Expansion Efforts Aid Starbucks (SBUX), High Costs Hurt

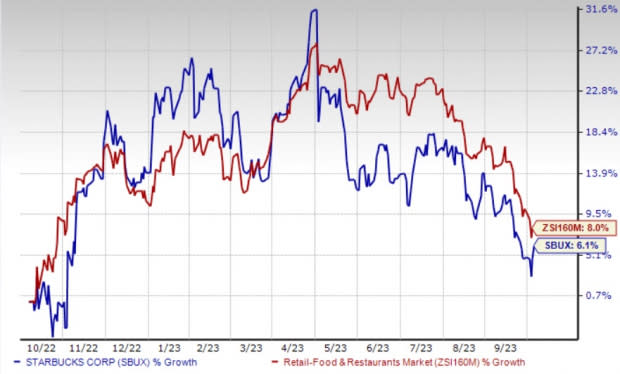

Starbucks Corporation SBUX is capitalizing on its expansion initiatives and strong North America comparable sales. Nevertheless, disappointing Channel Development sales and rising inflationary costs are challenges. Over the past year, the stock has risen by 6.1% compared with the industry's 8% growth.

The Zacks Rank #3 (Hold) company’s earnings and sales in fiscal 2023 are likely to witness jumps of 16.9% and 11.1% year over year, respectively. SBUX also has an impressive long-term earnings growth rate of 16.5%.

Growth Drivers

Starbucks, a globally recognized coffee brand, strategically expands its market presence by opening stores, renovating existing ones, leveraging technology, cost management and fostering innovation. In fiscal 2017, 2018, 2019, 2020, 2021 and 2022, it added 2,250, 2,300, 1,900, 1,400, 1,173 and 1,120 net new stores, respectively.

In the first, second and third-quarter fiscal 2023, Starbucks opened 459, 464 and 588 net new stores worldwide, respectively. During fiscal 2023, it expects store count in the United States and China to grow approximately 3% and 13%, respectively, on a year-over-year basis. Management projects global store growth to be nearly 7%. Capital expenditures in fiscal 2023 are estimated to be approximately $2.5 billion.

SBUX’s North America comps impressed investors for the tenth straight quarter. The segment benefited from growth in company-operated comparable store sales of 7%, net new company-operated store growth of 4% and strong licensed store sales. Segmental average ticket and transaction rose 6% and 1%, respectively, on a year-over-year basis. For fourth-quarter fiscal 2023, our model predicts company-operated store sales in North America to improve 9.6% to $6,085.1 million year over year.

For fiscal 2023, management anticipates global comparable sales to reach the high end of 7-9% target range. Consolidated revenues for fiscal 2023 are anticipated to rise in the range of 10-12% on a year-over-year basis. For fiscal 2023, the company estimates non-GAAP EPS growth in the range of 16-17% compared with the previous expectation of 15-20%.

Image Source: Zacks Investment Research

Concerns

The company’s results in third-quarter fiscal 2023 were hurt by dismal Channel Development sales. Net revenues in the segment declined 6.4% year over year to $448.8 million. The downside was primarily caused by a fall in its Global Coffee Alliance business.

Meanwhile, the segment’s operating margin expanded 630 bps year over year to 46.3%. A rise in North American Coffee Partnership joint venture income and mix shift primarily drove the upside.

The ongoing inflationary pressure is likely to hurt SBUX’s performance. Its ingredients are witnessing a price hike since the last few quarters. Higher expenses may weigh on margins in the near term. During third-quarter fiscal 2023, total operating expenses climbed 10.8% year over year.

Zacks Rank

SBUX currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Zacks Retail-Wholesale sector are:

Abercrombie & Fitch Co. ANF flaunts a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 724.8%, on average. Shares of ANF have surged 236.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANF’s 2023 sales and EPS implies increases of 10% and 1,644%, respectively, from the year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO currently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 35%, on average. The stock has gained 14.5% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS suggests rises of 19.2% and 13%, respectively, from the year-ago period’s levels.

Yum! Brands, Inc. YUM caries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 2%, on average. Shares of YUM have improved 9% in the past year.

The Zacks Consensus Estimate for YUM’s 2023 sales and EPS indicates growth of 5.9% and 15.1%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Starbucks Corporation (SBUX) : Free Stock Analysis Report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report