What to Expect Ahead of Cadence's (CDNS) Q4 Earnings Release?

Cadence Design Systems CDNS is scheduled to release fourth-quarter 2023 results on Feb 12.

For the fourth quarter, Cadence expects total revenues in the range of $1.039-$1.079 billion. The Zacks Consensus Estimate is currently pegged at $1.07 billion, suggesting an increase of 18.7% from a year ago.

Management projects non-GAAP earnings per share (EPS) in the range of $1.30-$1.36. The Zacks Consensus Estimate is pegged at $1.34, indicating an increase of 40% from the prior-year quarter’s reported figure.

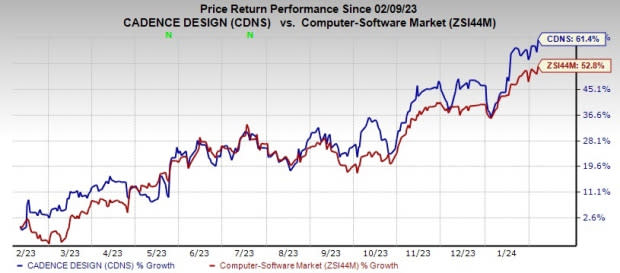

The company has a trailing four-quarter earnings surprise of 4.1%, on average. Shares of Cadence have rallied 61.4% in the past year compared with the sub-industry’s growth of 52.8%.

Image Source: Zacks Investment Research

Factors to Note

The top-line performance is likely to have benefited from continued strength across all segments, driven by higher customer demand.

Design activity continues to be robust owing to transformative generational trends such as AI, hyperscale computing, 5G and autonomous driving. Customers are significantly increasing their R&D budget in AI-driven automation. This bodes well for Cadence.

Increasing production of 3D-IC and chiplet designs is likely to have acted as a tailwind. More system companies are now building custom silicon, which is expected to be another positive for CDNS.

Continued momentum in comprehensive JedAI Generative AI platform is likely to have contributed to top-line performance in the fourth quarter.

Strong uptake of the company’s solutions like Palladium Z2 and Protium X2 systems as well as increasing system design complexity is likely to have driven verification business performance. Our estimate for revenues from the company’s Functional Verification, including the Emulation and Prototyping Hardware segment, is pegged at $318.8 million, suggesting a rise of 31.7% from the prior-year levels.

Cadence’s digital IC business performance is driven by the rapid adoption of digital full-flow solutions. Our estimate for revenues from the Digital IC Design and Signoff segment is pegged at $290.9 million, indicating 11.6% jump from the year-ago quarter.

The System Design and Analysis division is likely to have gained from its growing presence in industries like 5G, aerospace & defense, wireless and communications. Our estimate for revenues from System Design and Analysis is pegged at $163.1 million, implying 29.5% gain from the year-ago actuals.

Cadence Design Systems, Inc. Price and EPS Surprise

Cadence Design Systems, Inc. price-eps-surprise | Cadence Design Systems, Inc. Quote

However, ongoing uncertainty prevailing over global macroeconomic conditions and inflation remain concerns. Increasing expenses on product development amid stiff competition in the electronic design automation space might have impeded margin expansion in the quarter to be reported.

Key Recent Developments

On Feb 1, Cadence debuted Cadence Millennium Enterprise Multiphysics Platform. The platform is a hardware/software accelerated digital twin solution for multiphysics system design and analysis, which boosts high-fidelity computational fluid dynamics simulations.

On Jan 18, management unveiled a new set of applications designed to enhance the capabilities of its flagship Palladium Z2 Enterprise Emulation System. The applications are domain-specific apps that are tailored to help customers navigate the increasing complexity of system design, boosting system-level accuracy and expediting low-power verification for advanced applications like artificial intelligence, machine learning, hyperscale and mobile technologies. The Cadence applications and updates deliver industry-leading performance and feature to address the growing challenges, providing capacity, performance and debug efficiency to meet stringent time-to-market demands.

On Jan 8, 2024, Cadence announced the acquisition of California-based embedded software and system-level solutions provider Invecas, Inc. Financial terms of the deal were not disclosed. Moreover, the company does not expect the acquisition to materially contribute to total revenues and earnings this year.

What Our Model Says

Our proven model predicts an earnings beat for Cadence this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Cadence has an Earnings ESP of +2.88% and carries a Zacks Rank #2 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks to Consider

Here are a few other stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Watts Water Technologies WTS has an Earnings ESP of +0.87% and currently carries a Zacks Rank of 2. WTS is set to announce quarterly figures on Feb 12.

The Zacks Consensus Estimate for WTS’ to-be-reported quarter’s EPS and revenues is pegged at $1.78 and $532.4 million, respectively. Shares of WTS have gained 17.2% in the past year.

InterDigital, Inc IDCC has an Earnings ESP of +1.93% and presently carries a Zacks Rank #2. IDCC is slated to release quarterly numbers on Feb 15.

The Zacks Consensus Estimate for IDCC’s to-be-reported quarter’s EPS and revenues is pegged at $1.21 and $104.3 million, respectively. Shares of IDCC have increased 40.8% in the past year.

Shopify Inc SHOP has an Earnings ESP of +1.02% and currently sports a Zacks Rank #1. SHOP is scheduled to report quarterly earnings on Feb 13. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SHOP’s to-be-reported quarter’s EPS and revenues is pegged at 31 cents and $2.07 billion, respectively. Shares of SHOP have gained 71.6% in the past year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report