Concerns

Shares of Papa John's have declined 10.1% in the past year against the industry’s growth of 8.3%. Dismal comparable sales are hurting its performance.

In the fiscal second quarter, total comparable sales decreased 1.3% year over year compared with 1.4% fall reported in the prior-year quarter. The downside was primarily caused by dismal franchisees' comps performance and a challenging operating environment. At North America franchised restaurants, comps fell 2.3% year over year against a rise of 1.4% reported in the year-ago quarter.

Zacks Rank

PZZA currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Zacks Retail-Wholesale sector are:

Abercrombie & Fitch Co. ANF currently flaunts a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 724.8%, on average. Shares of ANF have surged 226.5% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANF’s 2023 sales and EPS implies increases of 10.4% and 1,644%, respectively, from the year-ago period’s levels.

BJ's Restaurants, Inc. BJRI presently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 121.2%, on average. Shares of BJRI have declined 4.6% in the past year.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates growth of 5.6% and 447.1%, respectively, from the year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO currently carries a Zacks Rank #2 (Buy). ARCO has a long-term earnings growth rate of 11.4%. The stock has gained 34.1% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS suggests rises of 19.2% and 13%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report