Expect an Earnings Beat From These 4 Energy Companies in Q3

The Oil/Energy sector is more than halfway through the Q3 reporting cycle and, as expected, the earnings growth picture remains firmly in the negative. However, the beat percentages remain impressive, with the majority of energy firms coming out with bottom line better than expected.

Based on our exclusive research and unique market insight, we present four stocks — Riley Exploration Permian REPX, Civitas Resources CIVI, Delek US Holdings DK and Devon Energy DVN — to take advantage of the positive post-announcement price reaction.

But it’s worth taking a look at the factors influencing the quarterly results this time around first.

Revenue & Earnings Comparison Relative to Q3 of 2022

Investors should know that there is a high correlation between commodity prices and the earnings of energy companies.

So, how does the price of oil and gas compare with the year-ago period?

According to the U.S. Energy Information Administration, in July, August and September of 2022, the average monthly WTI crude price was $101.62, $93.67 and $84.26 per barrel, respectively. In 2023, average prices were $76.07 in July, $81.39 in August and $89.43 in September, i.e., mostly weaker year over year.

The news is even more bearish on the natural gas front. In Q3 of 2022, U.S. Henry Hub average natural gas prices were $7.28 per MMBtu in July and soared to $8.81 in August before falling slightly to $7.88 in September. Coming to 2023, the fuel traded at $2.55, $2.58 and $2.64 per MMBtu in July, August and September, respectively. In other words, natural gas traded noticeably lower in all three months.

Considering the sharp drop in oil and gas prices, the picture looks rather downbeat for the Q3 earnings season. Per the latest Earnings Trends, energy is on track for a big earnings decline compared to a year earlier. Per our expectations, the sector’s bottom line is likely to have slumped 37.2% from third-quarter 2022 on 49.3% lower revenues.

Some Energy Firms Stand Out Despite Pricing Woes

Clearly, energy investors have ample reasons to worry about. But pricing woes do not necessarily indicate that all energy scrips have lost potential. In fact, with the rebound in oil prices toward the end of the quarter, successful cost control initiatives and strong production, some companies could surprise on the upside.

As a reflection of this, for the 50% S&P 500 companies that have already reported, total earnings are down 37.1% from the same period last year on 17% lower revenues. However, 71.4% beat earnings estimates and 50% have managed to outperform revenue estimates. In particular, the bottom-line beat ratios so far are suggestive of encouraging numbers this season.

Investing in companies with an earnings beat potential can fetch handsome returns. This is because a stock generally surges on an earnings beat.

How to Identify Potential Outperformers?

With several energy firms thronging the investment space, it is by no means an easy task for investors to arrive at stocks that have the potential to deliver better-than-expected earnings. While it is impossible to be sure about such outperformers, our proprietary methodology makes it fairly simple.

Our research shows that for stocks with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), the chance of a positive earnings surprise is as high as 70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP is our proprietary methodology for determining stocks that have the best chances to surprise with their next earnings announcement. It is the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

Our Choices

One might start with Riley Exploration Permian, which is a leading independent explorer and producer of oil and natural gas in Texas and New Mexico. The company focuses on modern drilling techniques in the Permian Basin and boasts of assets with low production decline rates.

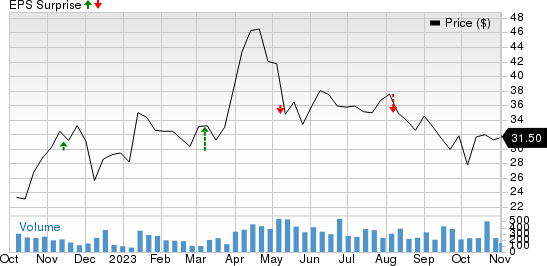

REPX, with an Earnings ESP of +18.95% and a Zacks Rank #1, is scheduled to release third-quarter earnings on Nov 7. Riley Exploration Permian beat the Zacks Consensus Estimate in two of the last four quarters and missed in the other two, which resulted in an earnings surprise of 4.7%, on average.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Riley Exploration Permian, Inc. Price and EPS Surprise

Riley Exploration Permian, Inc. price-eps-surprise | Riley Exploration Permian, Inc. Quote

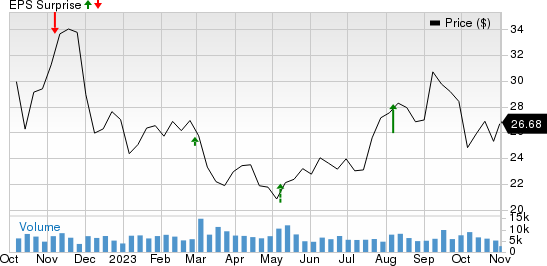

You may also consider Civitas Resources, which is #2 Ranked with an Earnings ESP of +7.46%. The Denver, CO-based company was formed out of the merger between Bonanza Creek Energy and Extraction Oil & Gas. CIVI’s high-quality asset base, disciplined capital allocation and fortress balance sheet allow it to maintain an attractive long-term cash flow profile.

Civitas Resources is scheduled to release earnings on Nov 7. It beat the Zacks Consensus Estimate for earnings in two of the last four quarters but missed twice, which resulted in an earnings surprise of 2.7%, on average.

Civitas Resources, Inc. Price and EPS Surprise

Civitas Resources, Inc. price-eps-surprise | Civitas Resources, Inc. Quote

Delek US Holdings also deserves mention. The stock has a Zacks Rank of 2 and an Earnings ESP of +5.26%. It is an independent refiner, transporter and marketer of petroleum products. With 70% of Delek’s refining capacity leveraged to favorable Permian pricing, the company is poised for significant bottom-line growth.

Delek US Holdings beat earnings estimates in three of the last four quarters and missed big in the other, the earnings surprise being (1.4%), on average. The company is set to release results on Nov 7.

Delek US Holdings, Inc. Price and EPS Surprise

Delek US Holdings, Inc. price-eps-surprise | Delek US Holdings, Inc. Quote

Finally, we have Devon Energy, an upstream energy explorer with strong U.S. operations spread across the key oil assets of Delaware Basin, Eagle Ford, Anadarko Basin, Williston Basin and Powder River Basin. With improved cycle time, incorporation of production optimization strategies and other cost-reduction initiatives, DVN is able to lower breakeven costs across its portfolio of assets.

Devon Energy, with an Earnings ESP of +0.72% and a Zacks Rank #2, is scheduled to release earnings on Nov 7. DVN surpassed earnings estimates in three of the trailing four quarters and missed in the other, with the average being 0.8%.

Devon Energy Corporation Price and EPS Surprise

Devon Energy Corporation price-eps-surprise | Devon Energy Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Delek US Holdings, Inc. (DK) : Free Stock Analysis Report

Civitas Resources, Inc. (CIVI) : Free Stock Analysis Report

Riley Exploration Permian, Inc. (REPX) : Free Stock Analysis Report